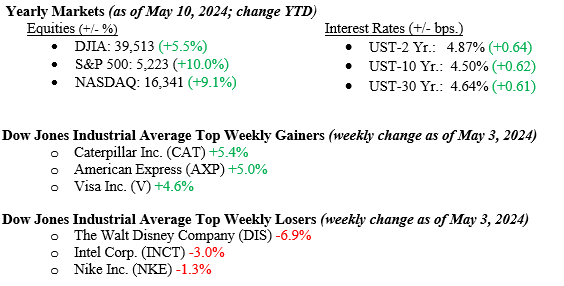

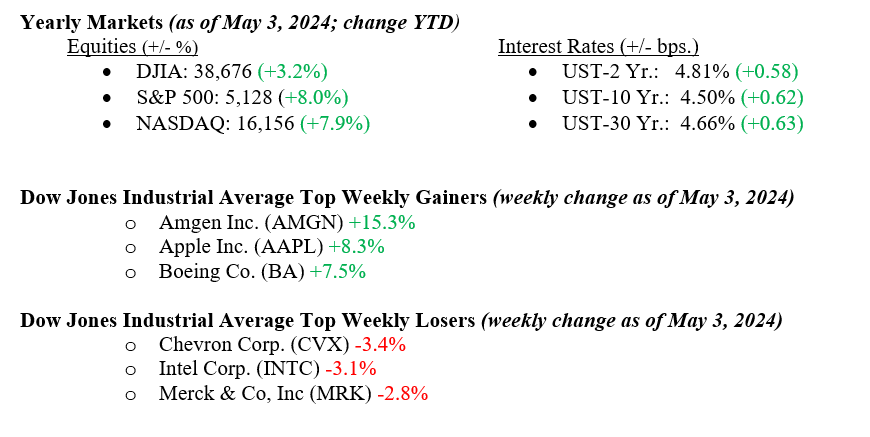

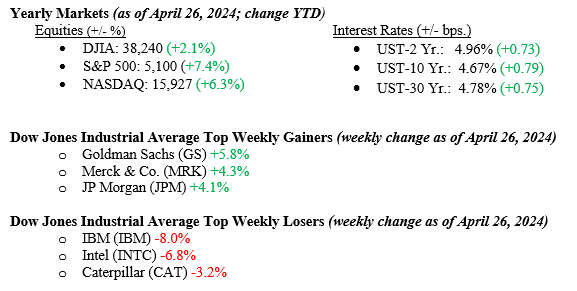

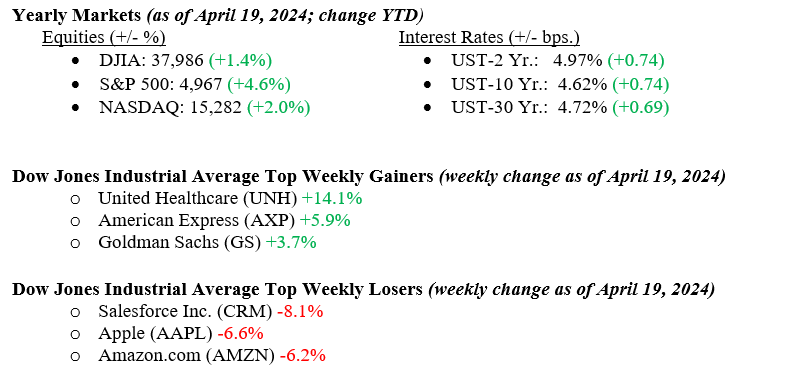

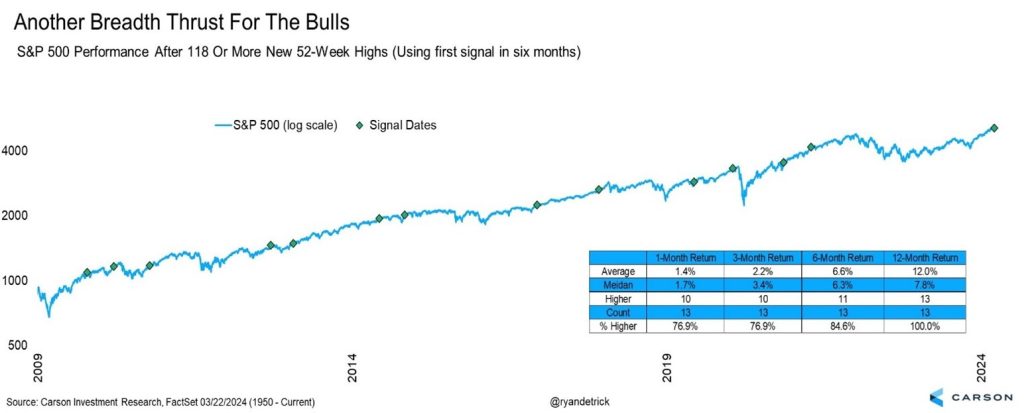

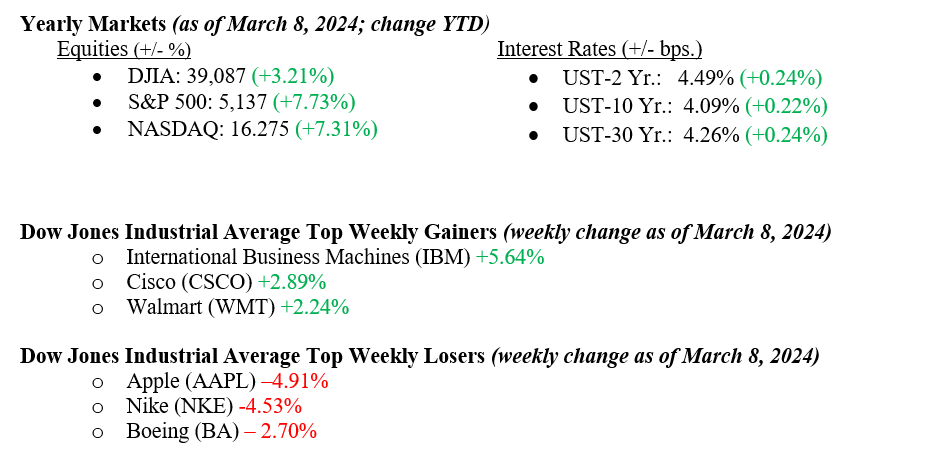

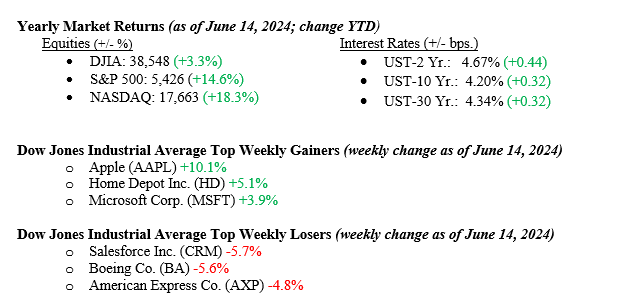

Last week, the S&P 500 and NASDAQ surged to new record highs, continuing their upward trajectory. The NASDAQ led the charge with a strong 3.3% total return, surpassing the S&P 500, which posted a 1.6% gain, while the Dow lagged with a slight decline of 0.5%. Positive U.S. inflation data and highlights from the June FOMC meeting bolstered investor confidence, driving upward market momentum. However, an equally weighted version of the S&P 500 underperformed its capitalization-weighted index by 215 basis points, indicating a more narrowly focused market. Information technology was the standout sector of the week, surging 6.4%, whereas energy and financials both experienced declines of over 2%. Last week, the markets saw 10-year U.S. Treasury closed at 4.20%, a stunning 23 basis points lower than the previous week.

