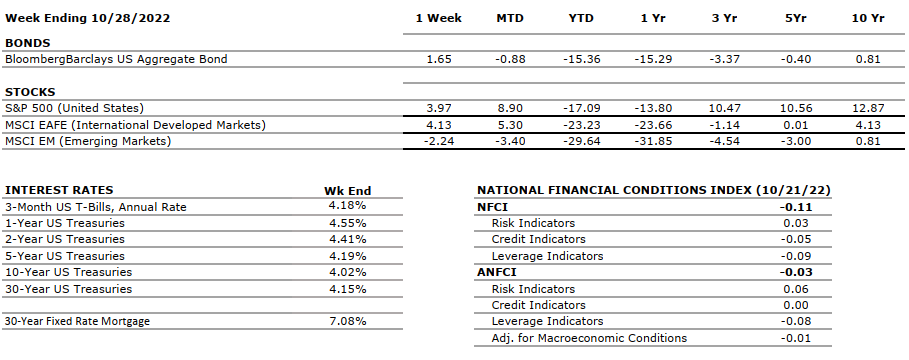

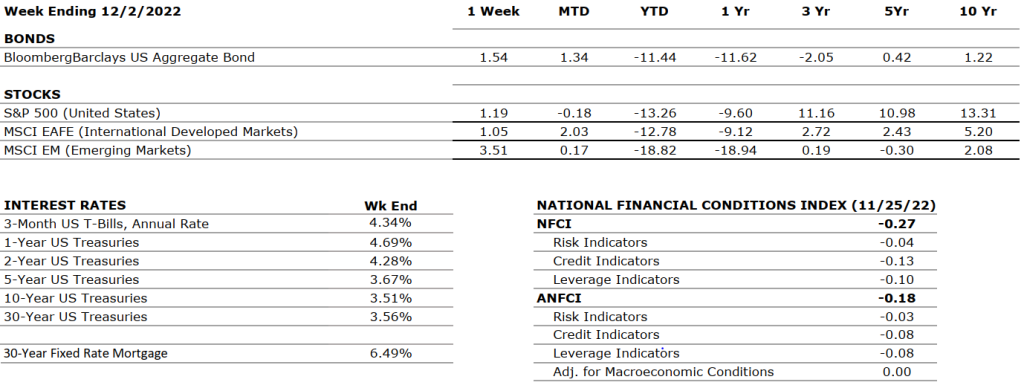

THE NUMBERS

The Sou rces: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

rces: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

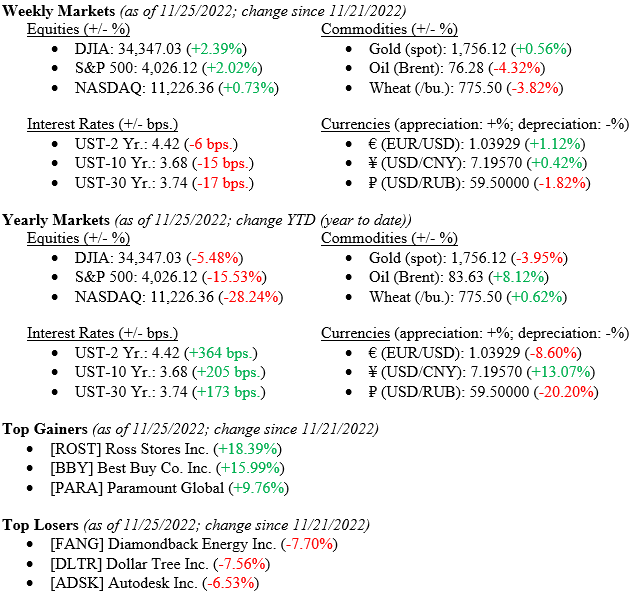

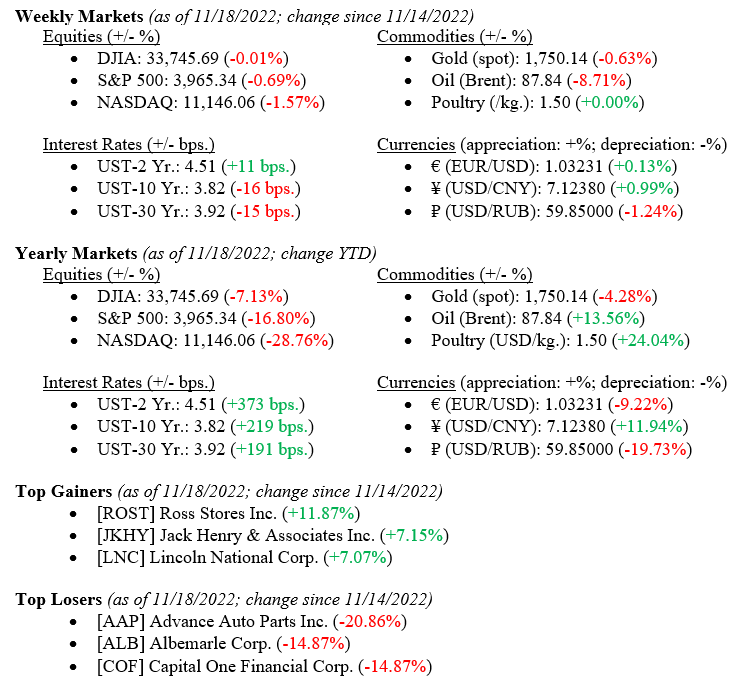

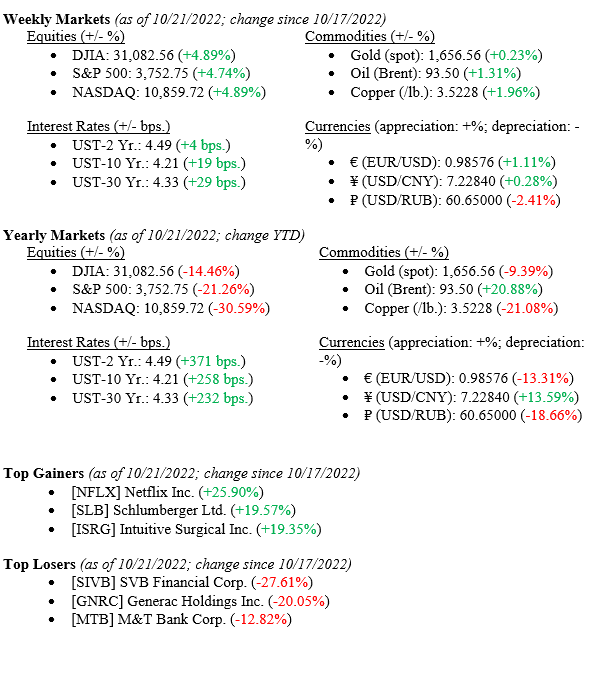

MARKET HEAT MAP

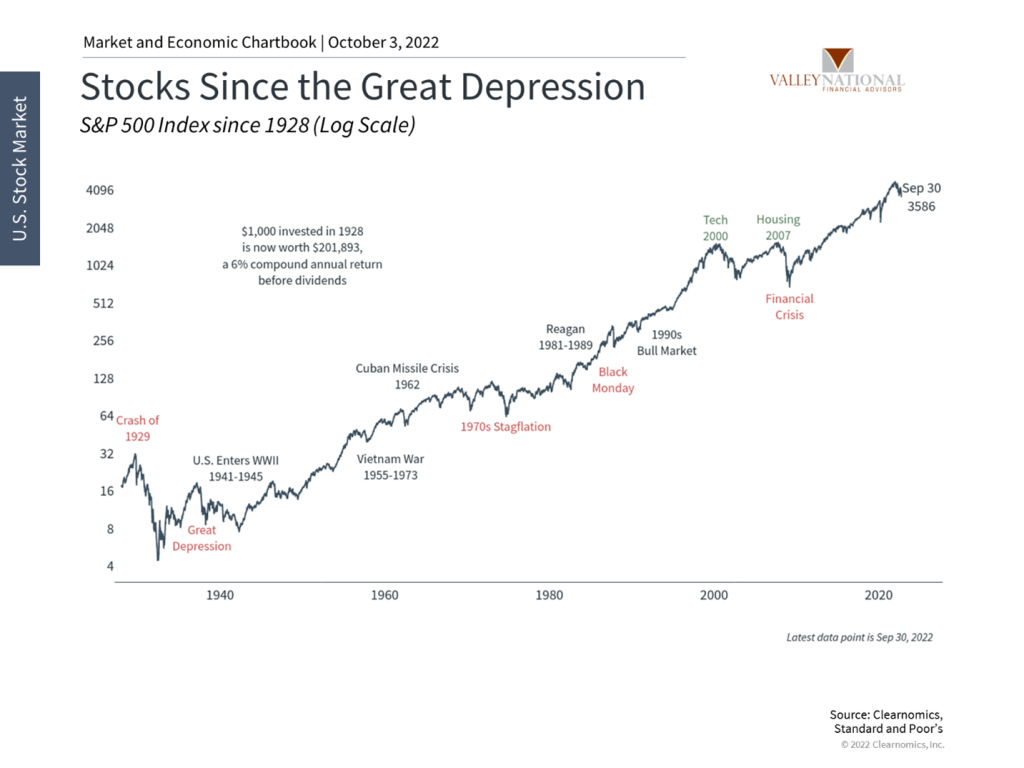

