Did you miss last week’s Market Update with our CIO William Henderson?

Category Archives: economy

Current Market Observations

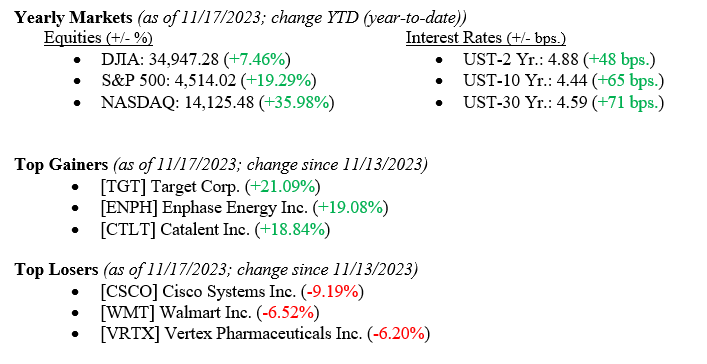

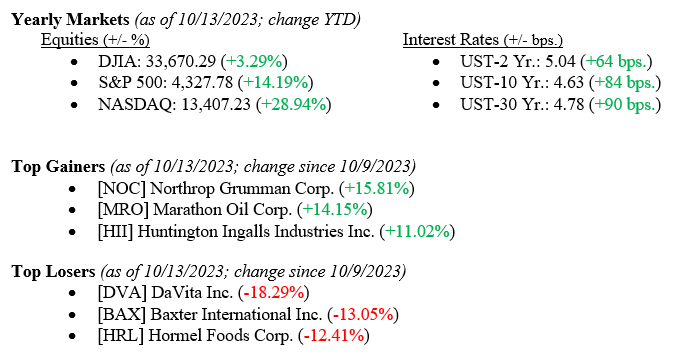

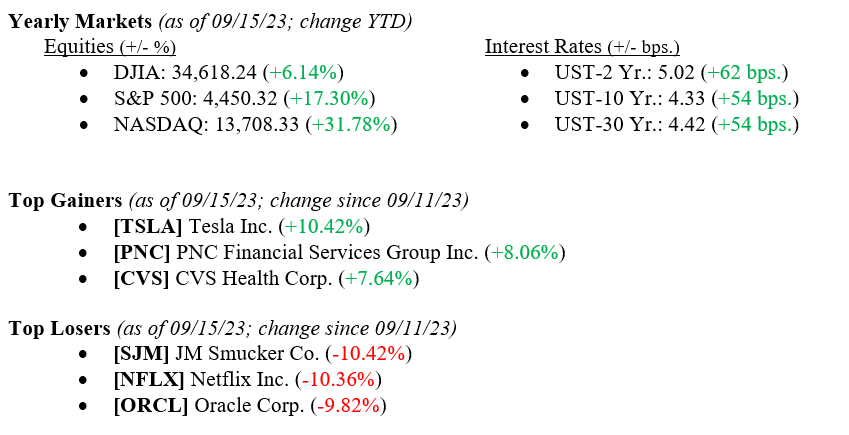

Equity markets notched another modest win last week, with all major indexes reporting gains (see year-to-date numbers below). We typically only point out the major indexes here at Valley National Financial Advisors, but last week saw gains in small capitalization stocks, a sector left out of this year’s market rally. As measured by the Russell 2000 Index, small caps gained +5.5% last week, which also shifted their year-to-date return into positive territory at +3.5%. A rally in small-cap stocks has been long overdue as most of the big gains this year have been in large-cap and even mega-cap stocks like the “Magnificent Seven.” An equity market rally balanced across all sectors and includes deep depth and breadth of all capitalization stocks rather than just large or mega-cap is healthier and more sustainable over longer periods. Bonds also continued their rally, with the 10-year U.S. Treasury falling 18 basis points to close the week at 4.44%.

US Economy

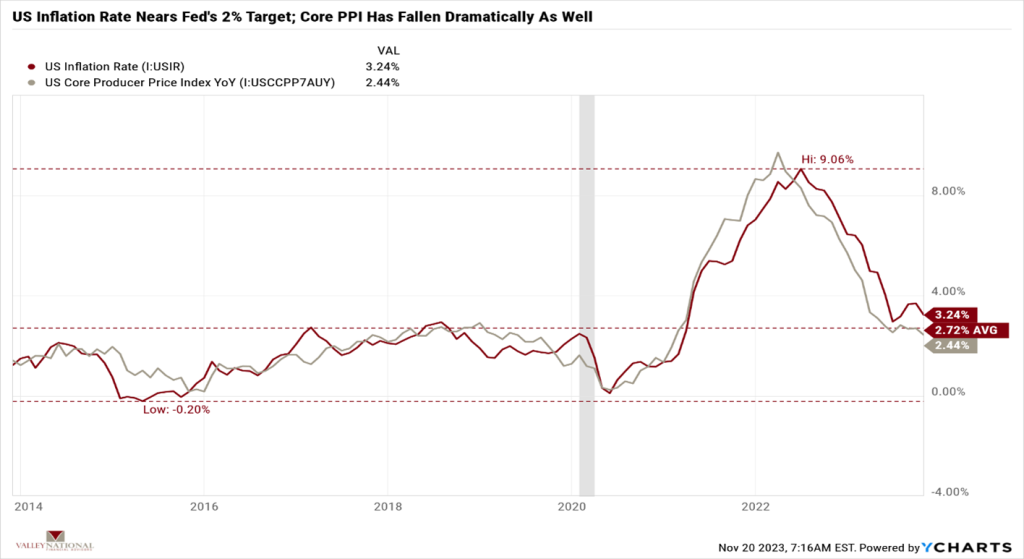

Last week’s equity gains were precipitated by the inflation data released mid-week. The U.S. Inflation Rate fell to 3.24% for October, down from an August 2022 high of 9.06%. See Chart 1 below from Valley National Financial Advisors and Y Charts showing the U.S. Inflation Rate and the U.S. Core Producer Price Index. While the U.S. inflation rate is not yet at the Federal Reserve’s target rate of 2%, the rate has come down dramatically. Furthermore, as we have stated many times here at Valley National Financial Advisors, interest rate hikes take time to work their way through the economy; therefore, even without further rate increases, the inflation rate should continue to track downward from here, given all the tightening that has occurred over the past 18 months. This view, shared by most economists, confirms that the Fed will remain on the sidelines, refraining from further intervention and instead watching and interpreting the data.