U.S. & Global Economy

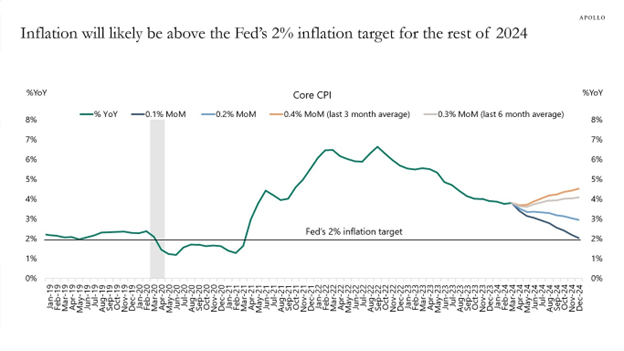

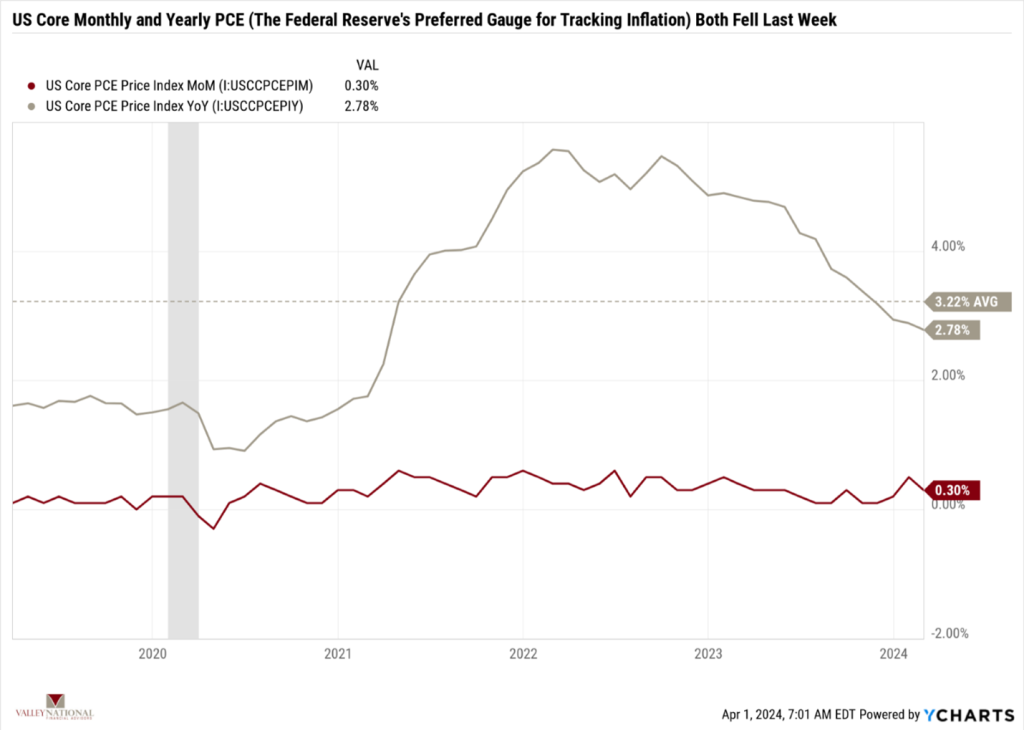

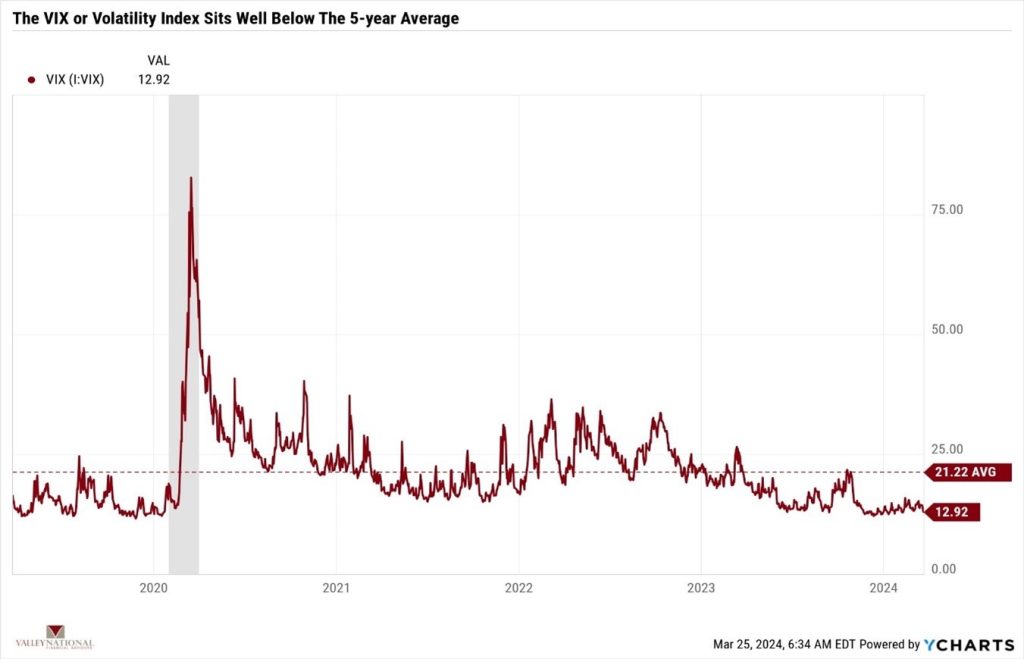

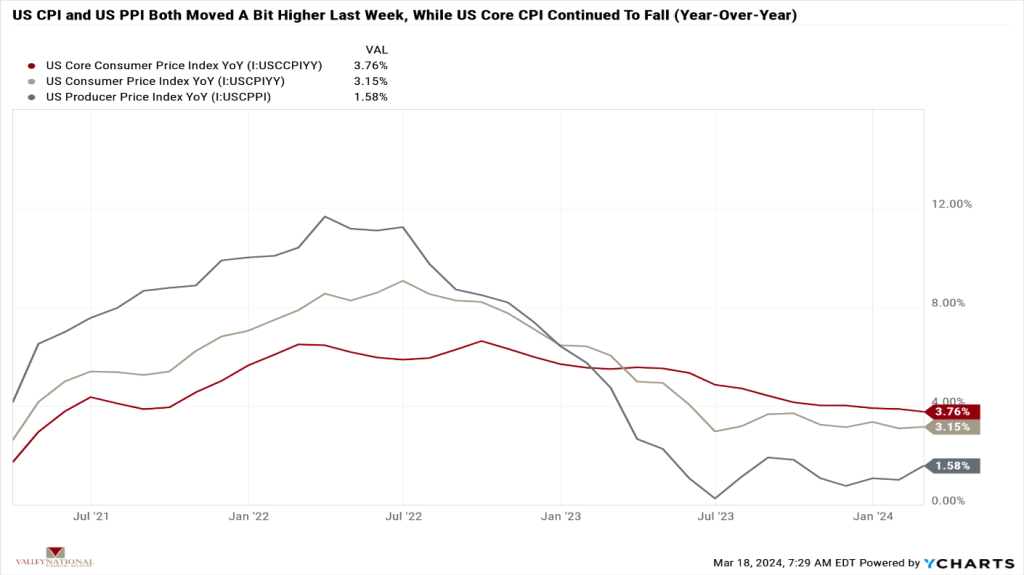

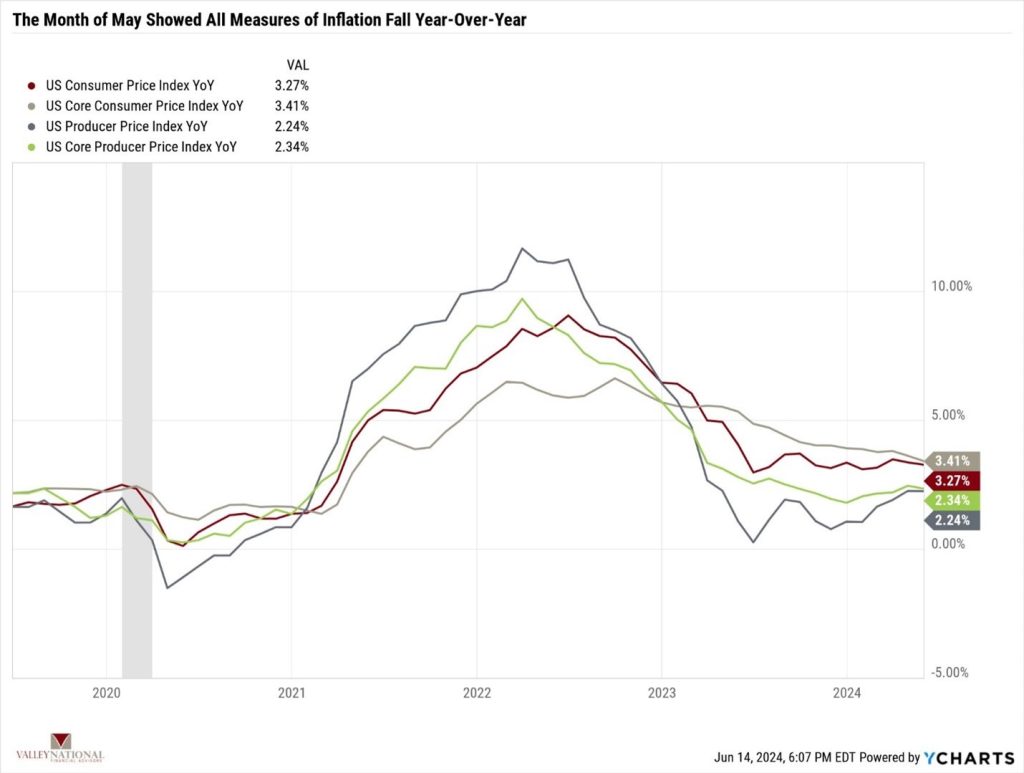

Last week, inflation data showed much-welcomed lower readings. See Chart 1 below from Valley National Financial Advisors & Y Charts. The consumer price index (CPI) remained unchanged in May, the first time in nearly two years. Core prices, excluding food and energy, increased by 0.2%, slightly below expectations and hitting a seven-month low. Year-over-year core inflation dropped to 3.4%, the lowest since April 2021.

