“Life is too important to be taken seriously.” – Oscar Wilde

Monthly Archives: December 2020

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY 88.1FM: Social Security and Medicare odds and ends. Filing options, withholdings, IRMAA adjustments and Form SSA-44

Laurie can take your questions live on the air at 610-758-8810, or address those submitted via yourfinancialchoices.com.

Recordings of past shows are available to

listen or download at both yourfinancialchoices.com and wdiy.org.

VNFA Team Chat (December 2020)

Trending Topics (December 2020 – PART I)

Financial Advisors Laurie Siebert, CPA, CFP®, AEP® and Tim Roof, CFP® discuss estate planning topics including beneficiary and charitable giving elements. WATCH NOW (and stay tuned for PART II next week).

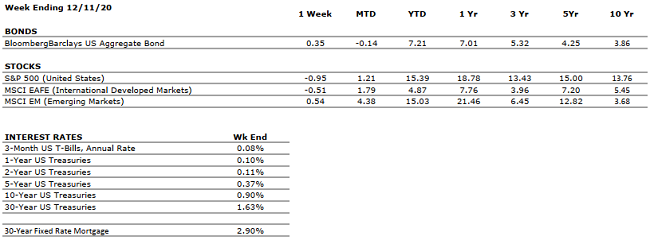

Current Market Observations

by William

Henderson, Vice President / Head of Investments

For

the week that ended December 11, 2020, U.S. stock markets pulled back a bit

with each of the major indices turning in modest negative returns. For the

week, The Dow returned -0.6%, the Standard & Poor’s 500 Index returned

-1.0%, and the NASDAQ returned -0.7%. Last week’s pull back, however, was

not significant enough to move any of the major indices into red territory for

the full year. In fact, the major markets have given investors comfortable

returns across the board. Year-to-date, the Dow has returned +5.3%, the

S&P 500 +13.4%, and the NASDAQ Composite +38.0%.

We continue to see positive notes impacting the economy. President Trump signed a stopgap spending bill on December 11, 2020 to avoid a government shutdown. Congress now has one week to agree on a full-year $1.4 trillion spending bill combined with COVID-19 relief. Lawmakers are squabbling over the details of another stimulus package with one group at $908 billion and another at $748 billion. The good news is that House Speaker Nancy Pelosi has agreed to speak with Treasury Secretary Steven Mnuchin so we could see an additional stimulus plan before year end. According to Gustave Perna, the army general who serves as Chief Operating Officer for Operation Warp Speed, the first shipments of Pfizer Inc.-BioNTech’s COVID-19 vaccines are scheduled to arrive this week in all 50 U.S. states. The widespread release of a vaccine for COVID-19 first by Pfizer, and quickly followed by Johnson & Johnson and Moderna by early spring 2021, is just what consumers and the markets are looking for to release pent up demand for spending. We have seen a faster-than-expected economic recovery and a concomitant rebound in risk assets like stocks; but yields on U.S. Treasury Bonds remain depressed. Don’t expect the Federal Reserve to raise rates anytime soon as they have clearly reflected a plan to keep rates lower for longer even in the face of higher inflation risks.

What is important for investors is diversification. A thoughtfully diversified portfolio can weather different environments better than one that is stuck on a single style, geography or factor. A glance at returns for 2020 across the markets reinforces this notion as we have the Dow at a reasonable +5.3%, the NASDAQ posting a stellar +38.0%; and for fixed income, we have the Bloomberg Barclays US Treasury Total Return Index returning +8.0%. Diversification, when coupled with a sound financial plan, may be the last remaining free lunch for intelligent investors. There are just under three weeks left in 2020, a year that will be remembered long after the books are closed on the markets’ returns.

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

GDP increased at a 33.1% annualized pace in Q3. The U.S. economy has now recovered about 2/3 of its output lost to the COVID-19 pandemic. |

|

CORPORATE EARNINGS |

NEUTRAL |

As more than 90% of S&P 500 constituents have reported Q3 results, the index’s earnings are down 7-8% from the year-ago period. This compares to Q2 2020, in which S&P 500 earnings were down by 1/3 from the comparable 2019 quarter. |

|

EMPLOYMENT |

NEGATIVE |

In November, the unemployment rate declined to 6.7%. This continued the month-over-month improvements seen since April, when the metric was above 14%. However, the pace of hiring slowed greatly in November as COVID-19 cases surged. |

|

INFLATION |

POSITIVE |

The Fed plans to allow inflation to temporarily overshoot its 2% target such that the long-term average is 2%. Inflation has been tame since the Great Financial Crisis, less than 2%. |

|

FISCAL POLICY |

POSITIVE |

A second major COVID-19 stimulus bill is likely to be passed over the coming months. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve supported asset markets with unprecedented speed and magnitude in response to COVID-19. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