Policy and Politics

We have talked about global turmoil often and how global issues create uncertainty and fear—both of which markets hate. The Ukraine/Russia War continues to languish well into its second year. Further, the Israel/Hamas War shows no signs of abating. Thankfully, last week’s APEC Summit in San Francisco and the meeting of Chinese President Xi Jinping and President Biden may help to revive the recently cool relations between China and the U.S., the world’s two largest economies. Both countries are moving past pandemic-related inflation periods and experiencing growing economies, so healthy relationships rather than trade wars or tariff spats are important going forward.

What to Watch

- We have a Thanksgiving Holiday shortened trading week so Wall Street will be quiet but Main Street will be all buzz on Friday as the Holiday Season will kick off with Black Friday sales hitting the retail space. Next week Cyber Monday starts and by the end of the week we will have some idea of the consumer’s appetite for shopping and spending as many retailers will report 3rd quarter earnings.

Everyone agrees that the U.S. has avoided a recession in 2023, and the outlook for 2024 is starting to look equally rosy. We remain cautiously optimistic about the markets and the economy, as we have been for over a year. The Fed may be done with interest rate hikes, but even if more hikes are coming, they will be modest, if at all, and minimally impactful. Investors have been rewarded this year for staying the course and remaining invested, a path that is often painful. According to the Nation Retail Federation, consumer spending is expected to be 3-4% higher this holiday season. The U.S. consumer has remained resilient all year and continues to support the economy. Reach out to your financial advisor at Valley National Financial Advisors for help and advice, but more importantly, enjoy the Thanksgiving Holiday Weekend.

Current Market Observations

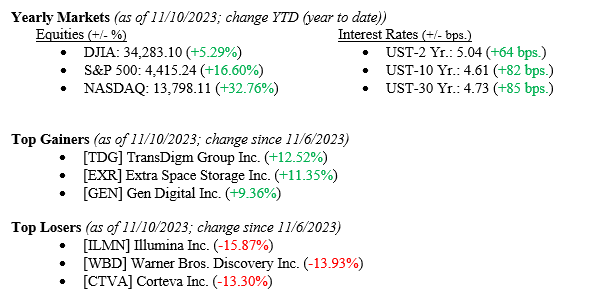

We will talk about market headwinds and tailwinds later in the report, but for now, let us just talk about what the markets did last week and year-to-date to remind investors where we really are and what the markets have done. Last week, the Dow Jones Industrial Average added +0.7%, the S&P 500 Index notched a +1.3% return, and the NASDAQ added +2.4%. These returns pushed year-to-date figures higher for each major index, with the Dow at +5.3%, the S&P 500 at +16.6%, and the mega-tech heavy NASDAQ at 32.8%. Certainly, few investors own only index-based investments or only mega-tech equities. Still, most investors with balanced portfolios own a slice of each and, therefore, have captured their risk-related slice of these market returns thus far in 2023. Bonds moved little last week, with the 10-year U.S. Treasury closing at 4.62%, five basis points higher than the previous week.

Global Economy

There continues to be sufficient geopolitical global turmoil to worry us at Valley National Financial Advisors. The Israeli/Hamas War shows no signs of abating, while the Russia/Ukraine War has dragged on for almost two years; both wars are overheating the already unsteady markets for oil, natural gas, and some food commodities like wheat and creating an ongoing humanitarian crisis. On the flip side of bad news, Chinese President Xi Jinping will meet with President Biden this week in California in a move that officials on both sides hope will ease tensions in the important bilateral relationship between the U.S. and China. While these three events seem distant from the U.S. equity markets, they individually and collectively add uncertainty to the markets, which everyone who reads The Weekly Commentary knows we hate.

Policy and Politics

In the continuing saga of Washington, DC’s version of “The Gang That Couldn’t Shoot Straight,” we are three days away from another government shutdown. The newly elected Speaker of the House, Mike Johnson, must bring together the contentious parties from both sides of the aisle to pass a budget bill before Friday, November 17, to avoid a government shutdown. While a lot of the actions and bargaining going on in Washington are in partisan brinkmanship, the farce of a looming U.S. Government shutdown has real market implications. For example, last week, the credit rating agency Moody’s lowered the outlook on the U.S. Credit to “negative” from stable, citing large fiscal deficits and declining debt affordability. Moody’s move followed a rating downgrade by another rating agency, Fitch, to A.A. from AAA earlier this year. Although the actions by rating agencies do not have any real market implications, as U.S. Treasury bonds still represent the “risk-free” market measure, moves like this slowly chip away at investor confidence and place a finer negative global spotlight on the U.S.

What to Watch

- Monday, November 13th

- 4:30PM: Retail Gas Price (Prior: $3.52/gal.)

- Tuesday, November 14th

- 8:30AM: U.S. Consumer Price Index MoM/YoY (Priors: 0.40% | 3.70%)

- 8:30AM: U.S. Core Consumer Price Index MoM/YoY (Priors: 0.32% | 4.13%)

- Thursday, November 16th

- 8:30AM: Initial Claims for Unemployment Insurance (Prior: 217,000)

- 10:00AM: NAHB/Wells Fargo U.S. Housing Market Index (Prior: 40.00)

- 12:00PM: 30-Year Mortgage Rate (Prior: 7.50%)

- Friday, November 17th

- 8:30AM: U.S. Building Permits (Prior: 1.473M)

- 8:30AM: U.S. Building Permits MoM (Month Over Month) (Prior: -4.41%)

- 8:30AM: U.S. Housing Starts (Prior: 1.358M)

- 8:30AM: U.S. Housing Starts MoM (Prior: 7.01%)

We have focused on quite a few negative notions this week, which we know is a bit out of character, but there are plenty of positive things to highlight. Contrary to most economists, the U.S. has avoided a recession in 2023, and it looks like 2024 will continue our growth pattern, at least into the first half of the year. Further, inflation has come down from 9% to 3% in just over a year, which means the Fed and most other global central banks are nearing completion in their interest rate hiking cycle. Corporate earnings remain healthy, with most companies reporting earnings that beat Wall Street expectations. Lastly, while the consumer may be getting understandably tired of supporting the economy with their spending, we expect consumer spending to continue well into 2024, especially during the 2023 holiday season. The markets are efficient and always look well into the future rather than watching the past. Investors would do well to do the same. Reach out to your financial advisor at Valley National Financial Advisors for help or questions.