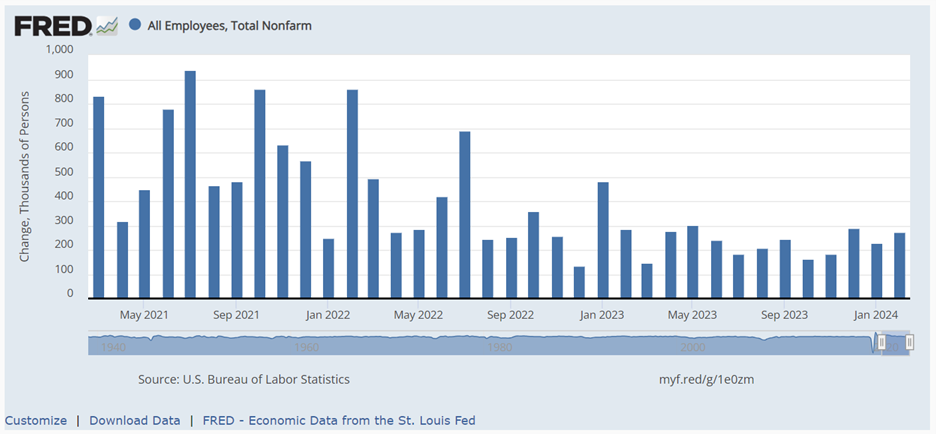

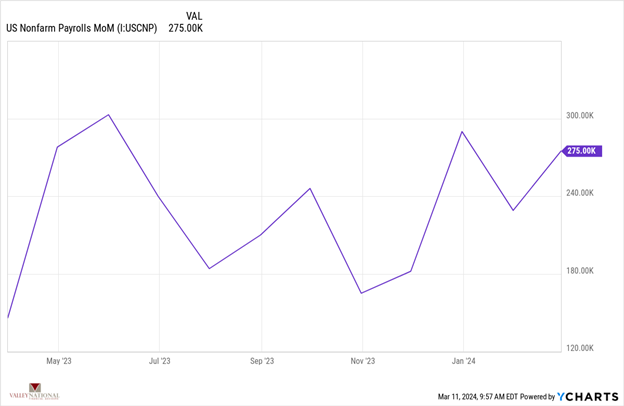

Similarly, producer price index (PPI) inflation fell unexpectedly by 0.2% in May, halting five consecutive months of increases, and core PPI every year fell to 2.3%. Concurrently, import prices declined by 0.4%, the first drop in four months. However, concerns over economic health emerged as weekly jobless claims unexpectedly rose, with 242,000 Americans filing for unemployment, the highest in nearly a year, and continuing claims reaching 1.82 million, the third-highest level in the past year. Despite these developments, the Federal Reserve showed minimal reaction to the benign inflation data, maintaining its stance after its policy meeting and projecting a slight increase in core PCE inflation expectations for 2024. While leaving interest rates unchanged as anticipated, Fed officials revised their median forecast for the federal funds rate to 5.1% by the end of 2024, suggesting a single rate cut later in the year despite acknowledging some progress on inflation.

Policy and Politics

President Biden is behind former President Trump by approximately one percentage point in national polls and about two percentage points in Pennsylvania, a critical swing state crucial for securing the electoral vote. Prediction markets suggest an even chance between the two candidates.

On Friday, President Vladimir Putin stated that Russia would cease the war in Ukraine only if Kyiv abandoned its NATO aspirations and ceded control of four disputed provinces to Moscow. Kyiv promptly dismissed these demands as akin to surrender.

After the French far-right won a significant victory in the European elections, President Macron dissolved the lower chamber of the French Parliament and scheduled legislative elections for June 30 and July 7. This move sparked a notable sell-off, with the index that tracks large-cap European stocks dropping 2.4% for the week.

Economic Numbers to Watch This Week

- U.S. Empire State manufacturing survey for June 2024, prior –15.6%.

- U.S. U.S. retail sales for May 2024, prior 0.0%.

- U.S. Home Builder confidence index for June 2024, prior 45.

- U.S. Housing starts for May 2024, prior 1.36 million.

- U.S. Philadelphia Fed manufacturing survey for June 2024, prior 4.5.

- U.S. Existing home sales for May 2024, prior 4.14 million.

- U.S. Leading economic indicators for May 2024, prior –0.6%.

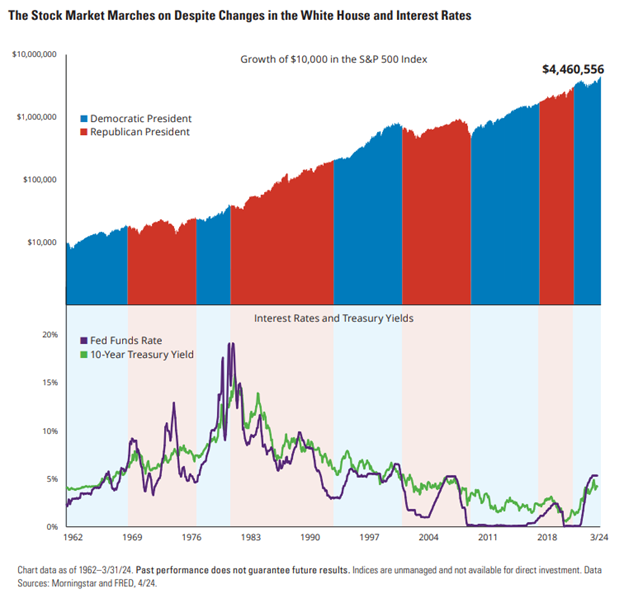

We are looking for signs that the market’s strength is broadening beyond the dominant tech giants that have been leading the charge. We need consistent market broadening for equity indexes to continue their move higher. Anticipated rate cuts later this year are expected to ease financial pressures on smaller capitalization companies struggling with higher interest rates. We applaud the Fed for its efforts in lowering inflation thus far and appreciate its commitment to a 2% inflation target. Higher interest rates have impacted inflation, yet the economy remains comfortably strong across many sectors. It is also encouraging to see the World Bank raise its forecast for global economic growth in 2024, partly due to improving conditions in the U.S. The bottom line is that there are plenty of reasons for investors to feel optimistic. Please contact your advisor at Valley National Financial Advisors with any questions.