Tune in Wednesday, 6 PM for “Your

Financial Choices” show on WDIY 88.1FM: More Special

Planning Circumstances

Laurie

can take your questions live on the air at 610-758-8810, or address those

submitted via yourfinancialchoices.com.

Monthly Archives: November 2020

Welcome Tim Richmond, CPA to the VNFA Tax Department

Our team is pleased to welcome Tim Richmond, CPA to Valley National Financial Advisors in the full-time role of Tax Preparer.

Tim joins VNFA with 15 years of tax and accounting experience. He has a master’s degree in Business Intelligence from Saint Joseph’s University and a Bachelor of Science in Accounting and Economics/Finance from Muhlenberg College.

Tim will work as part of the VNFA Tax Department headquartered in Bethlehem. He will begin his work with VNFA remote as our offices remain closed during the COVID-19 pandemic.

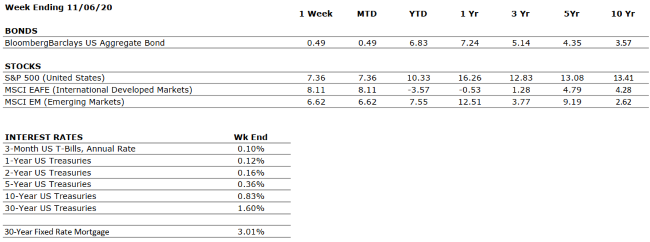

Current Market Observations

by William

Henderson, Vice President / Head of Investments

Is it really possible that we are taking out two unknowns in one week? Joe

Biden wins the Presidency and Pfizer announces a COVID-19 vaccine that is 90%

effective in trials. Wow! We are left with the recession and its recovery

and social unrest as our remaining unknown events in 2020. Last week, we

saw impressive returns in the markets with all three major indices trading up

on the week. The Dow Jones Industrial Average gained +6.9%, the S&P

500 Index gained +7.3% and the NASDAQ gained +9.0%; putting their year-to-date

returns respectively at: -0.75%, +8.6%, and +32.6%; proving once again that

patience, long-term horizons and a sound financial plan are important.

Looking forward, we will most likely have a divided government and a strengthening economy as our tailwinds for the close of 2020 and even into 2021. Add to that a vaccine for COVID-19 that is 90% effective in clinical trials, continued monetary and potential fiscal stimulus and you see why the markets are rallying so strongly already this week. Last week, Federal Reserve policymakers met on Wednesday and Thursday but announced no changes in monetary policy. In fact, the Fed’s post-meeting statement noted that the COVID-19 pandemic continues to meaningfully weigh on economic growth. Fed Chair Jerome Powell stated that the central bank still has monetary tools it can deploy to stimulate the economy, if needed. That said, the economy continued to add jobs at a better-than-expected pace with 638,000 new jobs added in October 2020; driving down the unemployment rate to 6.9% vs. 7.9% in September. The Fed was basing their statements and outlook on last week’s data and last week’s more or less global spike in COVID-19 cases.

This week, Pfizer announced promising news about a potential vaccine for COVD-19. The market is seeing beyond the unknowns and is perhaps more efficient than investors realize. Although the presidential race is all but decided, a divided government remains a distinct possibility. The amount and timing of additional fiscal stimulus is still uncertain, what remains a certainty is the Fed keeping interest rates at near zero and with more arrows in their policy quiver.

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEGATIVE |

GDP increased at a 33.1% annualized pace in Q3. The U.S. economy has now recovered about 2/3 of its lost output owed to the COVID-19 pandemic. |

|

CORPORATE EARNINGS |

VERY NEGATIVE |

With 90% of S&P 500 constituents having reported Q3 results, earnings are down 7-8% from the year-ago period. This compares to Q2 2020, in which S&P 500 earnings were down by 1/3 from the comparable 2019 quarter. |

|

EMPLOYMENT |

VERY NEGATIVE |

As of October’s end, the U.S. unemployment rate stood at 6.9%, well below where most expected the metric to be at this point some months ago. However, with Covid-19 cases surging, the risk of a lockdown is elevated, which would likely cause an increase in the jobless rate. |

|

INFLATION |

POSITIVE |

The Fed plans to allow inflation to temporarily overshoot its 2% target such that the long-term average is 2%. Inflation has been tame since the Great Financial Crisis, less than 2%. |

|

FISCAL POLICY |

VERY POSITIVE |

A second major COVID-19 stimulus bill is likely to be passed over the coming months. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve has supported asset markets with unprecedented speed and magnitude in response to Covid-19. The Fed is prioritizing a recovery in economic output over the curtailing of potential inflation, which is an accommodative stance. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