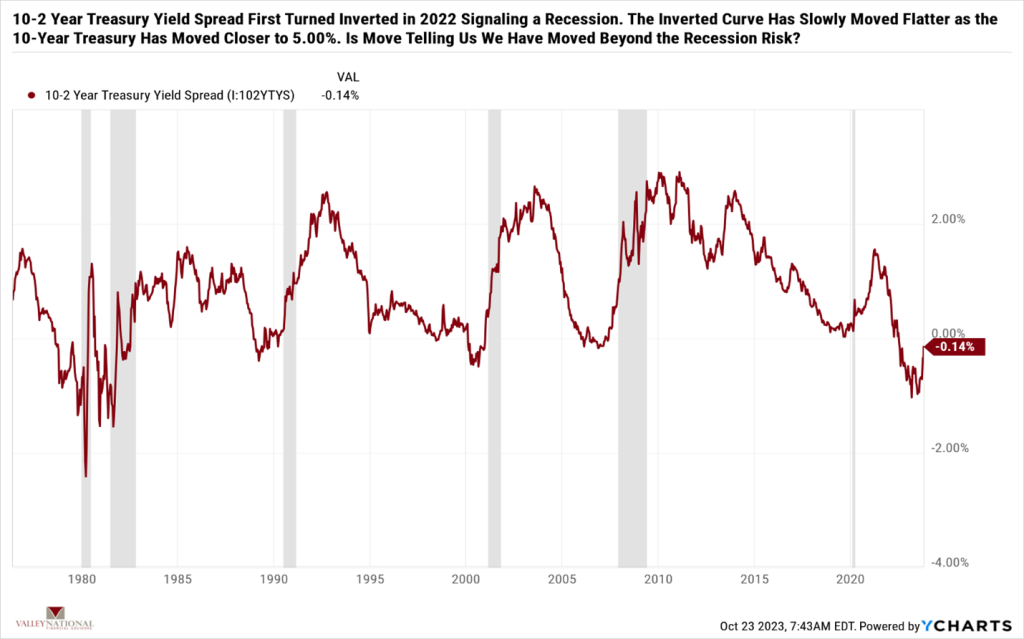

Current Market Observations

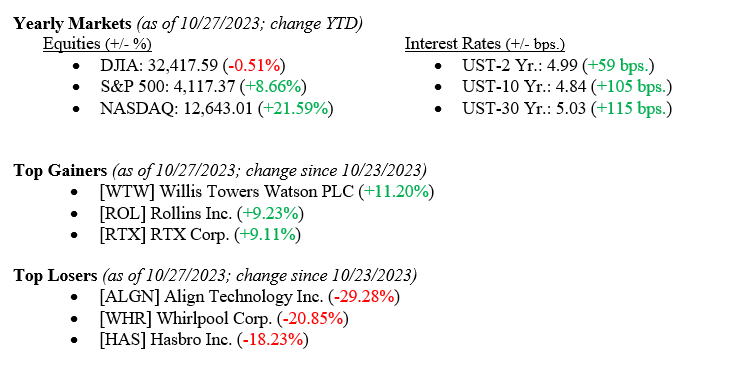

U.S. Equity markets were battered again last week across all sectors, even in the face of strong economic data released that showed 3rd quarter GDP rose +4.90%. Weak and mixed earnings reports and continued global turmoil weighed more heavily on the markets than a strong GDP report. For the week, the Dow Jones Industrial Average fell -2.1%, the S&P 500 Index dropped -2.5% and the NASDAQ fell -2.62%. Meanwhile, the 10-year U.S. Treasury bond yield fell nine basis points to close the week at 4.84% as several large investment houses either lifted their short trade on treasuries or recommended an outright buy for the sector. Both moves rallied bond prices.

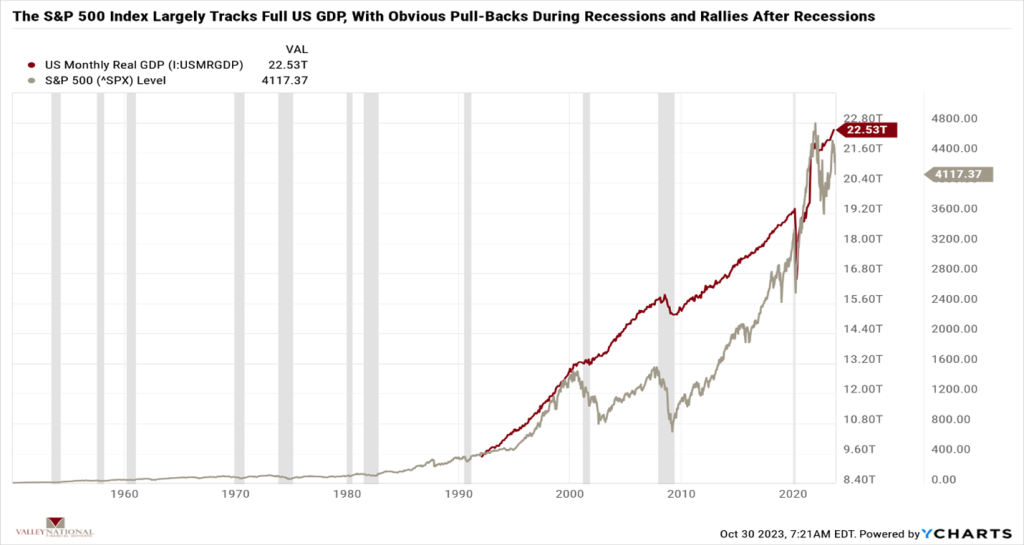

US Economy

As mentioned above, the 3rd quarter U.S. GDP was released last week and showed that the U.S. economy grew by 4.90%, which was more than double the 2nd quarter rate and led by consumer spending on Travel & Leisure and Retail Goods & Services. The economy has been bolstered by a strong labor market and consumer savings accumulated during the pandemic. See Chart 1 below from Valley National Financial Advisors and Y Charts below showing the U.S. GDP and S&P 500 Index since 1950. We purposely picked an exceptionally long-dated chart to show why it is important to think about investing over extended periods rather than over very volatile short periods of time. You will see from the chart that, over time, the S&P 500 Index grows with the U.S. economy, and we continue to believe that the U.S. economy has a long way to go from here, especially over an extended period. Remember, time is an investor’s partner, not their enemy, and it is easy to get caught up in the volatile short-term noise and miss the big picture.