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

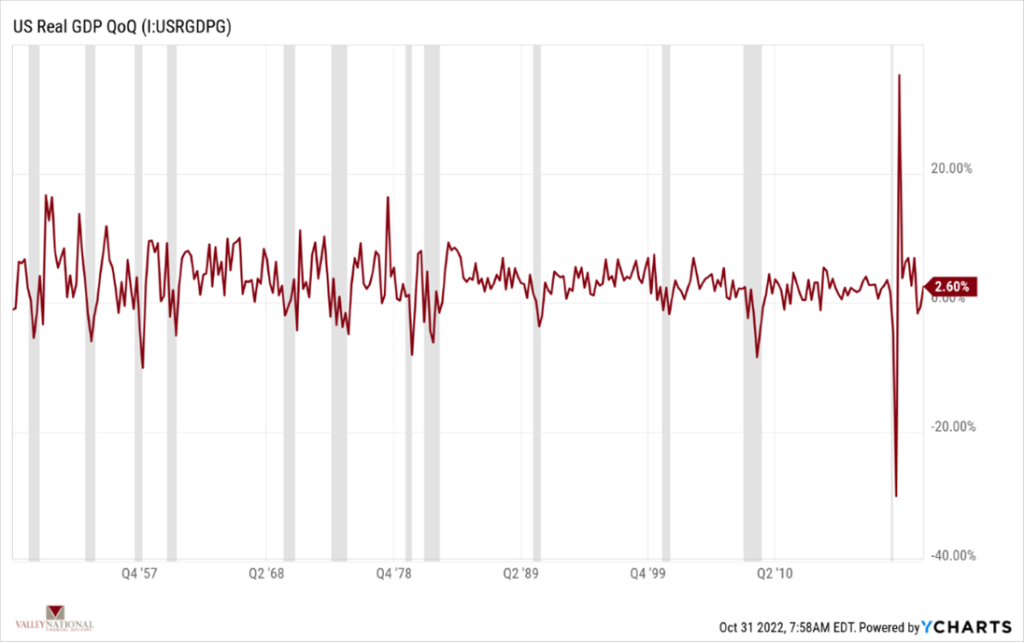

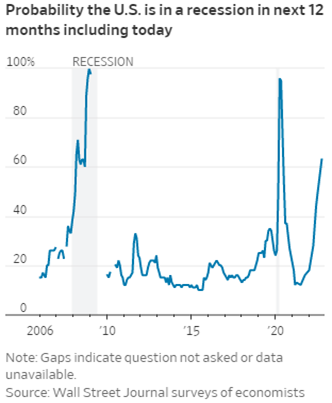

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

Real GDP for Q2 2022 decreased at an annual rate of 0.6% (up from the first estimate of -0.9%) marking the second consecutive quarter of declining GDP. The second estimate for Q3 2022 shows Real GDP to have increased by