U.S. Equity markets were battered again last week across all sectors, even in the face of strong economic data released that showed 3rd quarter GDP rose +4.90%. Weak and mixed earnings reports and continued global turmoil weighed more heavily on the markets than a strong GDP report. For the week, the Dow Jones Industrial Average fell -2.1%, the S&P 500 Index dropped -2.5% and the NASDAQ fell -2.62%. Meanwhile, the 10-year U.S. Treasury bond yield fell nine basis points to close the week at 4.84% as several large investment houses either lifted their short trade on treasuries or recommended an outright buy for the sector. Both moves rallied bond prices.

US Economy

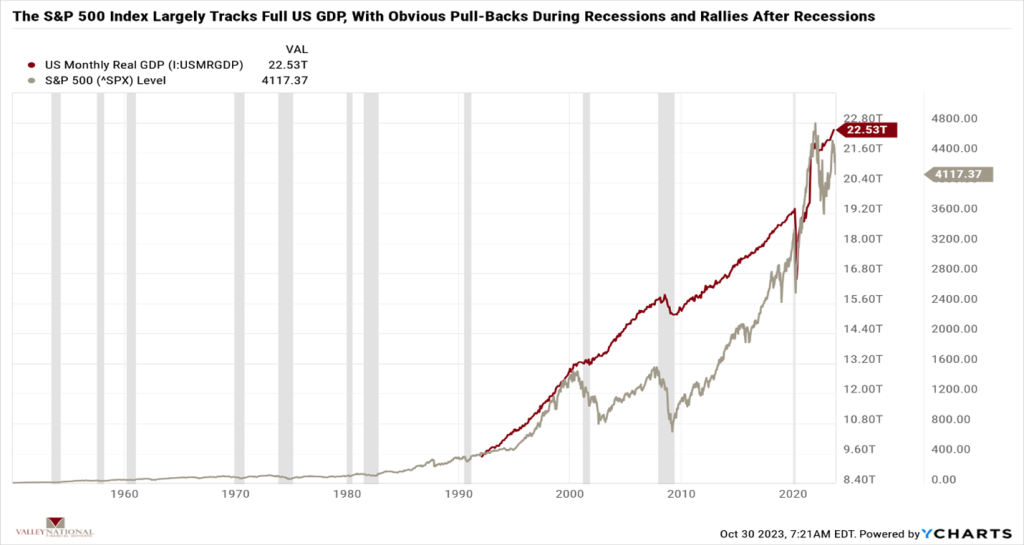

As mentioned above, the 3rd quarter U.S. GDP was released last week and showed that the U.S. economy grew by 4.90%, which was more than double the 2nd quarter rate and led by consumer spending on Travel & Leisure and Retail Goods & Services. The economy has been bolstered by a strong labor market and consumer savings accumulated during the pandemic. See Chart 1 below from Valley National Financial Advisors and Y Charts below showing the U.S. GDP and S&P 500 Index since 1950. We purposely picked an exceptionally long-dated chart to show why it is important to think about investing over extended periods rather than over very volatile short periods of time. You will see from the chart that, over time, the S&P 500 Index grows with the U.S. economy, and we continue to believe that the U.S. economy has a long way to go from here, especially over an extended period. Remember, time is an investor’s partner, not their enemy, and it is easy to get caught up in the volatile short-term noise and miss the big picture.

This week, we will look at the latest FOMC report after their two-day meeting ends on November first. Futures markets and traders are currently pricing in another “pause” in interest rate movements, which would be welcomed, but alone not enough to move markets higher. However, if that announcement is paired with a more dovish statement or language akin to “we believe the current interest rate levels are sufficient to combat inflation,” we could see the fear leave the markets to be replaced by positive investor sentiment.

Policy and Politics

Last week, we emphasized our concerns impacting markets: global regional turmoil, fear of the Fed continuing to raise interest rates and uncertainty related to our political spectrum. With the election of Congressman Mike Johnson (R-LA) as U.S. Speaker of the House, the political sideshow and uncertainly related to it has been lifted, and Washington (rightly or wrongly) can now get back to work with focus on a spending bill that avoids another embarrassing government shutdown.

What to Watch

- Target Fed Funds Rate from the FOMC meeting, released 11/1/23; current upper limit 5.50%

- U.S. Initial Claims for Unemployment Insurance for week of 10/28/23, released 11/2/23, prior 210,000 new claims.

- U.S. Unemployment Rate for October 2023, released 11/3/23, prior rate 3.8%

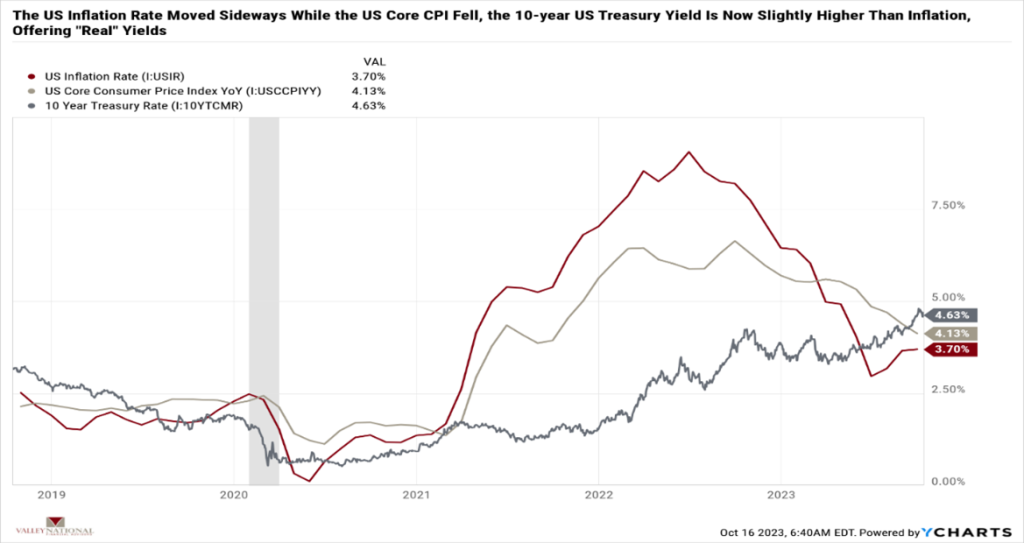

Certainly, the economy continues to grow at a healthy pace despite interest rates rising from 0.00% to 5.50%. However, we are seeing sanguine earnings releases from companies and, along with that, language from CEOs and CFOs pointing to less-than-stellar earnings going forward. We stated before that interest rate hikes take time to work through the economy (typically 9-18 months). The first-rate hike in this cycle was in March 2022, about 18 months ago. We believe the FOMC is close to being finished with rate hikes as inflation continues to creep towards their 2% target (the September 2023 rate was 3.7%). As usual, watch for dovish (lower rates) or pivot (hike to cuts) language from Fed Chairman Jay Powell during the press conference after the FOMC meeting and announcement this Wednesday. We understand there is a lot of conflicting data: a growing economy, healthy consumer spending, strong labor market, less than stellar earnings, high-interest rates hurting the real estate market, and, of course, all equity markets continuing to sell off each week. Sometimes, it is not easy to be an investor. Please reach out to your financial advisor at Valley National Financial Advisors for questions or help.