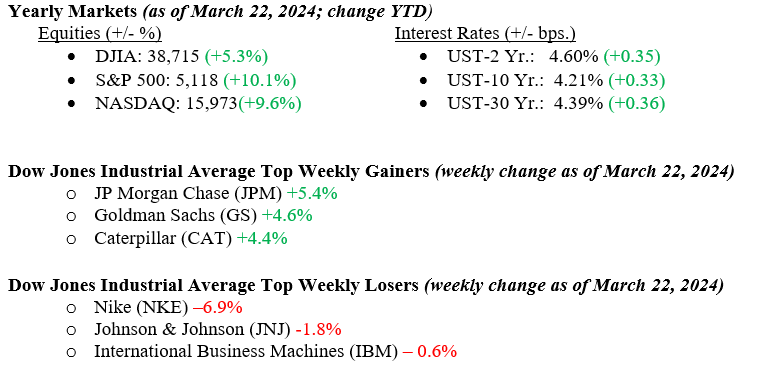

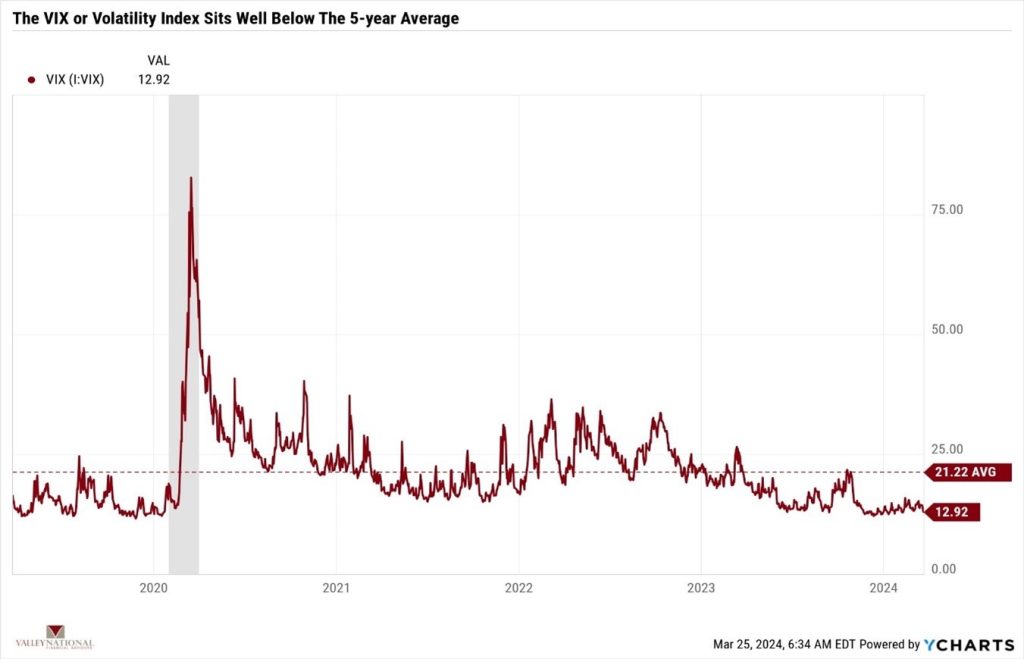

Last week, the Federal Reserve’s more dovish tone was well received by the markets. The Dow Jones Industrial Average rose 2.0%, the S&P 500 Index rose 2.3%, and the NASDAQ rose 2.9%. Communication services were the best-performing sector for the week (+3.9%), while healthcare was the worst-performing sector (+0.5%). The CBOE Volatility Index fell about 9% for the week, indicating greater confidence and calmness among investors (See Chart 1 below). The latter part of the week saw market participation broadening beyond mega-cap stocks, with small and mid-cap stocks performing well. With the Fed’s rate outlook intact, the 10-year treasury saw increased buying, pushing yields down 12 basis points for the week.

U.S. Economy

As mentioned above, the CBOE Volatility Index fell again last week. The index measures the implied expected volatility of the U.S. stock market. VIX (Volatility Index) is used as a barometer for fearful and uncertain markets. The VIX tends to increase when the market decreases and vice versa. During the financial crisis in 2008-2009, the VIX reached as high as 80.86. See Chart 1 below from Valley National Financial Advisors and Y Charts shows the VIX over 5 years.