This week, we will look at the latest FOMC report after their two-day meeting ends on November first. Futures markets and traders are currently pricing in another “pause” in interest rate movements, which would be welcomed, but alone not enough to move markets higher. However, if that announcement is paired with a more dovish statement or language akin to “we believe the current interest rate levels are sufficient to combat inflation,” we could see the fear leave the markets to be replaced by positive investor sentiment.

Policy and Politics

Last week, we emphasized our concerns impacting markets: global regional turmoil, fear of the Fed continuing to raise interest rates and uncertainty related to our political spectrum. With the election of Congressman Mike Johnson (R-LA) as U.S. Speaker of the House, the political sideshow and uncertainly related to it has been lifted, and Washington (rightly or wrongly) can now get back to work with focus on a spending bill that avoids another embarrassing government shutdown.

What to Watch

- Target Fed Funds Rate from the FOMC meeting, released 11/1/23; current upper limit 5.50%

- U.S. Initial Claims for Unemployment Insurance for week of 10/28/23, released 11/2/23, prior 210,000 new claims.

- U.S. Unemployment Rate for October 2023, released 11/3/23, prior rate 3.8%

Certainly, the economy continues to grow at a healthy pace despite interest rates rising from 0.00% to 5.50%. However, we are seeing sanguine earnings releases from companies and, along with that, language from CEOs and CFOs pointing to less-than-stellar earnings going forward. We stated before that interest rate hikes take time to work through the economy (typically 9-18 months). The first-rate hike in this cycle was in March 2022, about 18 months ago. We believe the FOMC is close to being finished with rate hikes as inflation continues to creep towards their 2% target (the September 2023 rate was 3.7%). As usual, watch for dovish (lower rates) or pivot (hike to cuts) language from Fed Chairman Jay Powell during the press conference after the FOMC meeting and announcement this Wednesday. We understand there is a lot of conflicting data: a growing economy, healthy consumer spending, strong labor market, less than stellar earnings, high-interest rates hurting the real estate market, and, of course, all equity markets continuing to sell off each week. Sometimes, it is not easy to be an investor. Please reach out to your financial advisor at Valley National Financial Advisors for questions or help.

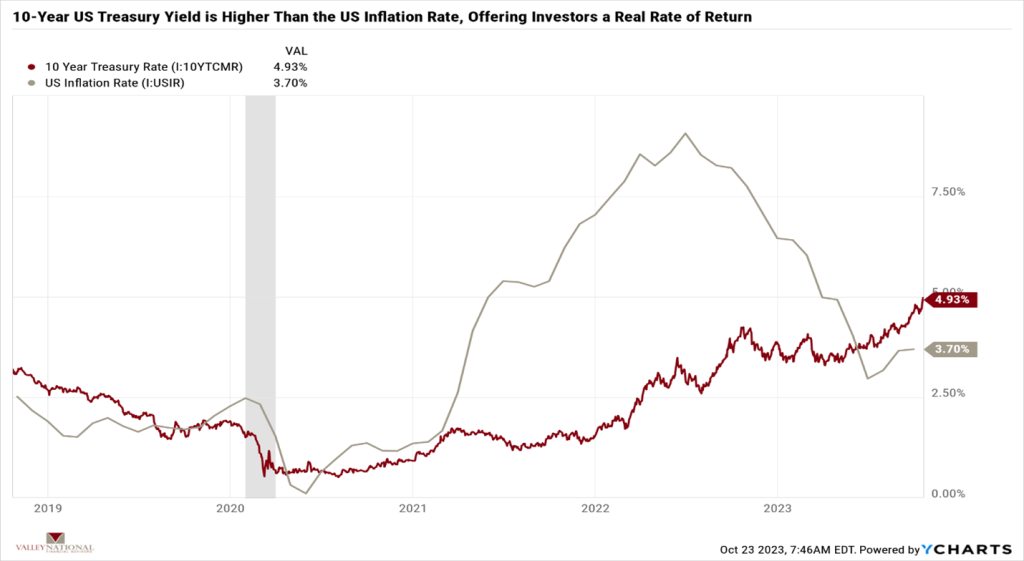

Current Market Observations

All three major market indexes posted heavy losses for the week, with the Dow Jones Industrial Average falling –1.6%, the broader S&P 500 Index falling –2.4%, and the tech-heavy NASDAQ falling –3.2%. A flurry of uninspiring earnings releases, higher bond yields, and continued global unrest led to the losses. Bond yields meanwhile moved higher, with the yield on the 10-year U.S. Treasury rising 15 basis points to close the week at 4.93%. Early reports this week show a 10-year Treasury yield moving to 5.00%, a level not seen since 2007. Two weeks ago, in this report, we introduced three words in our commentary that we do not take lightly. The words were turmoil, fear, and uncertainty. In this week’s report, we unpack those words and explain why we remain concerned.

Global Economy

The global economy is where turmoil firmly falls on the markets. The Israel/Hamas war continues without any view to a swift or less costly end to the conflict. The Middle East has rarely been a calm place, but relations have certainly been better than they are now among members of the region. For obvious reasons, oil markets and global trade rely on relative calm in the region – major oil producers are located here, and trade through the Suez Canal is a critical route for Asia/Europe trade. The Israel/Hamas War piles onto the Russia/Ukraine War and the China/Taiwan concerns. Hence, our use of the word turmoil – “a state of great disturbance or confusion.”