There are few, if any, looming geopolitical risks that could upset the economic recovery. |

|

ECONOMIC RISKS |

NEUTRAL |

Although economic activity mostly remains below 2019’s levels, improvement has occurred across nearly every measure since the April nadir. With a vaccine on the horizon, a fiscal package probable, and interest rates low, 2021 is positioning to be a strong economic year. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“Sometimes you just need to talk to a 4-year-old and an 84-year-old to understand life again. – Kristen Butler

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY 88.1FM: Social Security and Medicare odds and ends. Filing options, withholdings, IRMAA adjustments and Form SSA-44

Laurie can take your questions live on the air at 610-758-8810, or address those submitted via yourfinancialchoices.com.

Recordings of past shows are available to

listen or download at both yourfinancialchoices.com and wdiy.org.

VNFA NEWS

We are Hiring!

Valley National Financial Advisors is seeking a full-time Financial Technology and Trading Associate to manage our investment databases and assist with operational securities trading and support. Learn more and find the application link at our website: https://valleynationalgroup.com/about-vnfa/join-our-team/

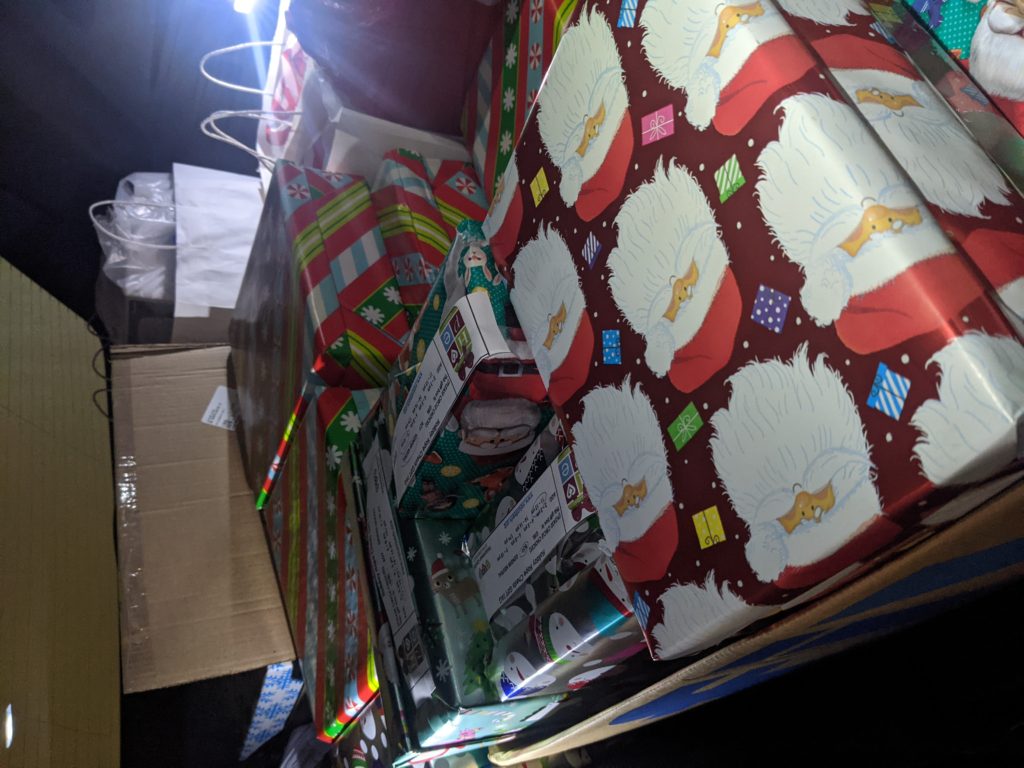

VNFA In the Community

Although it looked very different this year, without a wrapping party or group delivery, our team put together 35 Holiday Hope Chests for Volunteer Center of the Lehigh Valley. We were also able to sponsor additional online gift purchases and wrapped boxes to help the program supply a happy holiday to thousands of local children through non-profit distributions. “Our goal was 35 boxes as a nod to our 35th anniversary as a local and independent business this year,” said Judianne Harris, Chief Marketing Officer. “Members of our team really went above and beyond using creative and safe approaches to make a meaningful contribution.”