an annual rate of 2.9%, up from the previous advance estimate that reported a 2.6% gain. |

|

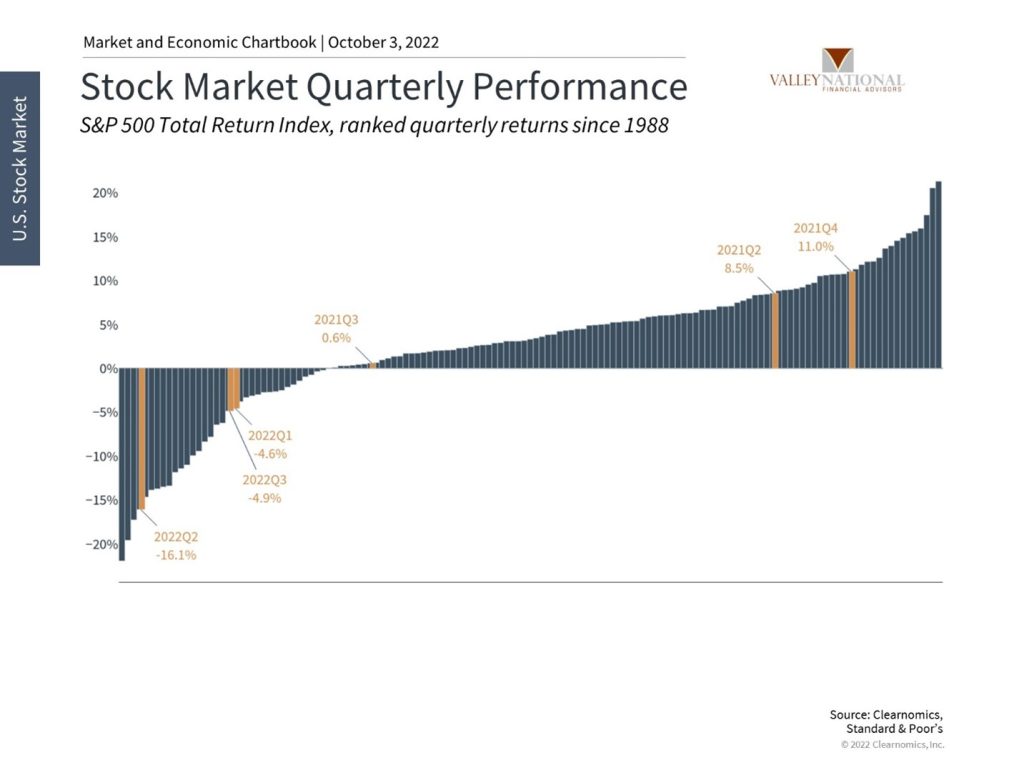

CORPORATE EARNINGS |

NEUTRAL |

The estimated growth rate for Q3 2022 is 2.2%, which was adjusted upwards from 2.2% last week. So far, with 99% of S&P500 companies reporting actual results, 70% of them reported a positive EPS surprise and 71% beat revenue expectations. |