The FOMC meeting went as expected, with Chairman Powell stating that the current path for rate cuts remains on track, and they plan on up to three rate cuts by year-end 2024. Just as important as the rate cut story, the FOMC announced an increase in their projections for economic growth in 2024 from 1.4% to 2.1%, thus cementing the so-called “soft-landing” scenario. Specifically, Chairman Powell noted, “The economy is strong, the labor market is strong, and inflation has come way down.” Lastly, Powell mentioned that it was appropriate for the Fed to slow the pace of its balance sheet reduction program, which has been another source of restrictive monetary policy.

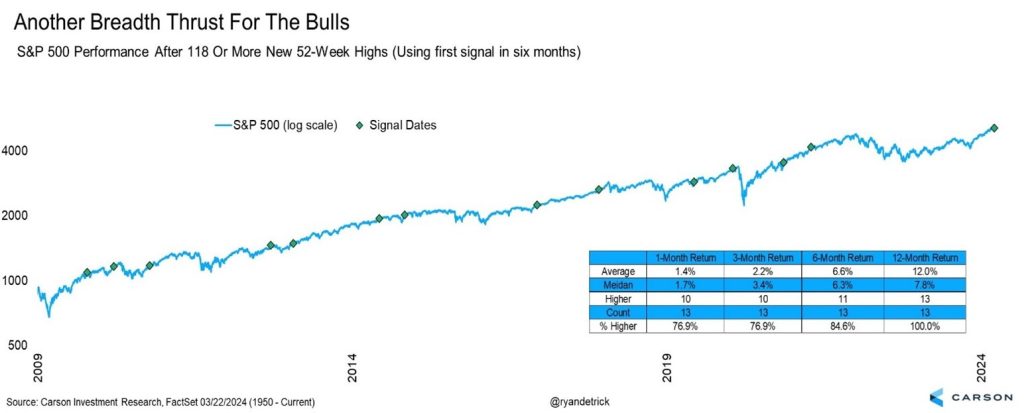

Thursday saw 118 new 52-week highs for the S&P 500, the newest highs in 3 years. The prior 13 times this number of 52-week highs was reached resulted in higher stocks one year out 13 out of 13 times, with the average return being 12%, see Chart 2 below from the Carson Institute.

Policy and Politics

Global turmoil escalated last week with an ISIS-linked terrorist attack in Moscow shortly after Vladimir Putin was reelected to another six-year term. Further, the Ukraine/Russia and Israel/Hamas wars are showing no signs of ending. In Washington DC, President Biden signed a $1.2 trillion spending package that was previously passed by the U.S. House and U.S. Senate, thus narrowly avoiding an embarrassing government shutdown. With this out of the way for Washington, DC, we will move heavily into the 2024 campaign season with both political parties (Democrats & Republicans) vying for wins in November.

Economic Numbers to Watch This Week

- U.S. Durable Goods New Orders MoM for Feb 2024, prior –6.11%

- U.S. Initial Claims for Unemployment Insurance for the week of March 23, 2024, prior 210,000

- U.S. Real GDP (Gross Domestic Product) QoQ for Q$ 2023 (Revised), prior 3.20%

- U.S. Index of Consumer Sentiment for March 2024, prior to 76.50.

- 30-year Mortgage Rate for the week of March 28, 2024, prior to 6.87%

- U.S. Core PCE (Personal Consumption Expenditures) Prince Index YoY for Feb 2024, prior 2.85%

Last week, several encouraging signs for the economy and markets were observed. The Federal Reserve left rates unchanged at their Wednesday meeting while upgrading their GDP growth projections and highlighting the strength and resilience of labor markets. Despite a recent blip in inflation readings, the trend lower appears intact, and the Fed continues to see three rate cuts coming later this year. Lower rates will serve as a tailwind to the housing market, which reported improved existing home sales last week. Despite these encouraging signs, we remain focused on identifying emerging market risk areas. We will continue to look for investment opportunities where the risk vs reward tradeoff looks the most compelling. Please reach out to your advisor at Valley National Financial Advisors with any questions.