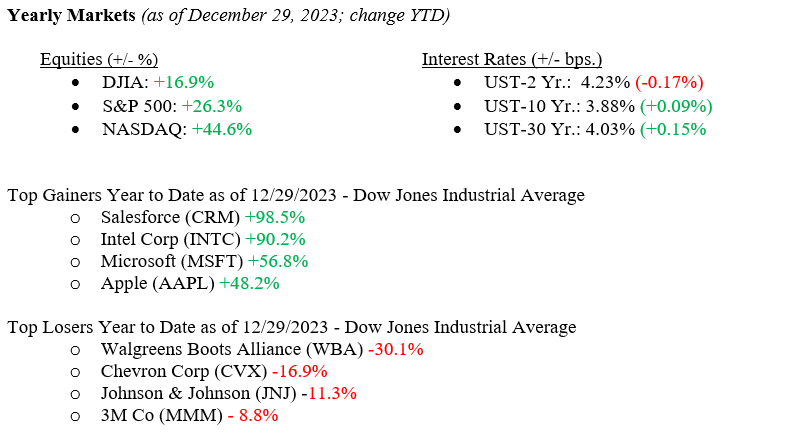

Equity markets proved resilient for one week and ended the year on a positive note for the week and year. The Dow Jones Industrial Average notched higher by +0.80%, the S&P 500 Index moved higher by +0.49%, and the NASDAQ moved higher by +0.32%. This was the ninth positive week for major stock indexes in 2023 and wrapped up a banner year overall for markets (see year-to-date figures immediately below). Another important data point is that 2023 marked the fourth positive year of the previous five years for the broadly followed S&P 500 Index, with only 2022 showing negative results. Also, important to note for 2023 was the positive impact on the bond market. The Bloomberg U.S. Aggregate Index (a widely followed barometer for the bond market) returned +5.53% for 2023, giving those investors counting on fixed-income returns a welcomed result.

U.S. Economy

As we mentioned each week last year, the U.S. Consumer remained resilient and carried the U.S. Economy for much of the year. We saw strong annual spending in travel & leisure and overall retail spending. Early reports for the 2023 holiday season show retail sales growing by +3.1% and online shopping rose by +6.3%. While these numbers were lower than in 2022, they still show robust consumer spending.

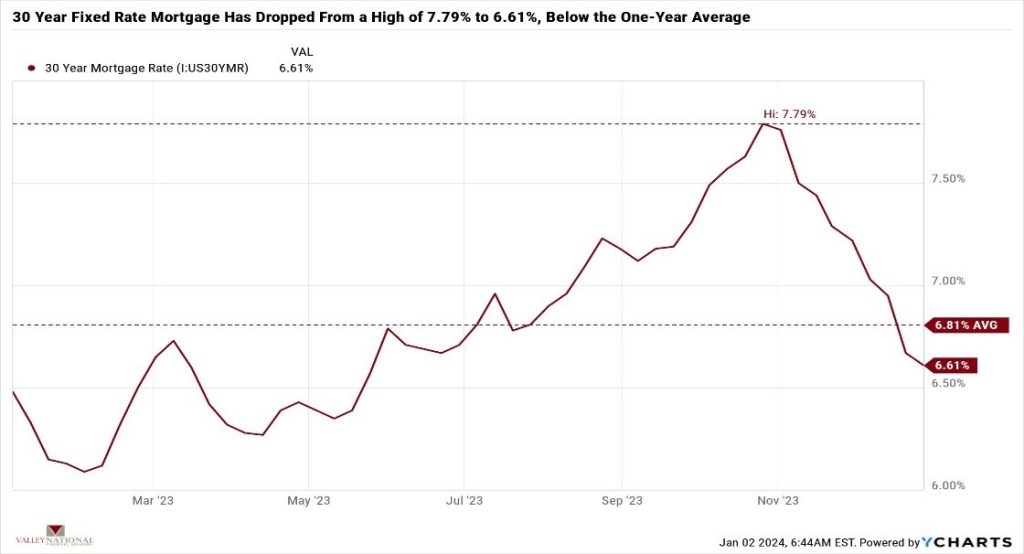

Financial markets are already pricing in rate cuts by the Fed for 2024. One area where we are seeing moving in rates is mortgage rates, which have fallen from recent highs near 7.80% to 6.61% before any actual cuts in rates by the Fed. See Chart 1 from Valley National Financial Advisors and Y Charts showing the 30-year mortgage rate over the past year. As mortgage rates fall, the housing industry will get a boost as affordability for new or existing homes will increase for all consumers.

Policy and Politics

Legislators and policymakers do not return to Washington, DC, until next week. Top on their agenda will be working out a funding agreement for the U.S. Government. The current funding agreement ends on January 19, and a new budget is needed to avoid a partial government shutdown. With 2024 being a major election year, we expect lawmakers to avoid looking any worse than they already do and, therefore, avoid embarrassing events like government shutdowns. Super Tuesday (the day when the greatest number of U.S. states hold presidential primary elections) is just 63 days away!

What to Watch

- U.S. Initial Claims for Unemployment Insurance for week of Dec 30, 2023, released 1/4/24.

- 30-year Mortgage Rate for week of Jan 4, 2024, released 1/4/24, prior 6.61%

- U.S. Unemployment Rate for Dec 2023, released 1/5/24, prior 3.70%

- U.S. Labor Force Participation Rate for Dec 2023, released 1/5/23, prior 62.80%

- U.S. Non-farm Payrolls MoM for Dec 2023, released 1/5/24, prior 199,000.

- U.S. Recession Probability for Dec 2024, released 1/5/24, prior 51.8%

While it may be fitting for readers of The Weekly Commentary to take a victory lap after 2023’s stellar returns for stock and bond markets, we would rather readers continue to follow the data. All year in 2023, we followed the data – watching the consumer, understanding the housing market, reading employment numbers, and understanding that if Americans are working – they are spending, and consumption is critical to the U.S. economy. Long-term investors were rewarded in 2023 for sticking to their plan and understanding that consistency and patience are the key to investing and gathering long-term wealth. Wall Street prognosticators and economists waited for a recession in 2023 that never arrived. Meanwhile, cautious optimism prevailed simply by following the data. 2024 is just starting, but our advice remains the same, stay invested, stay focused, and follow the data. Happy New Year.