|

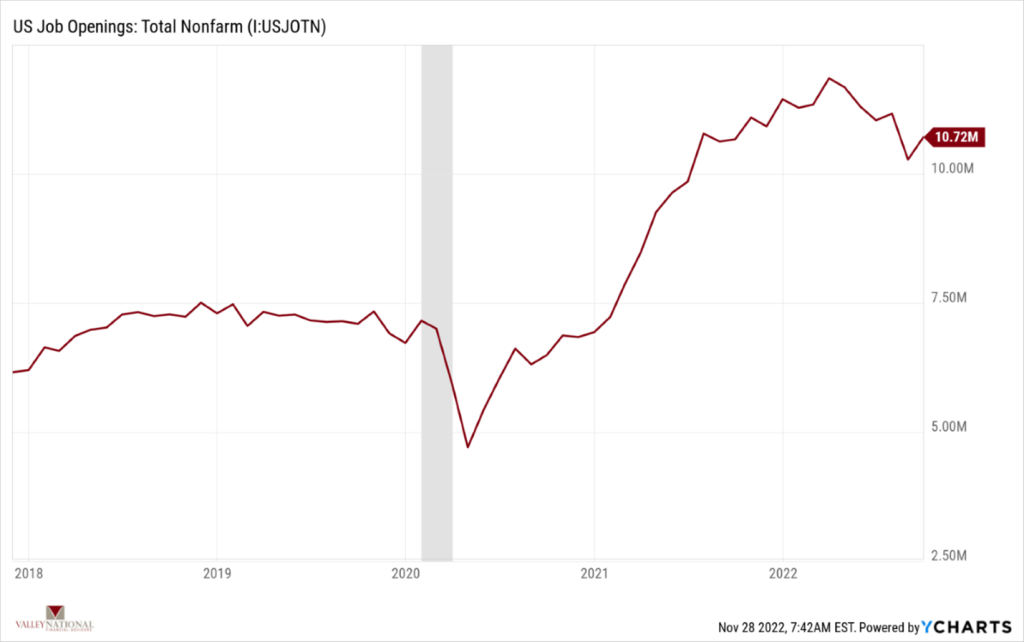

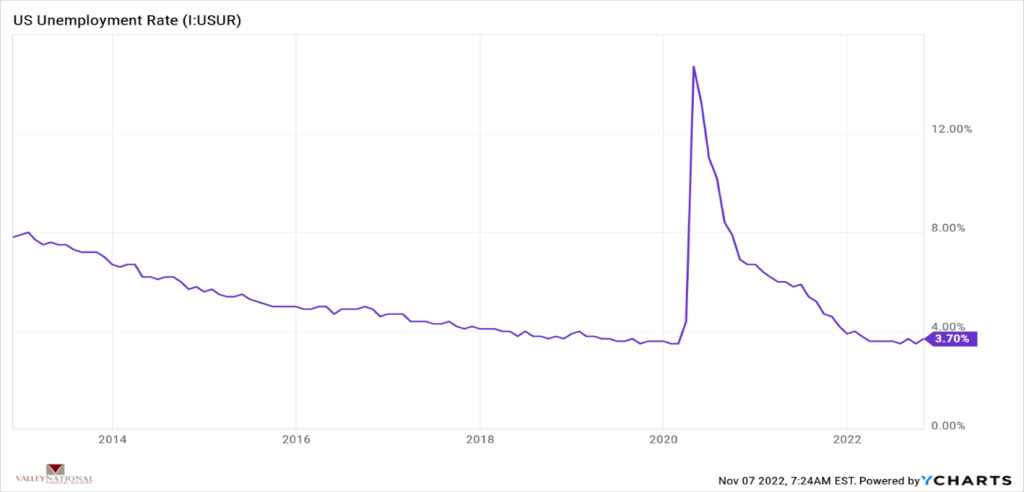

EMPLOYMENT |

NEUTRAL |

U.S. Nonfarm Payrolls for November 2022 increased by 263,000 and the unemployment rate remained unchanged at 3.7%. Wages have risen more than expected at a rate of 5.1% YoY. Service sectors contributed the most to the increase in jobs while industries that are sensitive torising rates, such as construction and manufacturing, have started to level off. |