Thank you to everyone who helped support our commitment to community!

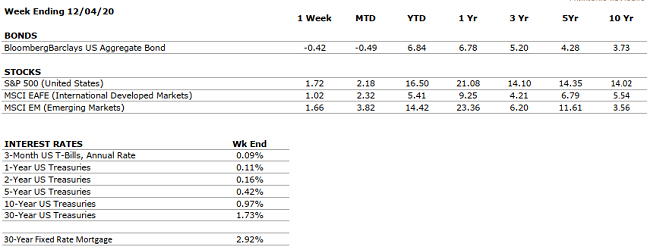

Current Market Observations

by William Henderson, Vice President / Head of Investments

For the week that ended December 4, 2020, stocks reached further into record territory with the Dow Jones Industrial Average closing comfortably above 30,000, at 30,218. For the week, The Dow returned +1.1%, the Standard & Poor’s 500 Index returned +1.7%, and the NASDAQ returned +2.1%. The weekly gains piled onto previous gains to put year-to-date figures well into the positive zone. Year-to-date, the Dow has returned +5.9%, the S&P 500 +14.5%, and the NASDAQ a staggering +38.9%. These numbers are all the more remarkable when factored in to what 2020 threw at the markets: a global pandemic, a huge double-digit recession and a complicated and costly U.S. Presidential Election.

Last week, news of European Union (EU) regulators considering emergency authorization for Pfizer/BioNTech’s COVID-19 vaccine for wide-spread release sparked a rally early only to be stymied later in the week after Pfizer acknowledged supply chain problems. The general flip-flop has plagued the markets all year. We get good news that is quickly followed by bad news. We’ve seen this with 1) the vaccine but increasing COVID-19 case abound; 2) a stimulus package is discussed but not passed by congress; 3) a decided presidential election but a run-off in Georgia for two senate seats. It should not be news to readers of this report that we always talk about one clear constant that the markets are relying on for support – the Federal Reserve. The Fed has lowered rates to zero, announced monetary policy steps to sure up the bond markets and stated over and over that it will provide all needed stability and liquidity to assure the economic recovery.

Sure, the news and economic reports are as negative as they are positive, but the markets seem to be seeing past this noise and looking to 2021 when a vaccine for COVID-19 could be widely available and distributed around the world. Consumers, who have been storing up cash, will then be released to spend again and we could see a very strong economic rebound following 2020. The larger macroeconomic risks that exist today make it more important than ever for investors to keep their goals front and center and stick with their investment plans. It is much better to focus on long-term results over full market cycles.

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

GDP increased at a 33.1% annualized pace in Q3. The U.S. economy has now recovered about 2/3 of its output lost to the COVID-19 pandemic. |

|

CORPORATE EARNINGS |

NEUTRAL |

As more than 90% of S&P 500 constituents have reported Q3 results, the index’s earnings are down 7-8% from the year-ago period. This compares to Q2 2020, in which S&P 500 earnings were down by 1/3 from the comparable 2019 quarter. |

|

EMPLOYMENT |

NEGATIVE |

In November, the unemployment rate declined to 6.7%. This continued the month-over-month improvements seen since April, when the metric was above 14%. However, the pace of hiring slowed greatly in November as COVID-19 cases surged. |

|

INFLATION |

POSITIVE |

The Fed plans to allow inflation to temporarily overshoot its 2% target such that the long-term average is 2%. Inflation has been tame since the Great Financial Crisis, less than 2%. |

|

FISCAL POLICY |

POSITIVE |

A second major COVID-19 stimulus bill is likely to be passed over the coming months. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve supported asset markets with unprecedented speed and magnitude in response to COVID-19. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

There are few, if any, looming geopolitical risks that could upset the economic recovery. |

|

ECONOMIC RISKS |

NEUTRAL |

Although economic activity mostly remains below 2019’s levels, improvement has occurred across nearly every measure since the April nadir. With a vaccine on the horizon, a fiscal package probable, and interest rates low, 2021 is positioning to be a strong economic year. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.