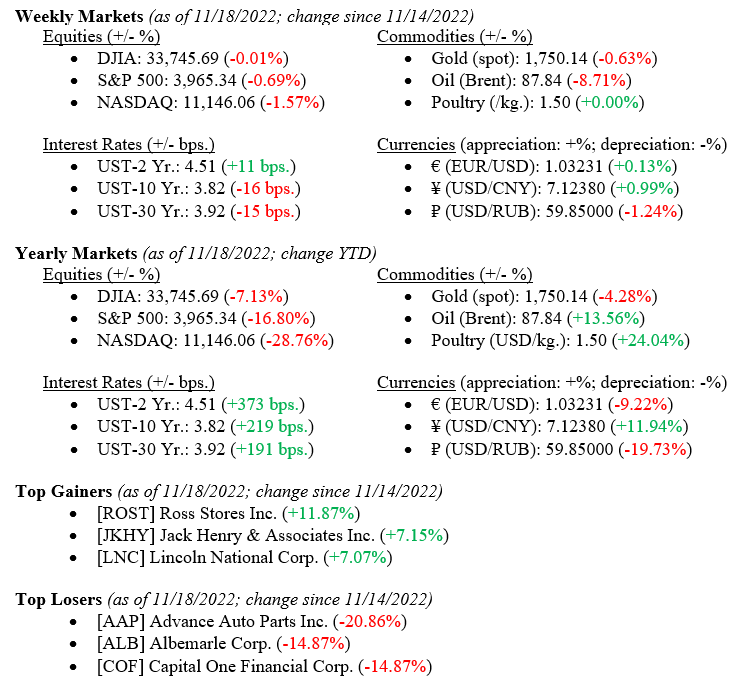

Equities rallied early in the week after an inflation report (U.S. Core PPI Year Over Year for October 2022 dropped to +6.68% from +7.12% in September 2022). However, the rally was brief as concerns about the pace of future interest rate hikes by the Fed, China “Lockdown” issues and retail sales data to be released this week renewed concerns of a recession in 2023. For the week, The Dow Jones Industrial Average was unchanged, the S&P 500 Index fell –0.69% and the tech-heavy NASDAQ fell by –1.57%. We review U.S. Treasury yields spreads and inflation data, including the drop in crude oil prices, below.

Global Economy

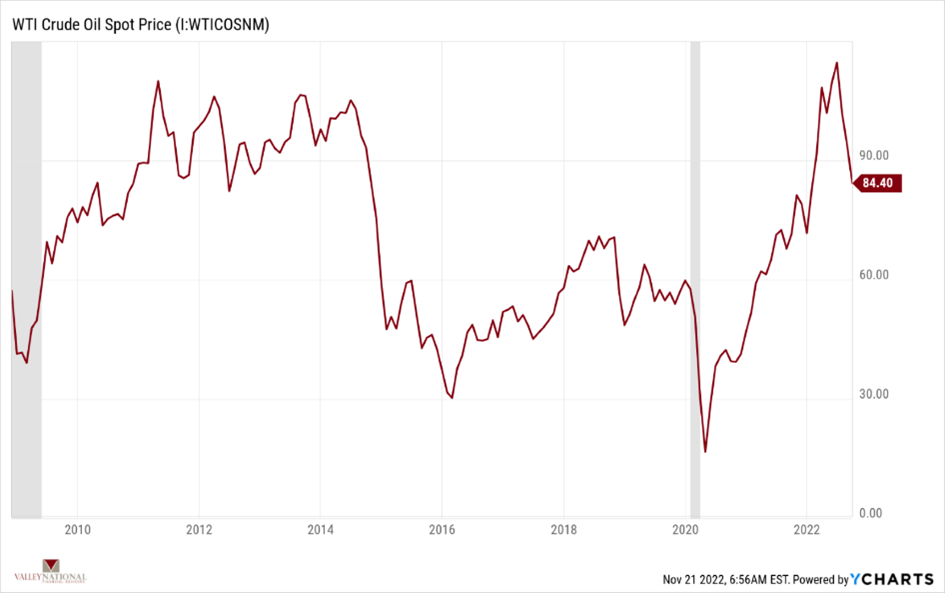

Last week’s inflation report (Core PPI) showed a modest drop in prices that producers are paying for goods and services. A major component for production is oil (consumers are equally impacted by oil prices). West Texas Intermediate crude oil continues to fall each week. Chart 1 from Valley National Financial Advisors and Y Charts showing WTI prices since 2008 Oil prices have come down dramatically since the spring of 2022 and are nearing the levels we saw after the 2008-09 recession when modest growth was the norm. Recall that petroleum products and byproducts are in every industry (agriculture for fertilizer production), transportation (planes, trains & automobiles (timely reference), and plastics of every kind, so lower prices in oil eventually translates to lower prices in everything else.

Industry experts are still calling for a modest recession in 2023. The September 2022 reading showed a 23% chance of a recession in 2023. This reading is higher than the long-term average of 14% and solely based on the spread between 10-year and 2-year US Treasury Notes. Certainly, this indicator is screaming recession in 2023. Chart 2 by Valley National Financial Advisors and Y Charts showing the spread between 10-year and 2-year US Treasury Notes. A negative spread, where the 2-year yield is higher than the 10-year yield, also called an inverted yield curve, has historically precipitated a recession. However, the start, depth, and duration of said recession is always unknown. At this point, economists are still calling for a brief and shallow recession for the U.S. and Eurozone in 2023.

Policy and Politics

Thankfully, Washington is in recess, so we are free from any new or intrusive regulations or laws. The massive $32 billion FTX bankruptcy and obvious fraud, if not actual criminal activity surrounding this cryptocurrency fallout must produce come form or government involvement. Investors in this space, after losing billions, might now wish for the Securities and Exchange Commission, FDIC or other oversight group to protect their investments.

What to Watch

- U.S. Durable Goods New Orders for October 2022, released 11/23 (Previous +0.36%)

- U.S. Claims for Unemployment week of November 19, 2022, released 11/23 (Previous 222,000)

- U.S. Index of Consumer Sentiment November 2022 reading, released 11/23 (Previous 54.70)

The Thanksgiving Holiday week marks the start of the holiday season on Wall Street. Traders sure up balance sheets and portfolio manager window dress their portfolios adding marquee names to their holdings. It will certainly cost more to put on the family Thanksgiving Feast this year. The American Farm Bureau Federation estimates that a classic Thanksgiving feast for 10 would cost $64.05, or $6.41 a person, up 20% from last year’s average of $53.31. That includes turkey, stuffing, sweet potatoes, rolls with butter, peas, cranberries, a vegetable tray, pumpkin pie with whipped cream, coffee, and milk, “with plenty for leftovers.” For $6.41 a person, Americans get to spend time with friends and family and share stories of happiness and Thanksgiving—to us, $6.41 seems like a bargain. Happy Thanksgiving.