VERY NEGATIVE |

The relationship between the US and China, the world’s two largest economies, was already weakened by the trade war but has deteriorated further as a result of COVID-19. |

|

ECONOMIC RISKS |

VERY NEGATIVE |

The impacts from Covid-19 were as swift and pronounced as any shock in modern times. Robust monetary and fiscal stimulus stabilized the system, and economic metrics improved in Q3 over Q2, however, economic activity remains well-below that in 2019. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“What we really want to do is what we are really meant to do. When we do what we are meant to do, money come to us, we feel useful, and the work we do feels like play to us.” – Julia Cameron

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your

Financial Choices” show on WDIY 88.1FM: Considerations

in real estate investing with guest David Ellowitch, CFP®

Laurie

can take your questions live on the air at 610-758-8810, or address those

submitted via yourfinancialchoices.com.

Recordings of past

shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

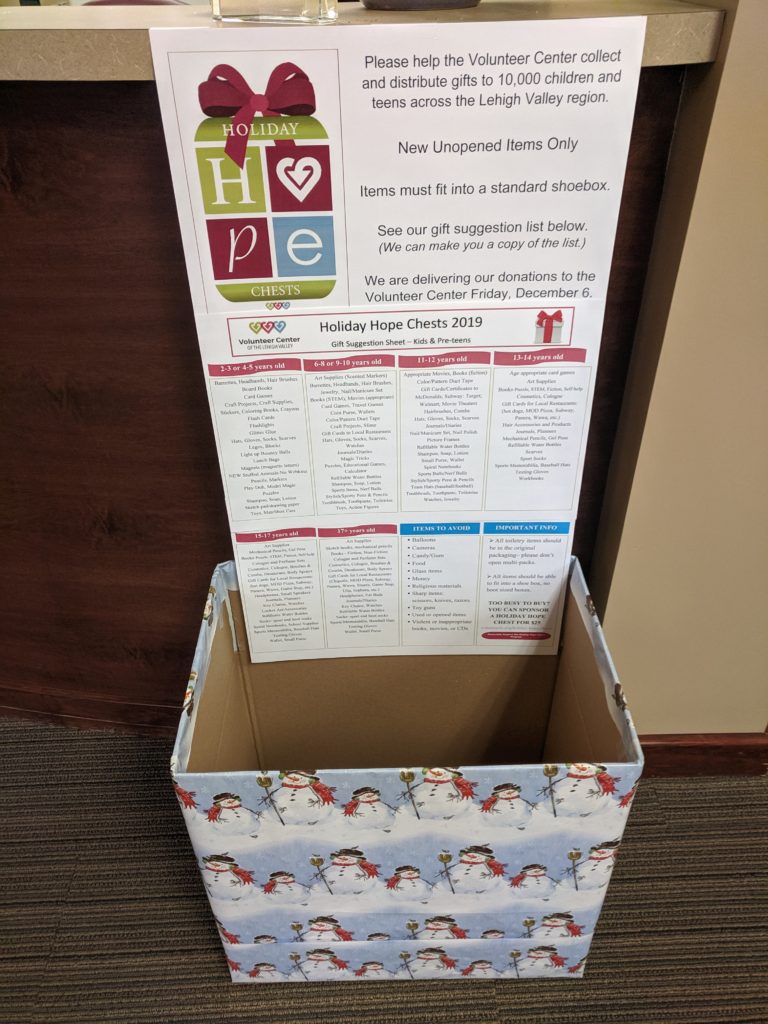

VNFA NEWS

Team VNFA invites you to be part of our Holiday Hope Chest donations. November is upon us and our team has made a commitment again to create 2020 Holiday Hope Chests.

The Volunteer Center of the Lehigh Valley’s annual program gathers shoe boxes filled with gifts for nonprofit organizations to distribute. This year, more than 9,000 boxes were requested from agencies across the Lehigh Valley. Learn more at volunteerlv.org/holiday-hope-chests

Although our offices remain closed for the safety of our clients and staff, we will be accepting appointments for drop off of items, if our neighbors and friends wish to donate gifts or complete shoe boxes. Contact our team with questions, to learn about the suggested gift list or to arrange an appointment for delivery in November. Thank you!

