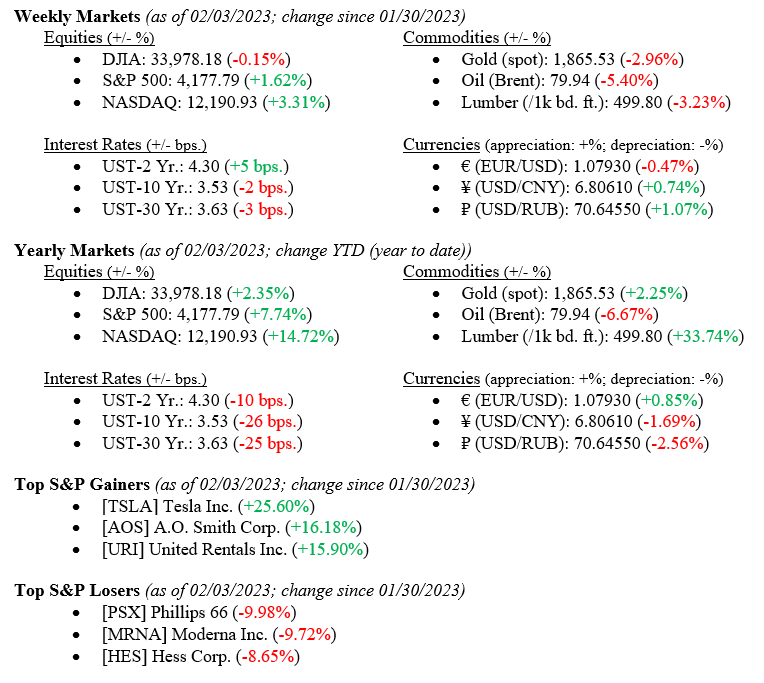

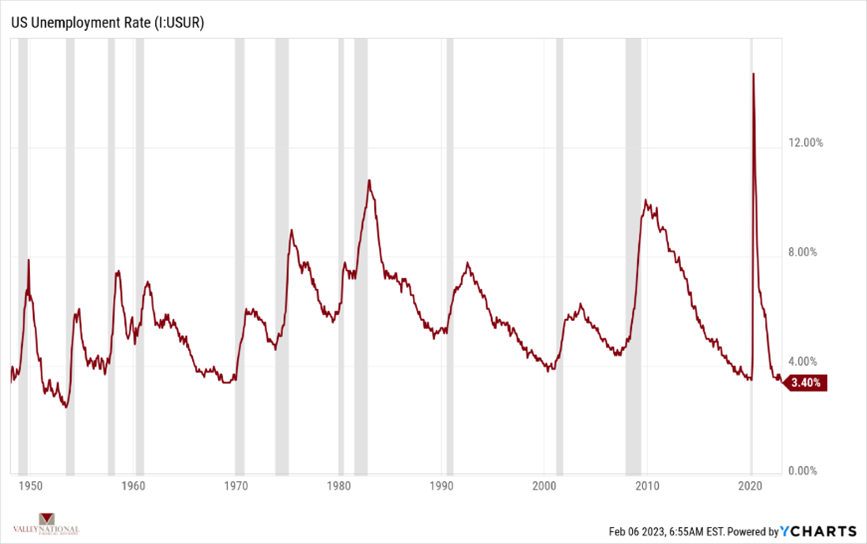

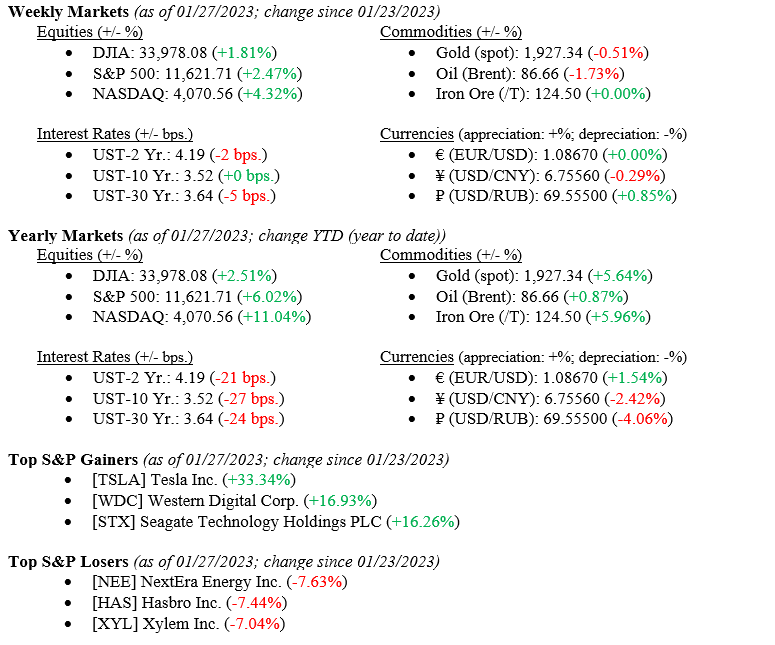

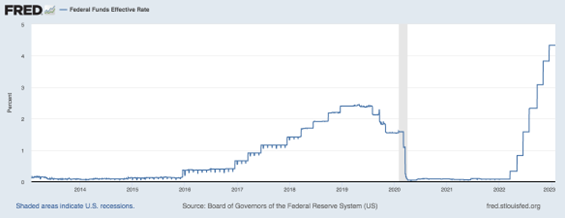

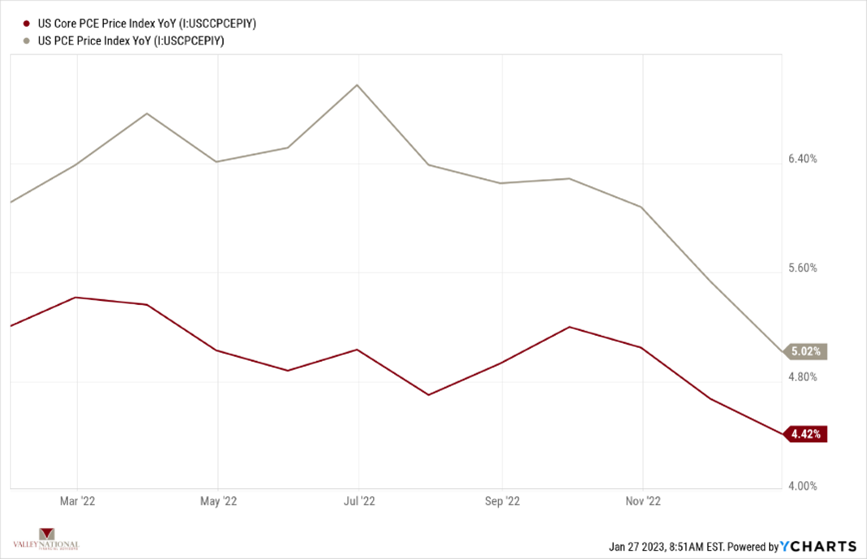

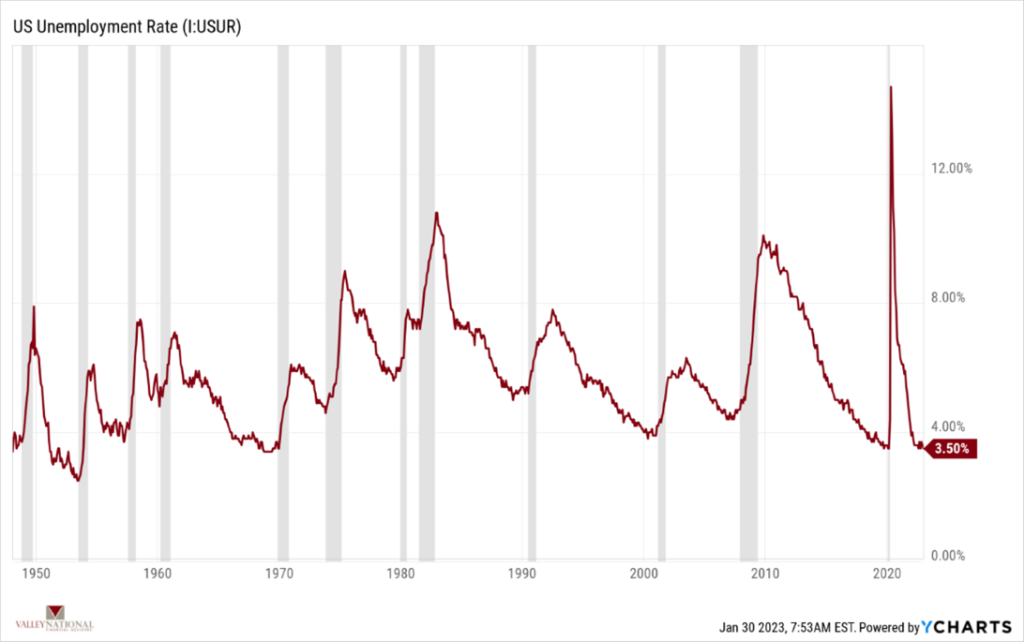

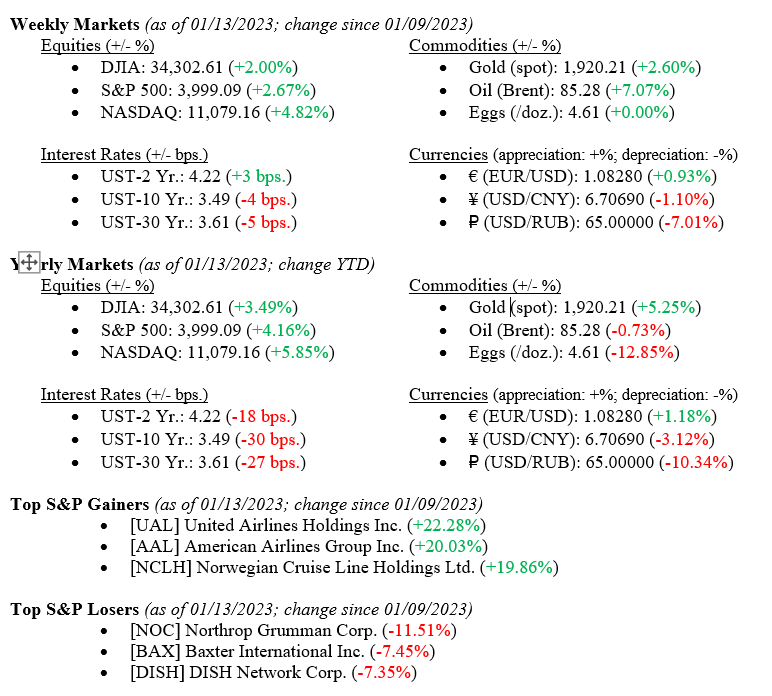

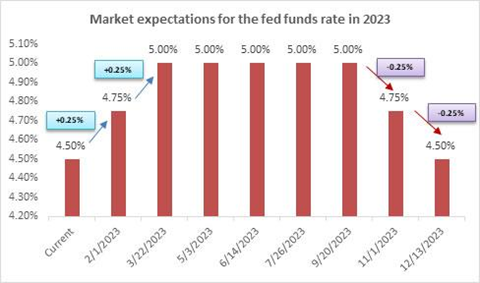

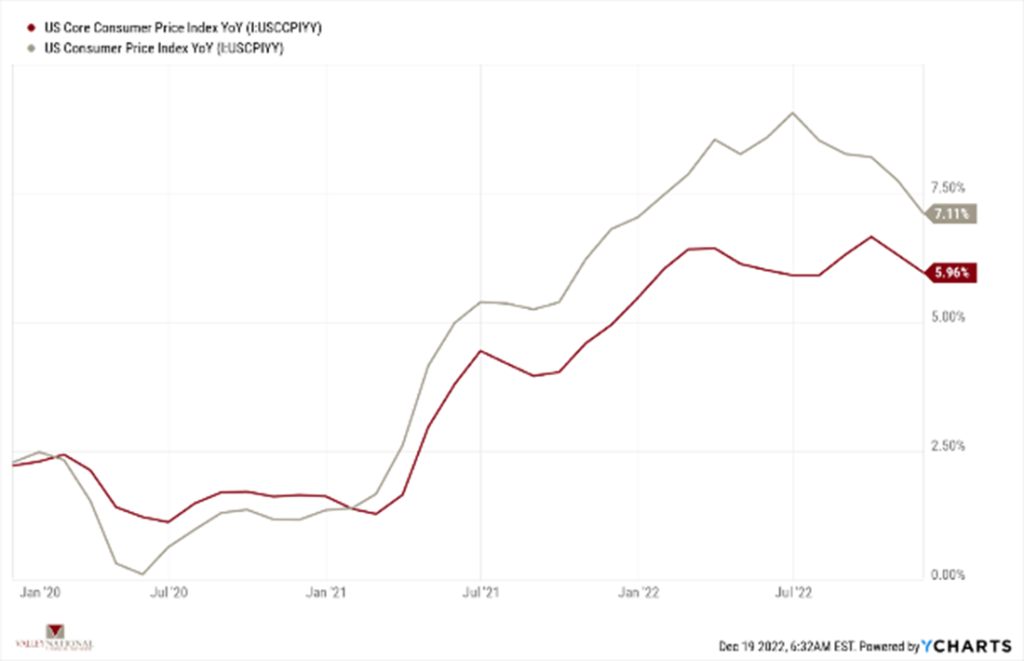