Policy and Politics

The second word we introduced is fear. Why fear? For the first time in many years, investors are fearing the Fed instead of welcoming the Fed and their concomitant market actions. Last week, in a speech to the Economic Club of NY, where we have two Valley National Group investment associates present, Fed Chairman Powell danced around the future path or direction of interest rates, pointing instead to the data as his compass for what the Fed will do next. Investors hoped to hear language stating that future rate hikes were off the table, but that was not the case in both fixed-income and equity markets sold off because everyone was still waiting for the classic Fed Put. The Fed Put happens when markets expect and price in lower interest rates, not higher ones. So, instead of welcoming Fed actions, markets fear future Fed actions. We believe that the economy remains healthy, which is most evident in the consumer who continues to spend. The labor market, where unemployment remains at a near-record low level of 3.8% and housing, while slower, continues to exhibit resilience.

What to Watch

- Merger activity – there are two major M&A (merger & acquisition) deals on the table right now: Exxon/Pioneer Natural Resources and Chevron/Hess. These mega-billion-dollar mergers provide much needed fuel and profits to Wall Street where M&A and IPOs have been quiet recently.

- U.S. Single Family Houses sold for September 2023, released 10/25/23, prior 675k.

- U.S. Real GDP QoQ for 3rd Quarter 2023, released 10/26/23, prior +2.1%

- U.S. Personal Consumption Expenditure Index YoY for September 2023, released 10/27/23, prior 3.48% (Fed’s favored inflation indicator)

- U.S. Index of Consumer Sentiment for October 2023, released 10/27/23, prior level of 63.

We chose the summary for the week to discuss our third word – uncertainty. We have discussed markets hating uncertainty the most out of all worrisome trends. Typically, in a market where fear and turmoil exist, investors are uncertain, and their natural reaction is a flight to quality, which means buying U.S. Treasuries. However, U.S. Treasuries continue to sell off as the Federal Reserve’s surge in debt supply and mixed signals on the rate path weaken fixed-income markets. Furthermore, our leaders in Washington continue to do nothing as they wrangle to simply fill the U.S. Speaker of the House position, notably the third position in line for succession to the U.S. President.

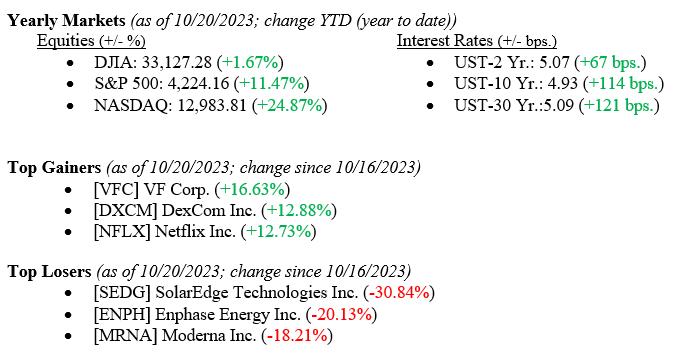

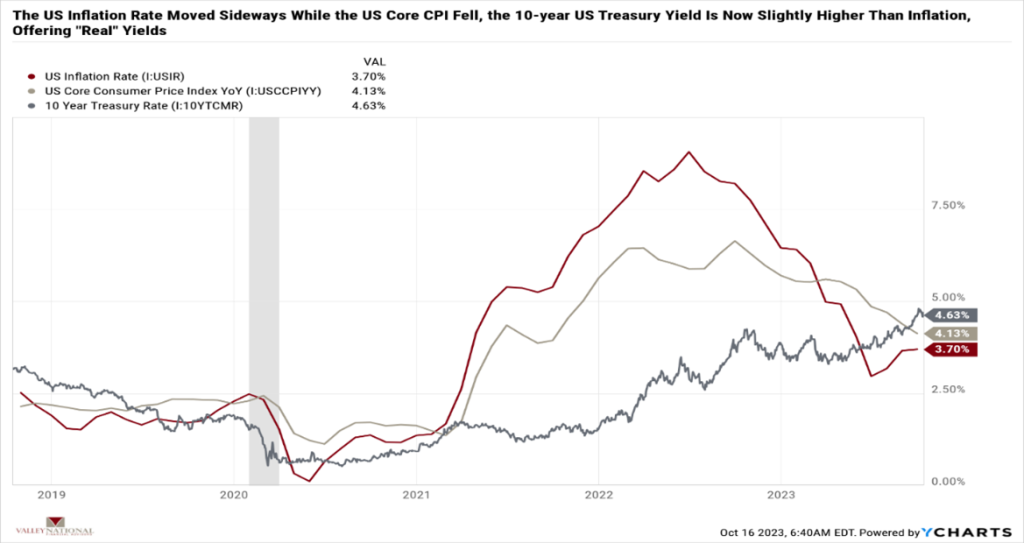

Uncertainty persists in our leaders, world politics, and the markets, so while it is not unusual for markets to sell off, it is unusual to see such a connected and broad sell-off in all markets in tandem. Treasuries at 5.00% offer investors real after inflation yields. See charts 1 & 2 above by Valley National & Y Charts showing first the U.S. Inflation rate and the 10-year U.S. Treasury yield and second the 10-2-year Treasury Yield Spread.

We expect to see turmoil, fear, and uncertainty in the market until each issue gets resolved over time, and time is always on the patient investors’ side. The patient investor can outlast uncertainty. Reach out to your advisor at Valley National Financial Advisors for advice or questions.

Current Market Observations

The broader markets rallied last week, seeing through the noise of continued inflation concerns, a protracted war in the Middle East, and mixed third-quarter corporate earnings releases. Last week, the Dow Jones Industrial Average and the S&P 500 Index moved +0.79% and +0.45%, respectively, while the NASDAQ moved lower by –0.18%. In a classic “Flight-to-Quality” trade, U.S. Treasury bond yields fell as investors moved to safe Treasuries during a time of global conflict. The 10-year U.S. Treasury bond fell 15 basis points, ending the week at 4.63%. Even at this lower yield, investors are finally seeing “real” yields on Treasuries as the U.S. Inflation Rate has finally fallen lower than the 10-year U.S. Treasury bond yield. See Chart 1 from Valley National Financial Advisors and Y Charts.

