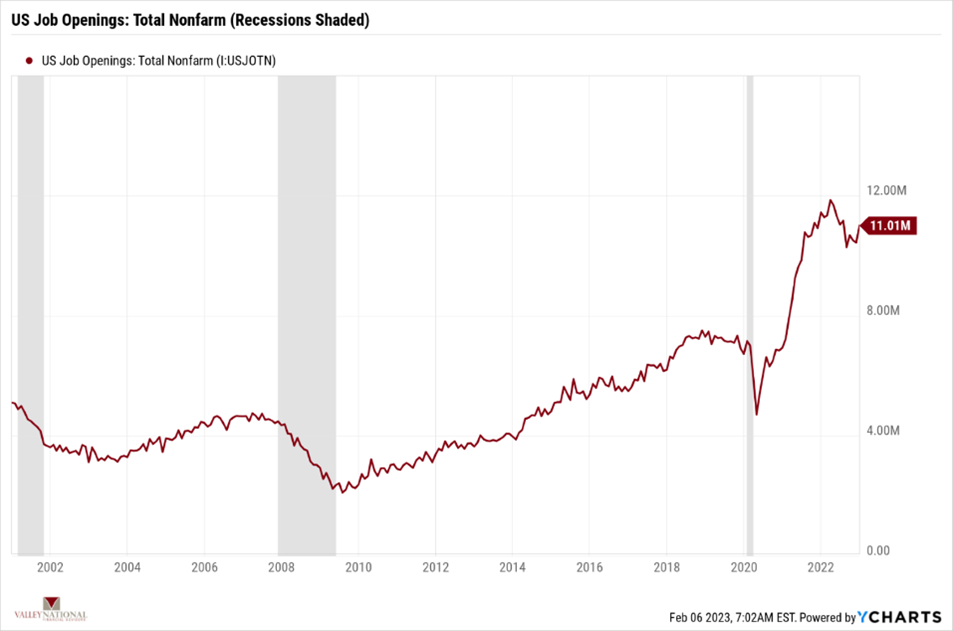

Equity markets posted mixed results last week with the NASDAQ leading the pack at +3.3%, the S&P 500 Index taking up second place at +1.6% and the Dow Jones Industrial Average cleaning up the rear at –0.15%. The FOMC (Federal Open Markets Committee) raised rates on Wednesday by +0.25%, the lowest increase in several meetings and investors took that action as a dovish move by Fed Chairman Jay Powell, meaning the Fed’s aggressive rate hiking is ending. However, by week’s end a case of “Good News” is “Bad News” hit the markets with the Nonfarm payrolls number blasting all Wall Street Economists’ estimates and coming in at +517,000 new jobs vs. estimates at +260,000. Further, the national U.S. Unemployment Rate fell to 3.5%, the lowest in 53 years! These numbers may be telling Chairman Powell that, regardless of higher interest rates, the economy is still doing quite nicely even as inflation is cooling.

Economy

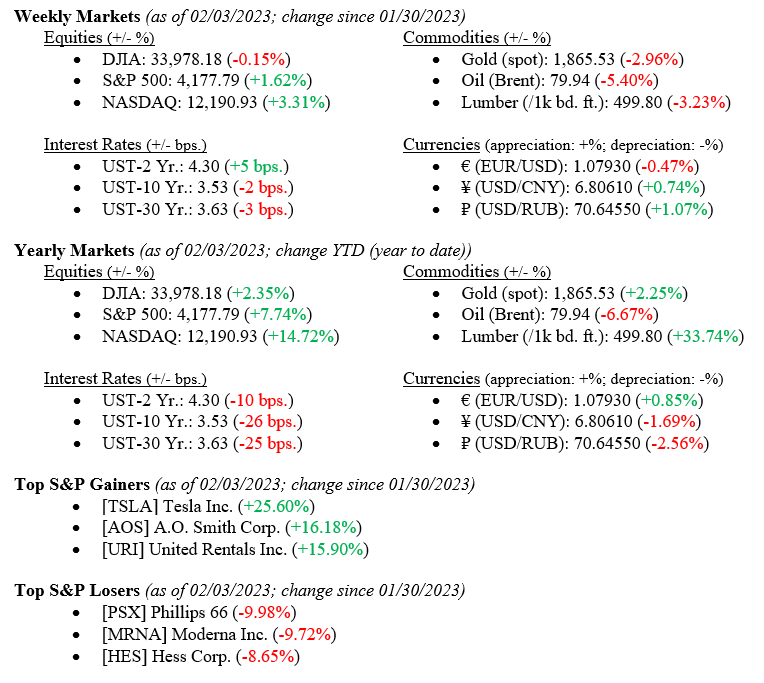

As mentioned above, the employment data continues to be strong, and unemployment continues to fall. Chart 1 below from Valley National Financial Advisors and Y Charts showing the U.S. Unemployment Rate 1940-2023.