|

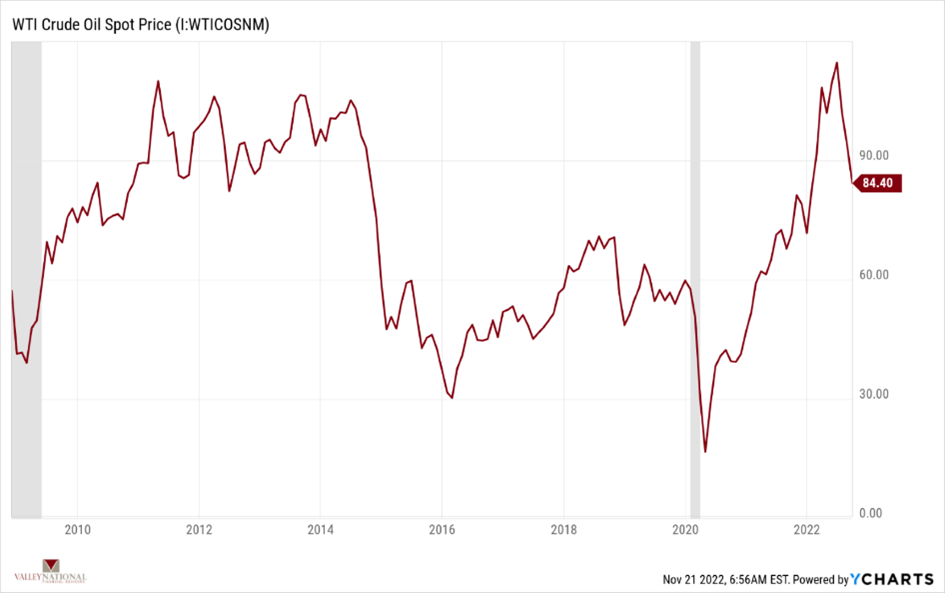

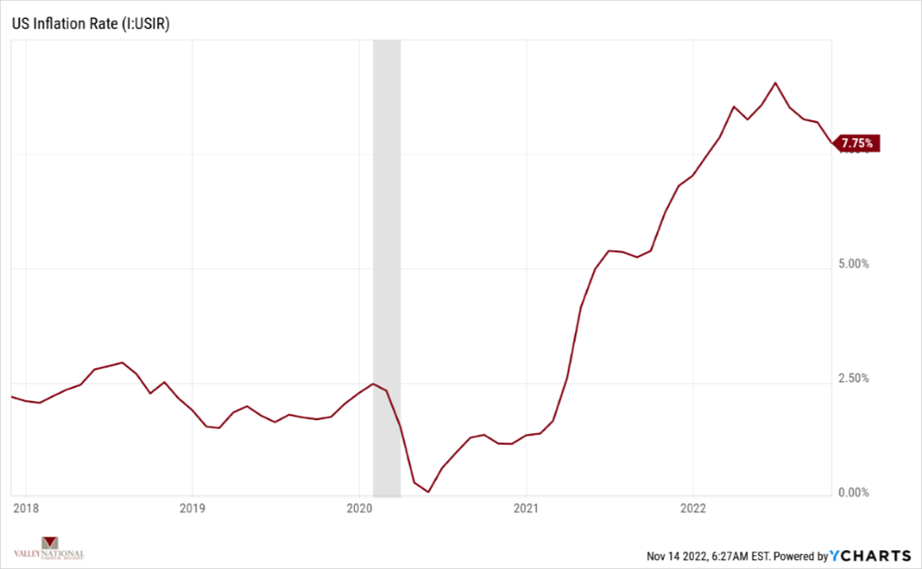

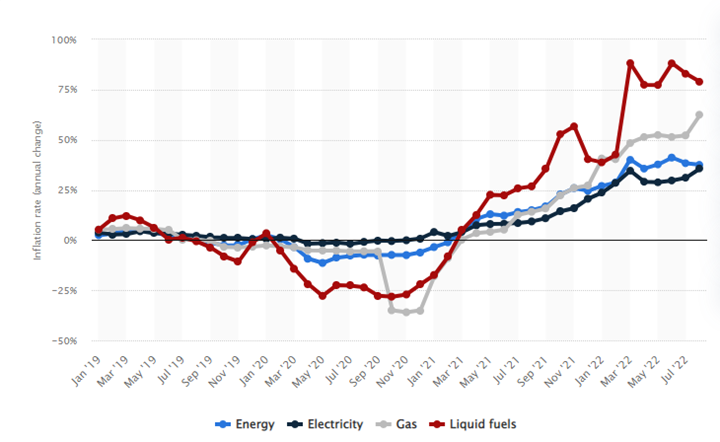

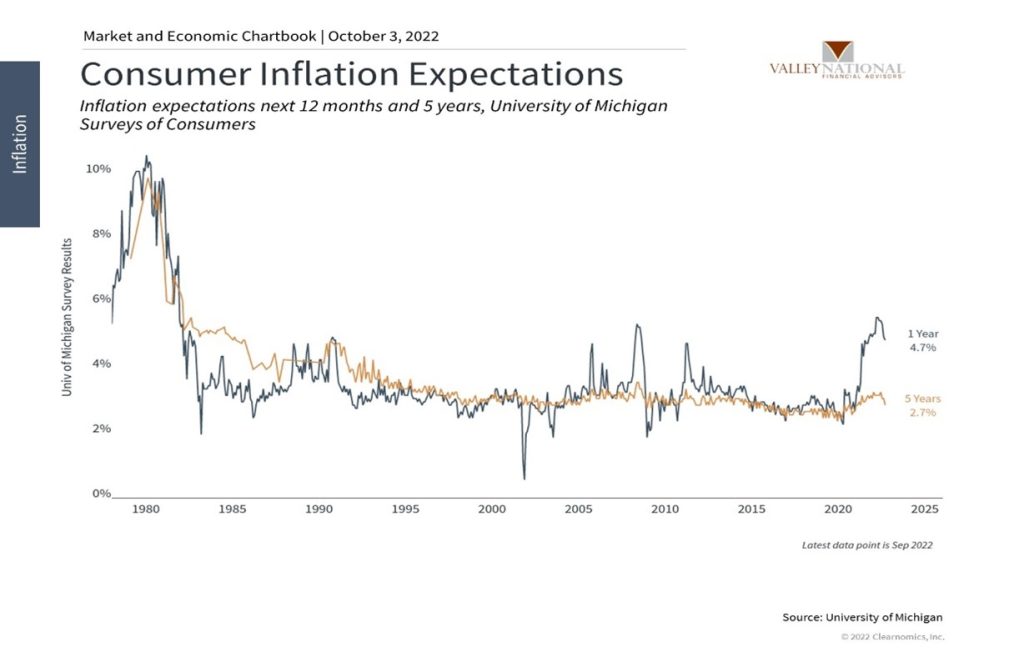

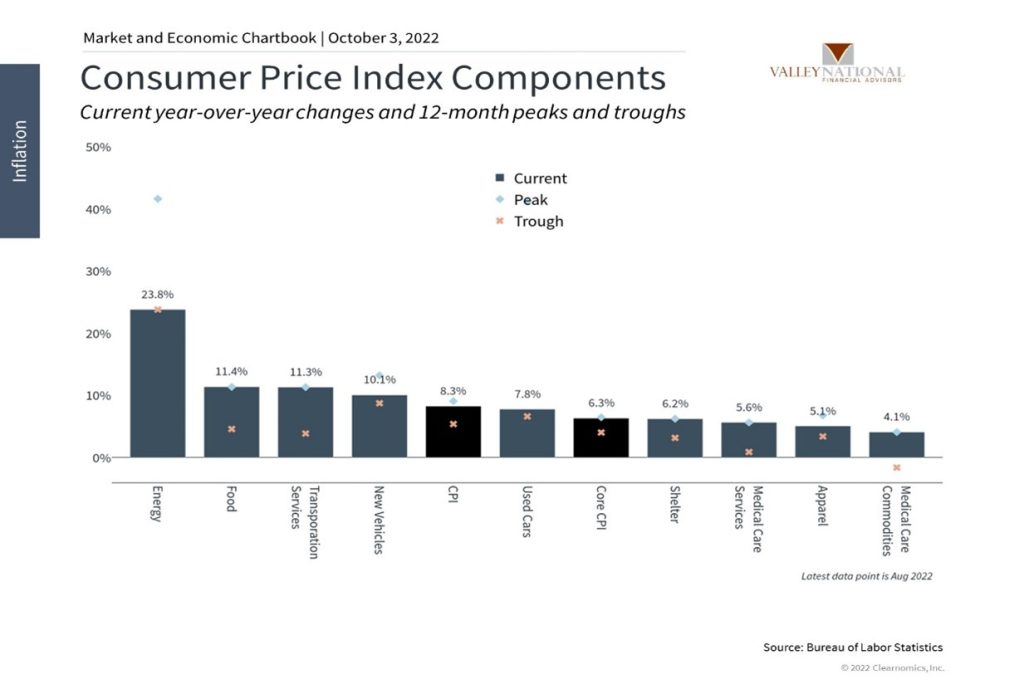

INFLATION |

NEGATIVE |

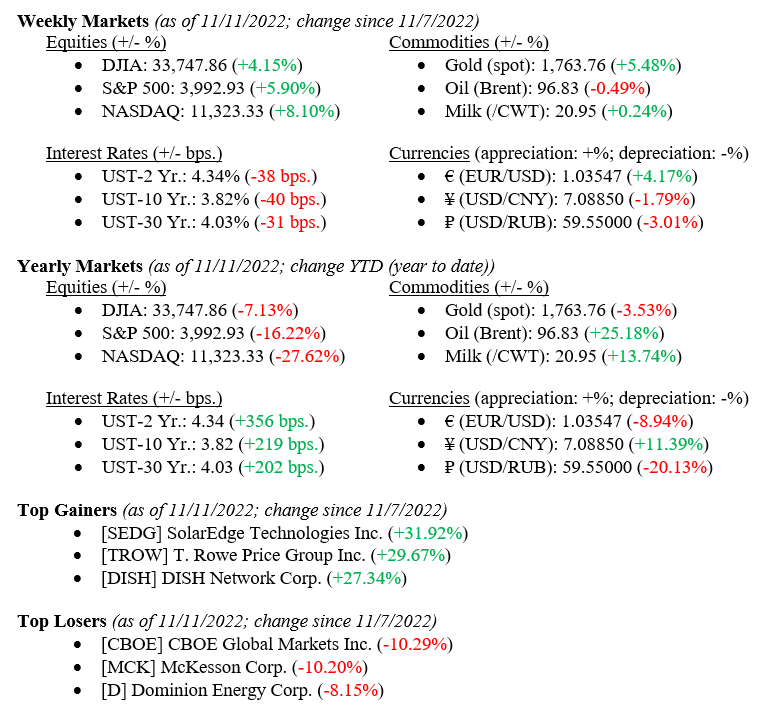

The annual inflation rate in the U.S. increased by 7.7% for October 2022 compared to the expected 7.9% — showing some signs of deceleration. Core CPI was also reported below expectations at 6.3% versus the estimated 6.5%. Shelter, food, and gasoline remain the main contributors to elevated inflation. |