US Economy

As mentioned above, while stubbornly staying above the Fed’s target rate of 2%, the U.S. Inflation Rate is now 3.70% (released last week). The U.S. Core CPI (Consumer Price Index) fell to 4.13% in September 2023 from 4.39% in August 2023. Chart 1 below shows the 10-year U.S. Treasury and two inflation measures. While inflation remains higher, the yield on the 10-year Treasury is slightly higher, thereby finally offering investors real, after-inflation returns.

Higher interest rates continue to negatively impact growth stocks as those companies typically borrow money to expand operations or hire additional employees. As third-quarter earnings releases hit the tape, we will get a better picture of which firms and industries are best dealing with higher interest rates for longer. Large banks Citigroup, JP Morgan, and Wells Fargo all reported earnings better than expected as higher interest rates helped these banks as they continue to remain a bit stingy in passing on the higher rates to their depositors.

A widening or global escalation of the Israel-Palestinian conflict could impact oil prices, but thus far, world oil prices have not been materially impacted. It is important to watch this event to see how various actors on the world stage choose sides. For example, the U.S. has moved the USS Gerald Ford carrier fleet to the region to support Israel. Of course, defense stocks (ex. Northrop Grumman, General Dynamics & Lockheed Martin) have modestly rallied because of the growing conflict.

Policy and Politics

Three government forces are working in the economy right now, and all are impacting the markets, pushing uncertainty and worry into prices:

- We have the Fed and its constant fight against inflation. Last week, Federal Reserve Bank Vice Chairman Philip Jefferson noted that higher long bond yields are doing a lot of the work for the Fed in slowing the economy, implying that there is no need for further rate hikes.

- U.S. Secretary of State Anthony Blinken is actively involved in the Israeli-Palestinian conflict, which clearly indicates the U.S. is willing to do whatever is necessary to support our allies in the region.

- We continue to see a circus in Washington, DC, as lawmakers fall over each other trying to elect a new U.S. Speaker of the House.

Taken together, these government forces are adding uncertainty and worry to the markets, which is quite the opposite of what we expect and desire from our leaders.

What to Watch

• U.S. Retail Gas Price for week of October 13, 2023, released 10/16/23, prior price $3.81/gallon.

• U.S. Housing Starts for September 2023, released 10/18/23, prior 1.283 million starts.

• U.S. Initial Claims for Unemployment for week of October 14, 2023, release 10/19/12, prior 209k

• 30 Year Mortgage Rate as of October 19, 2023, released 10/19/23, prior 7.57%

• Key Earnings releases to watch this week: Tesla, Netflix, Goldman Sachs, Lockheed Martin.

We pointed out the wall of worry above with confusion on interest rates, continuing global conflict, and a broken U.S. Congress. Meanwhile, the markets are moving slightly higher each week, and bonds finally offer “real” yields for investors. Instead of worrying about what is happening now, the markets are scaling the wall of worry and moving higher as they filter out the noise and see sectors like big tech, healthcare, and mega banks doing well, even given all the noise. It is easy to get mired down with worry and negativity – that is all we see on TV and hear from so-called experts, but the markets see the future and ignore the noise. Investors interested in creating long-term generational wealth should listen to the markets and ignore the TV. Reach out to your financial adviser at Valley National Financial Advisors for advice or questions.

Current Market Observations

U.S. stocks ended the week essentially flat. The Dow Jones Industrial Average gained 0.12% on the week, the S&P 500 lost 0.16%, and the NASDAQ fell 0.39%. Last week, U.S. inflation grew to 3.67% from 3.18% the month prior. Additionally, mortgage rates climbed to an average of 7.18% from 7.12%, the highest rate since May 2001. It’s also worth noting that the Index of Consumer Sentiment, a survey of general economic outlook based on a random sample of U.S. households, has fallen to 67.70, a slight drop from the prior month but still significantly ahead from a year ago when it was 58.60 (the higher consumer sentiment, the better). These reports coincide with a slight sell-off in bonds, with the 10-year U.S. Treasury ending the week at 4.33%, seven basis points higher than last Friday. As always, please reach out to your advisor at Valley National Financial Advisors with any questions or concerns.

Global Economy

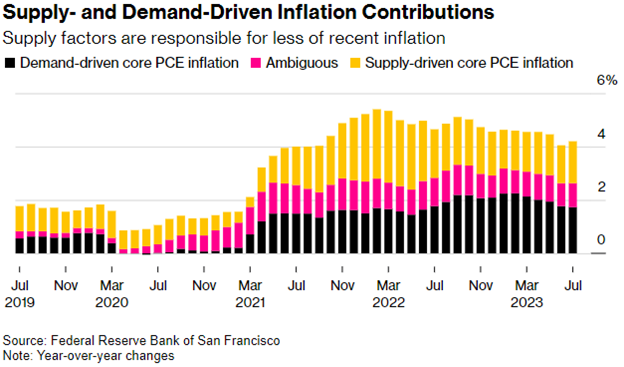

Though the Federal Reserve has raised rates by more than 500 basis points since January 2022, there has been a limited slowdown in US consumer demand. With the most recent inflation number gaining month-over-month, policymakers are beginning to look at rates from a new perspective: what do rate hikes mean for the supply side of the economy? The argument is that if rates rise too high, they could potentially undermine the benefits of increasing supply, as discussed in a paper presented at Jackson Hole last month. Despite this, we expect the Fed to remain data-driven in its battle to bring inflation down to the 2% target—it is unlikely that they will act solely on this argument moving forward when their action plan has proven relatively effective. Chart 1 below shows the components of inflation that are driven by either demand or supply.