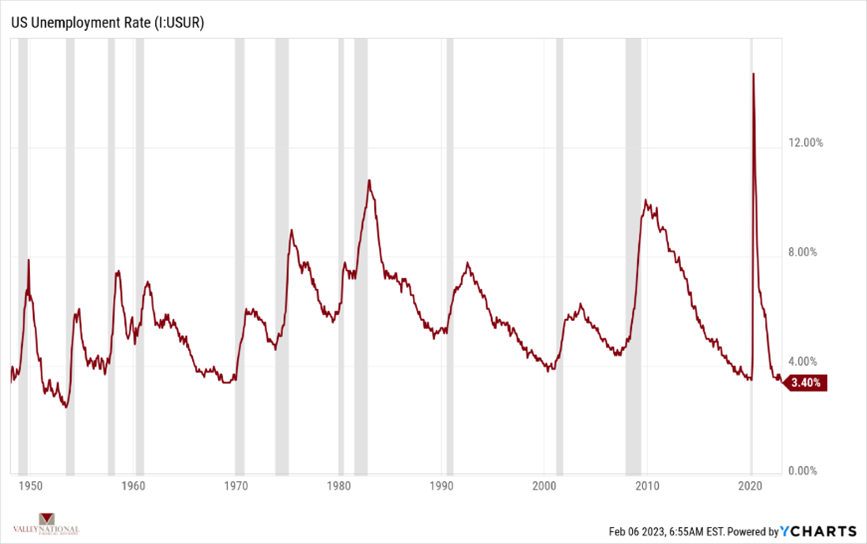

We have a 53-year low in the unemployment rate. This is at a time when the tech sector (e.g., Microsoft, Google, Facebook) is shedding jobs each week, announcing layoffs for the very first time in many of these companies. Oddly, these layoffs are not showing up in the data, which is most likely because an engineer or coder is immediately re-employable, especially in an economy with 11 million job openings, Chart 2 below from Valley National Financial Advisors and Y Charts showing the U.S. Job Openings.

What is puzzling to us at VNFA is the conflicting behavior of the markets. Historically, low unemployment, coupled with many job openings and lumped together with healthy banks, corporations, and consumers, would be good news for the markets. Still, the markets are only focused on the Fed and its fight against inflation. As we showed last week, we have seen inflation impacted by higher rates with falling Personal Consumption Expenditures over the past three months. However, the Fed is also watching employment, which, as noted above, is still strong and growing, telling us the economy is not slowing down. A slowing economy slows inflation, which is the Fed’s objective again.

Policy and Politics

The United States could certainly be a stand-alone, insular economy providing goods and services within the confines of our geographic region. Add in Canada, Mexico, and the North American region is a global powerhouse. However, it is neither practical nor realistic to think of economics and markets as regionally insolated. That said, there continue to be serious global pressures on markets. Not the least of which is China/U.S. trade policy, impacted as recently as last week when the U.S. shot down a Chinese “Spy Balloon” just off the coast of South Carolina. NO! This is not from a Jack Ryan spy novel; this happened. Further, the Russia/UK war is heating up rather than cooling down. Uncertainty prevails, and markets hate uncertainty, as we have repeatedly said.

What to Watch

- U.S. Initial Claims for Unemployment Insurance, week of Feb 4, release 2/9/23 (prior +183,000).

- U.S. Index of Consumer Sentiment for Feb 2023, released 2/10/23 (prior 64.90).

Equity markets are up year-to-date, with the NASDAQ leading the way at +14.8%, the S&P 500 Index up +7.9%, and the Dow Jones Industrial Average at +2.4%. Bonds, as measured by the Bloomberg U.S. Aggregate Index, are up +3.0% year-to-date, and bonds are finally paying a yield. The 2-year U.S. Treasury Note is currently yielding 4.30%, and the benchmark 10-year U.S. Treasury yields 3.53%. Uncertainty continues, especially regarding international tensions and conflict, but the U.S. economy continues to hum along nicely despite the Fed’s attempt to slow the economy and fight inflation. Inflation is falling, and jobs are plentiful; that is what the markets see. Wealth is created over generations, not by inefficient trading on rumors and conjecture. Stay focused on your objectives and reach out to your advisors at Valley National for assistance.