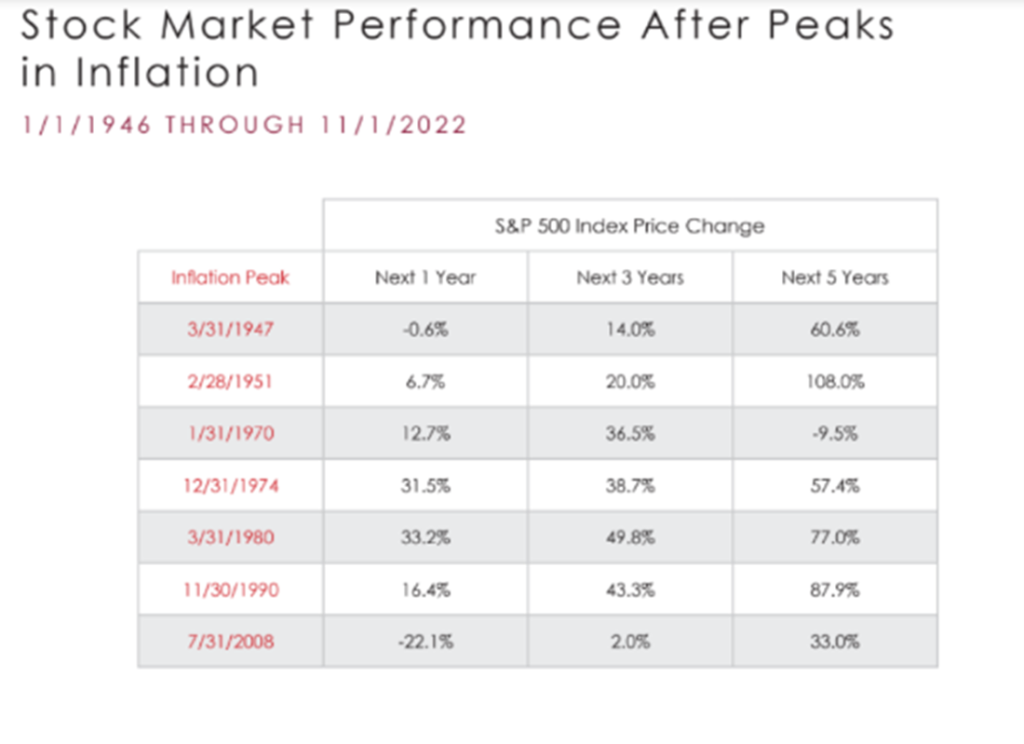

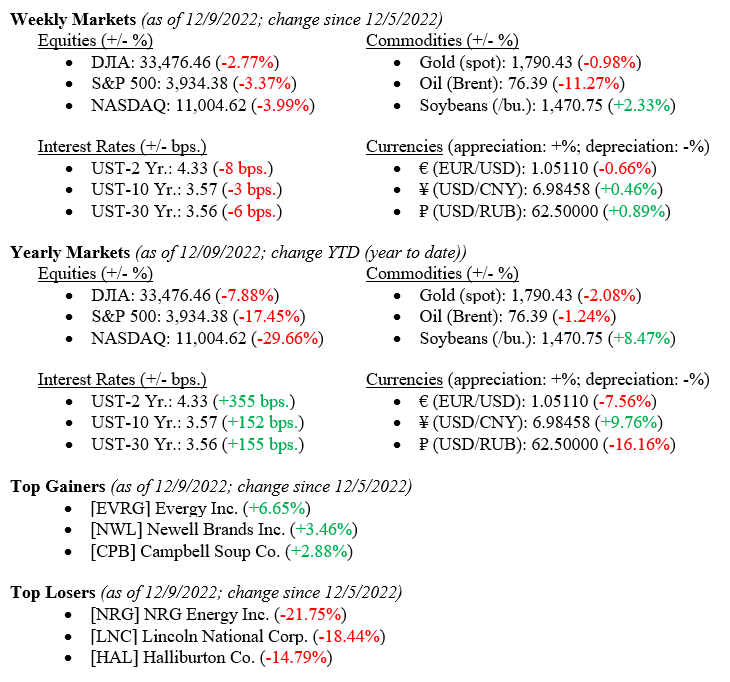

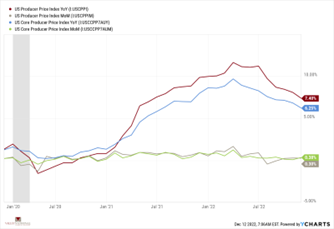

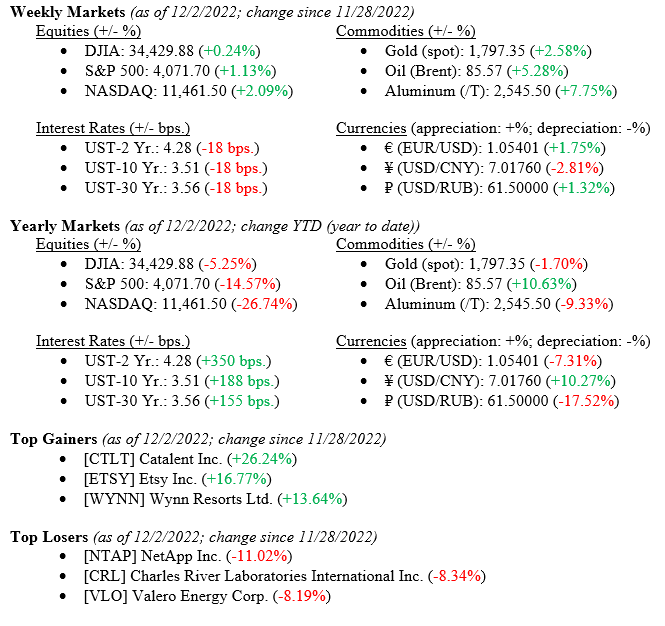

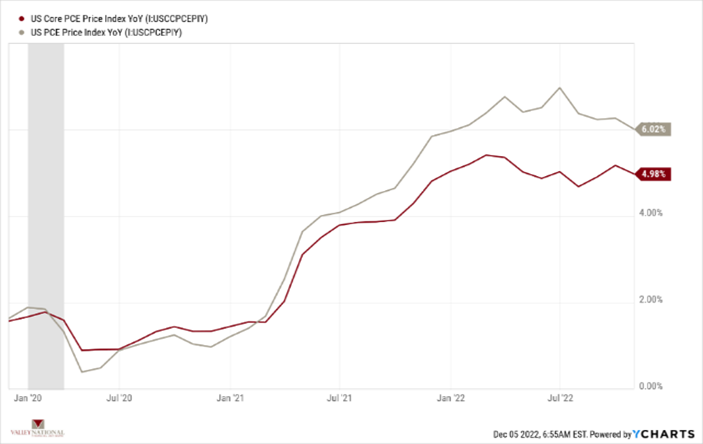

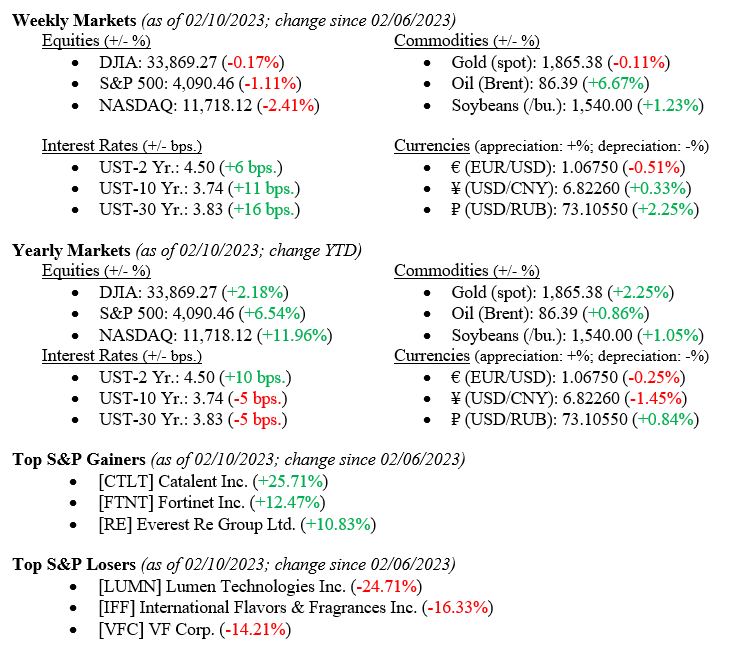

Equity markets moved slightly lower last week, with the Dow Jones Industrial Average down -0.17%, S&P 500 down -1.11%, and NASDAQ down -2.41%. On the other hand, mortgage rates have plateaued at approximately the 6% level, posting a slight average increase to 6.12% from 6.09%. Additionally, consumer sentiment increased slightly to 66.40, from 64.90—a 2.3% change from prior and up over 5% from this time last year. Pending the inflation numbers coming this week (currently 6.45%), the data could be painting the picture of an improving economy. As mentioned last week, this comes on the back of shockingly positive job numbers and the lowest unemployment rate in over 50 years. The Federal Reserve is sure to be weighing these data points heavily as it plans for the future of this tightening cycle.

Global Economy

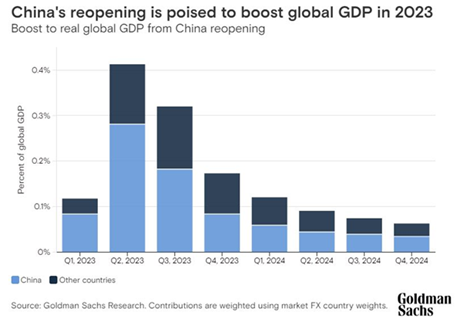

China has begun its reopening process and is doing so at a much faster pace than anticipated, causing some analysts to forecast a 6.5% GDP growth rate for the country in 2023. There are three core pillars of China’s reopening and its impact on the rest of the world. First, there is likely to be an increase in domestic demand, causing an increase in core goods exports from China’s foreign trade partners. Secondly, China’s rescission of the zero-Covid policies that have been in effect for the last three years will allow for a significant increase in travel to and from the country. Finally, commodity demand and prices may rise, especially for oil, and help to lift other net exporters up during potentially rough economic times.