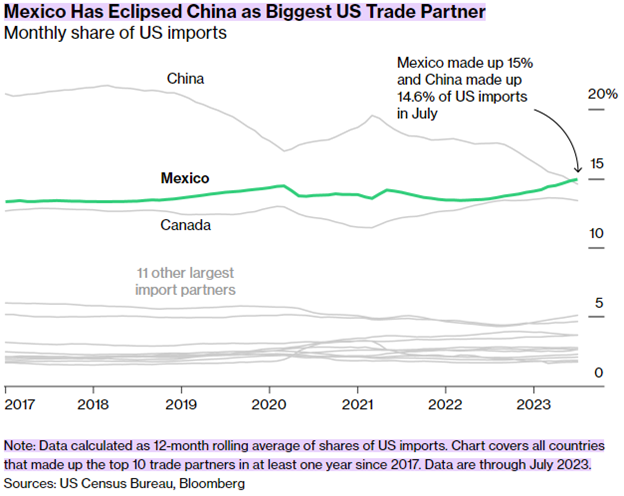

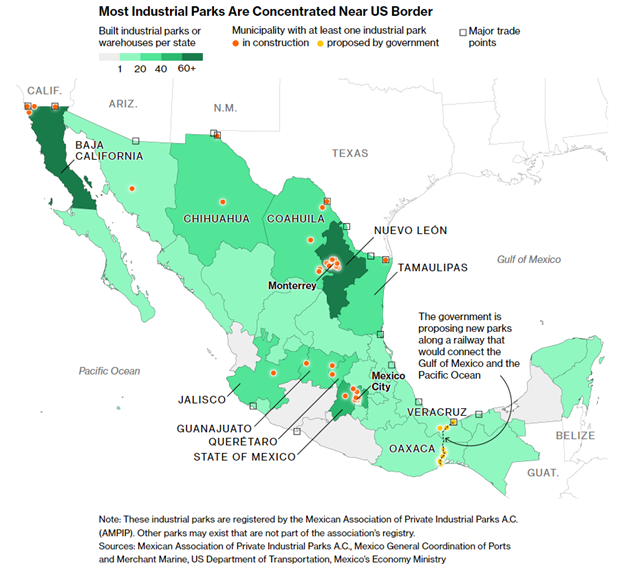

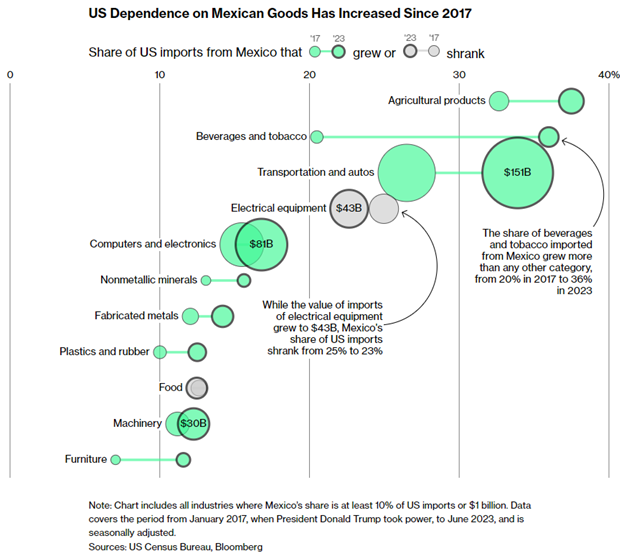

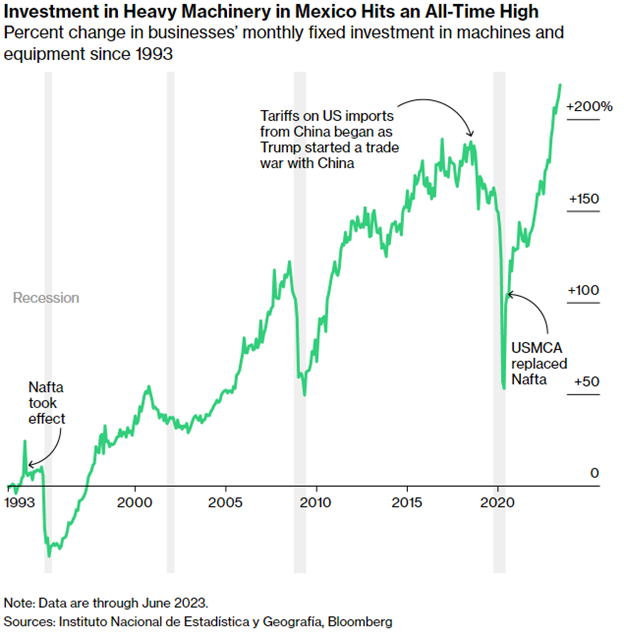

As of July, Mexico has overtaken China as the United States’s largest trade partner, representing 15% of U.S. imports (versus China’s 14.6%). Chart 2 below shows the trend in U.S. imports since 2017. As U.S.-China relations soured, the share of imports from Mexico and Canada increased significantly over the last six years, making nearshoring to Mexico a much more attractive option. Chart 3 is a map of major industrial parks that produce goods that eventually make their way into the United States—it’s no surprise that most of them are located near the border. As investment into these industrial parks increased, so did the U.S.’s dependence on Mexican goods. Since 2017, all categories of imports have increased except for food and electrical equipment, which decreased. Chart 4 shows each import category and their respective sizes. Chart 5 shows the change in investment in heavy machinery in Mexico since 1993—notice the sharp decline from when tariffs on Chinese goods began in 2018 through 2020 and then the sharp rise once the USMCA was enacted in place of NAFTA.

What to Watch

- Monday, Sept. 18th

- 4:30PM – Retail Gas Price (Prior: $3.941/gal.)