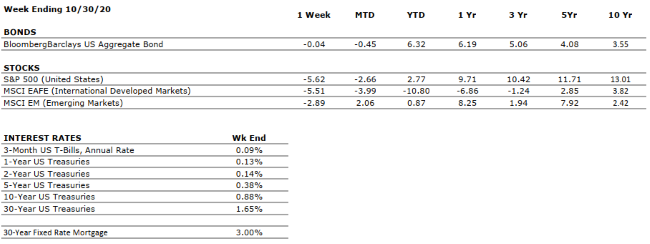

Current Market Observations

by William

Henderson, Vice President / Head of Investments

That was quite a week. All three major market indices were

down last week with the Dow Jones Industrial Average down -6.5% Standard &

Poor’s 500 Index down – 5.6% and the NASDAQ down -5.5%. Technology led the

averages lower even after four powerhouse firms beat earnings estimates: Apple,

Amazon, Facebook and Google all topped analyst’s estimates but they also

collectively spoke of lower guidance on revenues and slower growth going

forward. Another piece of positive news that failed to give the markets a

boost was the release of the 3rd Quarter year-over-year U.S. GDP at an

astounding 32%. Offsetting the positives were across the board and around the

world spikes in COVID-19 cases. Of course, we have the Presidential

Election ending Tuesday evening. Finally, we will put to rest one of our

unknowns for 2020.

Equity markets have been whipsawed this year, first staging the fastest the bear market on record in March before rallying to a staging a rebound not seen in 90 years. We have seen this volatility previously. Large swings were also a common feature of the 2008 financial crisis. In 2008, there were 42 trading days where the S&P 500 moved by more than 3%. So far in 2020, there have been 28 days where the S&P 500 has swung by 3% or more. Clearly, our collective unknowns that we frequently cite, continue to roil the markets.

The housing market continues to boom; and, by most measures, activity in the housing sector is running at its highest level since 2007. Thankfully, this is a rebound from Spring, when COVID-19 lockdowns all but halted activity in the sector. Record-low mortgage rates, demographic tailwinds, and a general movement out of urban locales into suburban regions continue to fuel the boom. The housing boom fuels related sector growth as well such as landscaping, appliances, carpentry, plumbing and HVAC, and household electronics. A strong housing market is an excellent base for a continued economic recovery into 2021 and beyond.

With the markets being down so much last week, it is difficult to believe there are green shoots in our economy; however, looking at the fiscal and monetary stimulus alone, things are firmly in place for an economic rebound. Add to this any possibility of a COVID-19 vaccine in 2021 and the economy could see dramatic growth as the power of the consumer will finally be unleashed. The election will decide the next President of the United States, but one person remains in office continuing to be extremely important to the financial markets – Jerome Powell. Mr. Powell is committed to keeping rates low for a long time. Low rates are fueling the housing boom (as mentioned above) allowing healthy firms to borrow at record-low levels, thereby improving their balance sheets and reducing the net interest expense of the federal debt.

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEGATIVE |

GDP increased at a 33.1% annualized pace in Q3. The U.S. economy has now recovered about 2/3 of its lost output owed to the COVID-19 pandemic. |

|

CORPORATE EARNINGS |

VERY NEGATIVE |

S&P 500 earnings fell by around 1/3 in Q2, the sharpest year-over-year decline since 2008. Q3 earnings season, which is just beginning, is expected to show strong improvement over Q2. |

|

EMPLOYMENT |

VERY NEGATIVE |

The unemployment rate declined to 7.9% in September, from a peak of 14.7% in April. While the rebound is material, the jobless rate remains well above the historical average. |

|

INFLATION |

POSITIVE |

The Fed plans to allow inflation to temporarily overshoot its 2% target such that the long-term average is 2%. Inflation has been tame since the Great Financial Crisis, less than 2%. |

|

FISCAL POLICY |

VERY POSITIVE |

A second major pandemic stimulus bill is likely to be passed after the Presidential Election. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve has supported asset markets with unprecedented speed and magnitude in response to COVID-19. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

VERY NEGATIVE |

The relationship between the US and China, the world’s two largest economies, was already weakened by the trade war but has deteriorated further as a result of COVID-19. |

|

ECONOMIC RISKS |

VERY NEGATIVE |

The impacts from COVID-19 were as swift and pronounced as any shock in modern times. Robust monetary and fiscal stimulus stabilized the system; however, economic activity remains well- below that in 2019, and uncertainty remains high, particularly with the election just eight days away. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

From the Pros… VIDEO

Team Chat – Trending Topics (October 2020)

Financial Advisors Joseph Goldfeder, CFP® and Jaclyn Cornelius, CFP®, EA discuss some planning topics that are top of mind currently in their work with clients. WATCH NOW