|

FISCAL POLICY |

NEUTRAL |

Senator Manchin and Majority Leader Schumer reached an agreement on the latest tax and energy bill with incentives for green energy, electric cars, and conversely oil & gas companies for exploration. No changes in private equity taxes or higher tax rates for the very wealthy were enacted. The bill has been officially passed by the Senate. President Biden announced student loan forgiveness of up to $20,000 subject to income limitations. |

|

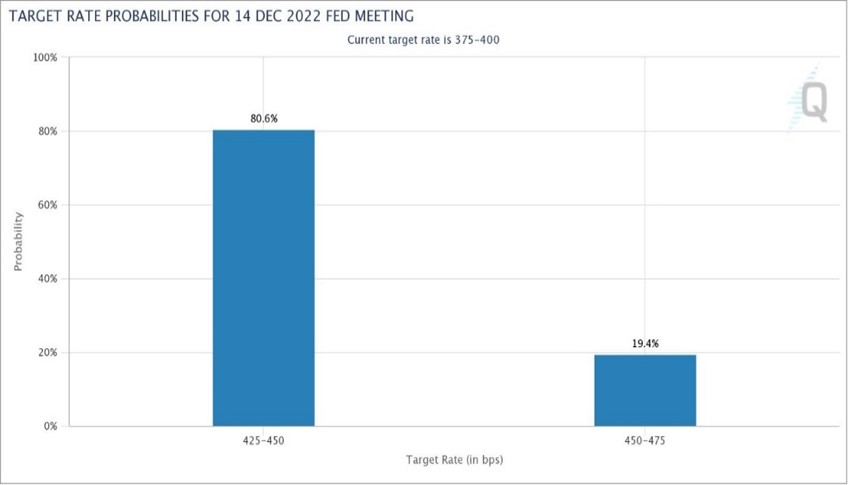

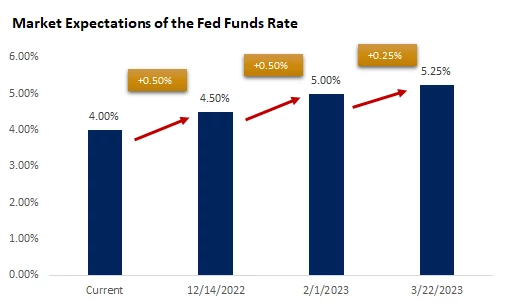

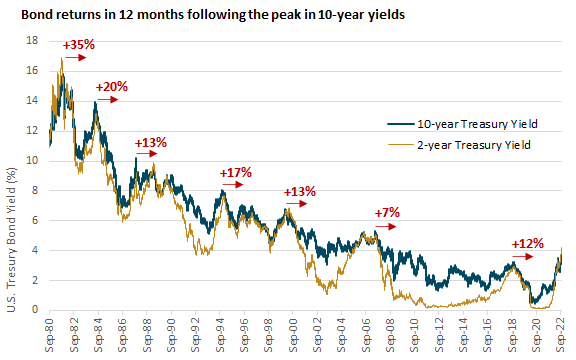

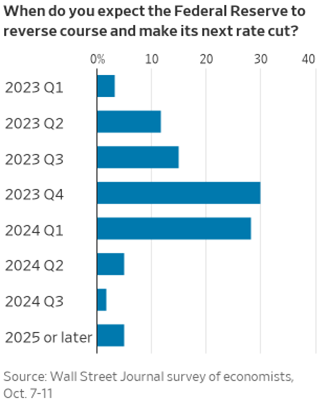

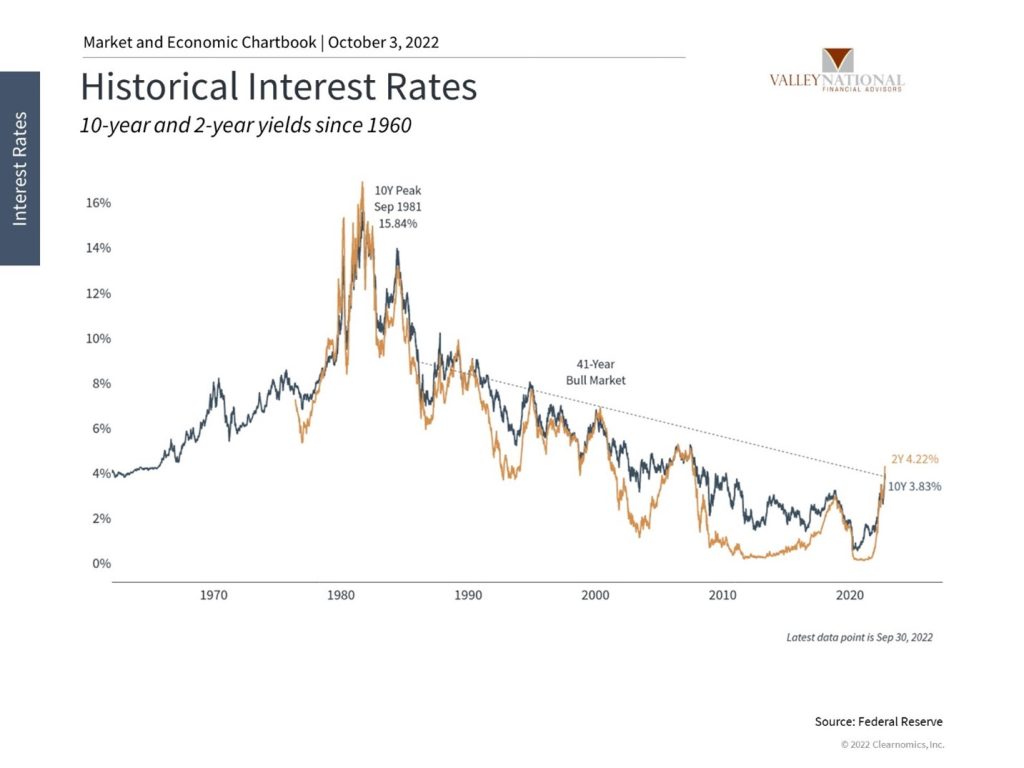

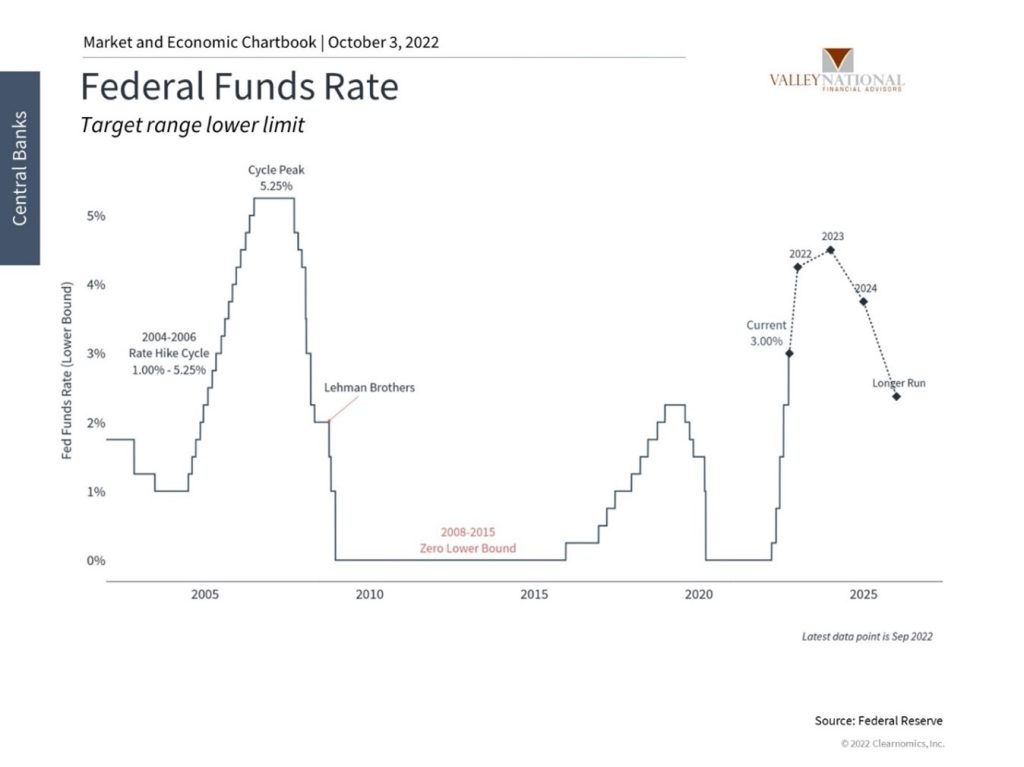

MONETARY POLICY |

NEGATIVE |

The Fed approved a fourth consecutive 75 bps hike earlier this month which took its target range to 3.75%-4.00% – the highest it has been since 2008. The Fed hinted at potentially reducing the magnitude of future rate increases from 75 to 50 bps but also mentioned the possibility of a new higher target range closer to 5%. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

Russia held controversial referendums for the annexation of four Ukrainian regions and the Russian Parliament unanimously recognized these regions as part of Russia. Ukraine and Western countries have condemned these actions by Russia by declaring them illegitimate and illegal. Additional sanctions are being imposed on Russia by many countries. |

|

ECONOMIC RISKS |

NEGATIVE |

COVID-19 lockdowns in China are easing which should help the global supply chain recover. On the other hand, the Russian-Ukraine war does not show signs of abating. Gas supplies from Russia to Europe have decreased by 88% over the past year and EU countries have agreed to cut gas usage by 15% as gas prices have more than doubled. The U.S. is now dealing with a major diesel shortage with national reserves at their lowest levels since 1951 and a ban on Russian products that willintensify the issue. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.