- Tuesday, Sept. 19th

- 8:30AM – Housing Starts (Prior: 3.86%)

- 10:00AM – Job Openings: Total Nonfarm (Prior: 8.827M)

- Wednesday, Sept. 20th

- 2:30PM – Target Federal Funds Rate (Prior: 5.25-5.50)

- Thursday, Sept. 21st

- 8:30AM – Initial Claims for Unemployment (Prior: 220k)

- 10:00AM – Existing Home Sales (Prior: 4.07M)

- 12:00PM – 30 Year Mortgage Rate (Prior: 7.18%)

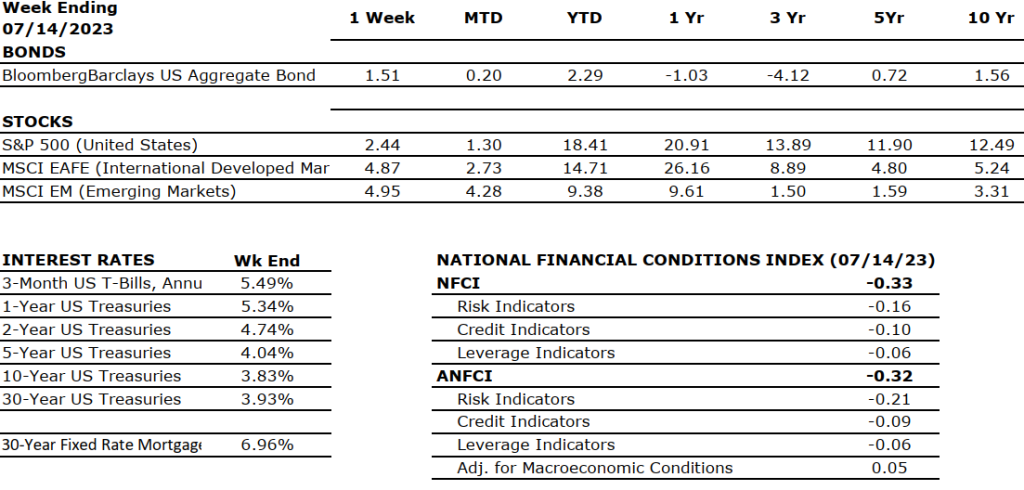

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five- and 10- year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

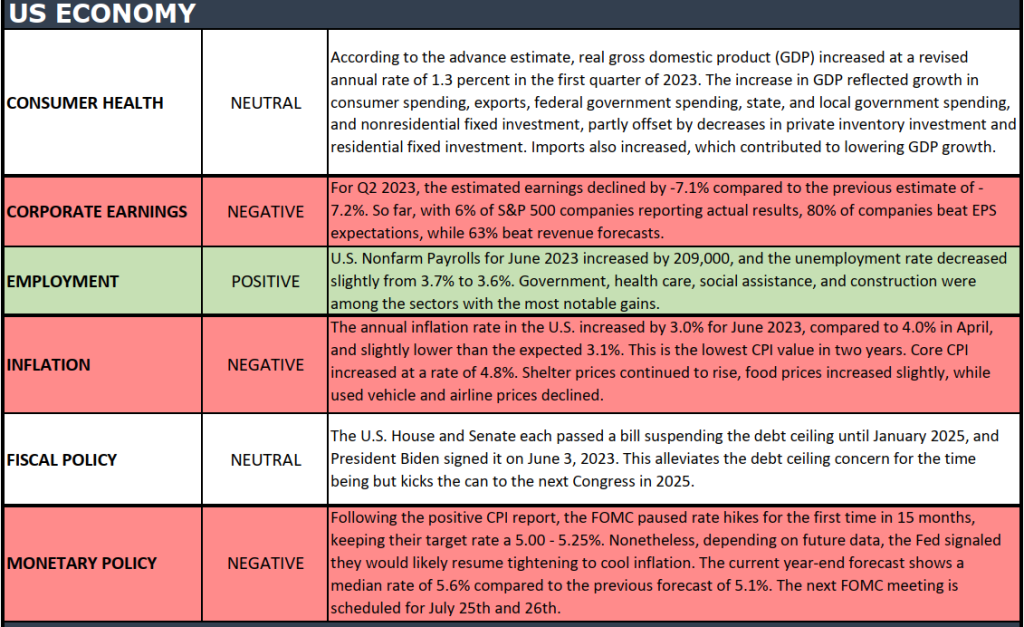

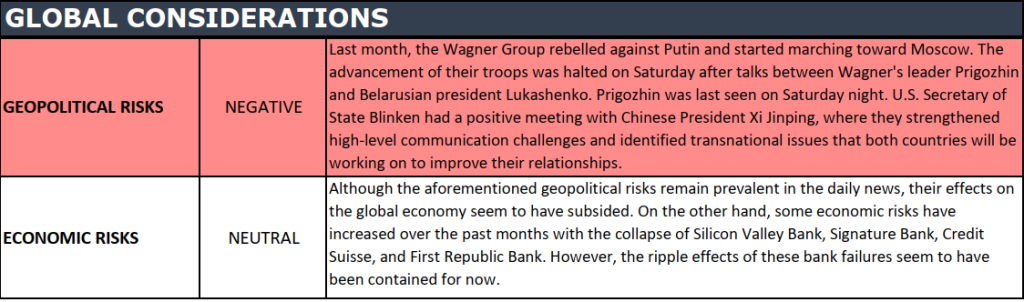

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade key economic conditions that we believe are of particular importance to investors.

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

The Economy

Last week was a light week for economic reports during which positive reports outweighed negative reports.

The positive reports were:

- Car sales are on fire, GM sales rose 6.4% and Ford sales rose 4.9%, vs expectations of a 0.6% and 1.8% increase, respectively.

- Unemployment came in at 5.3%, unchanged from last month and in line with expectations.

- Weekly jobless claims came in at 270k, in line with expectations.

- Personal income rose 0.4%, better than the 0.3% expected.

- Average hourly earnings rose 0.2%, in line with expectations.

And the negative reports were:

- Consumer spending rose 0.2%, below the 0.3% expected rise.

- The Institute of Supply Management Index fell to 52.7, down from 53.5 in June.

- Construction spending rose 0.1%, well below the 0.8% expected rise.

Factory orders rose 1.8%, below the 2% expected rise.

The Economy

Last week was a light week for economic reports during which positive reports outweighed negative reports.

The positive reports were:

- Weekly jobless claims came in at 255k, the lowest reading since 1973!

- Existing home sales rose 3.2% in June to an annualized rate of 5.49mm, the fastest pace in more than eight years.

- Mortgage applications rose 1% week over week.

And the negative reports were:

- Refinance applications fell 0.5% week over week.

- Pending home sales came in at 482k, below the 548k expected.