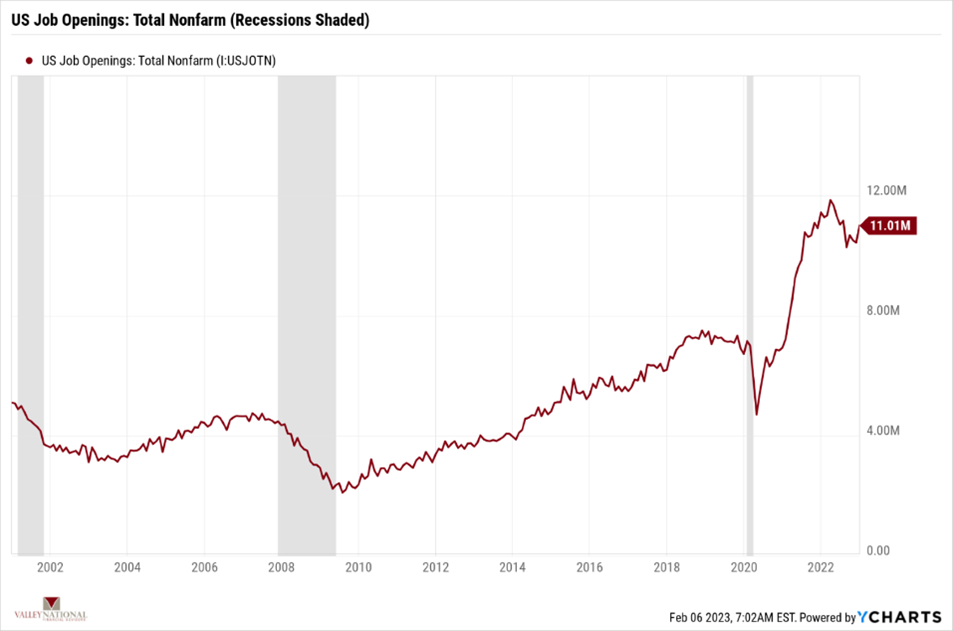

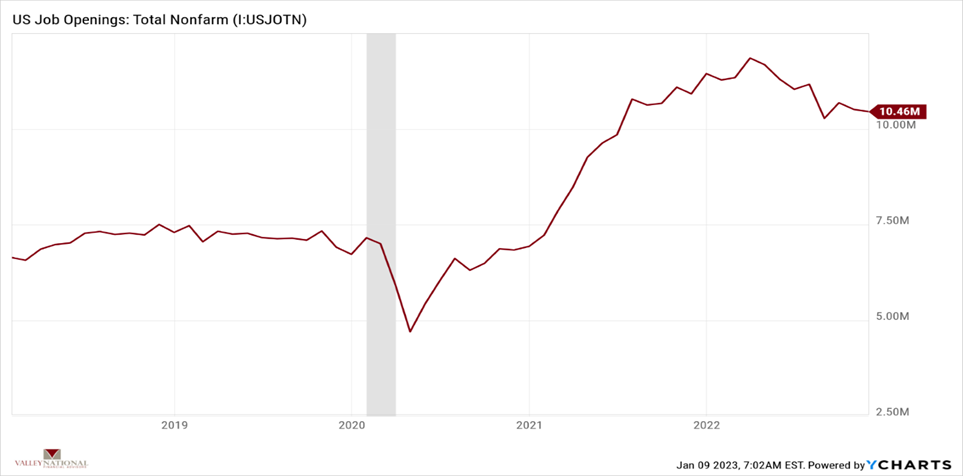

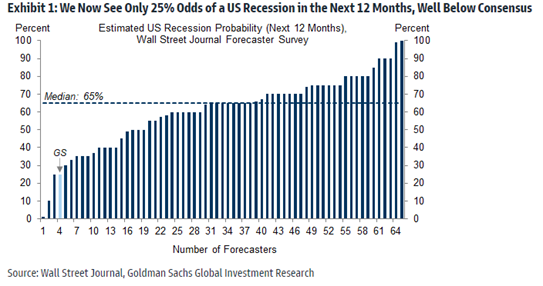

Based on the recent Wall Street Journal survey of recession expectations, firm economists forecast a median recession probability of 65%. However, the range of predictions is incredibly vast, as seen in the chart below. The thesis for those forecasting a lower-than-median recession probability is that labor markets continue to show signs of strength, and GDP growth is expected to increase beginning in the spring. However, it is worth noting that the rebalancing of the labor market is far from complete, although it is, in fact, on its way there, as indicated by the pullback in wage growth.

What to Watch

- Monday, February 13th

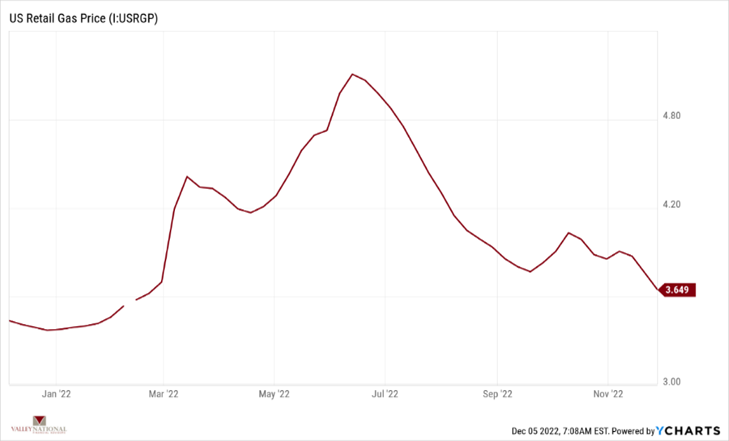

- U.S. Retail Gas Price at 4:30PM (Prior: $3.552/gallon)

- Tuesday, February 14th

- U.S. Consumer Price Index MoM at 8:30AM (Prior: -0.08%)

- U.S. Inflation Rate at 8:30AM (Prior: 6.45%)

- Wednesday, February 15th

- U.S. Job Openings: Total Nonfarm at 10:00AM (Prior: 11.01M)

- Thursday, February 15th

- U.S. Housing Starts MoM at 8:30AM (Prior: -1.36%)

- 30 Year Mortgage Rate at 12:00PM (Prior: 6.12%)