“Hope is the only bee that makes honey without flowers.” – Robert Ingersoll

Monthly Archives: December 2020

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY 88.1FM: Year-End Tax Planning starting with a discussion about charitable giving with a guest from the ArtsQuest Foundation.

Laurie can take your questions live on the air at 610-758-8810, or address those submitted via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

Message from the CEO: Thank you!

VNFA NEWS

Security update to eVault Client Portal login

As an added layer of security for your eVault Client Portal, dual-factor authentication will be required as part of the login process, beginning today – December 1, 2020. Due to updates, the VNFA app for portal access from mobile devices is experiencing down time. We apologize for any inconvenience this may cause temporarily. Please contact our team if you have any questions.

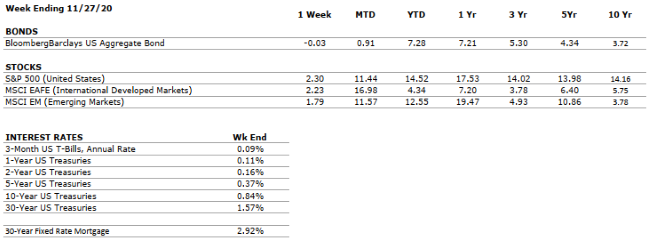

Current Market Observations

by William Henderson, Vice

President / Head of Investments

A holiday shortened trading week did not stop the markets’ strong weekly

performance as all three broad market indices showed positive results for the

week. The Dow Jones Industrial Average returned +2.2%, The Standard &

Poor’s 500 index returned +2.3% and The NASDAQ Composite returned +3.0%. These

weekly returns piled onto year-to-date figures that are shaping up 2020 to be a

year of healthy gains for equities. As of November 27, 2020, year-to-date

returns for the key market indices stood at +4.8% for the Dow Jones Industrial

Average, +12.6% for the S&P 500 Index and +36.0% for the NASDAQ

Composite.

Fortunately, the economy continues to display impressive resilience across multiple sectors, such as housing, auto sales, retail sales, manufacturing, and most services including health care and information technology. We’ve seen increased demand for services such as cloud computing and web-based services as working from home becomes the norm rather than the exception. Further, as an offshoot of strong housing, the home remodeling and home improvement sectors have also been very strong. Conversely, travel and leisure sectors continue to suffer. According to the FAA, Thanksgiving holiday travel was 50% lower than 2019. Lastly, elevated concerns of COVID-19 in the United States and elsewhere casts a pall on a positive path for the economy.

Three things leave us hopeful for a continued economic recovery in 2020 and into 2021. First, and most important, the Federal Reserve is likely to keep rates low and provide as much liquidity and accommodation as the economic recovery requires. Secondly, online and virtual holiday shopping could be very strong this year as the consumer is flush with cash and suffering from pent up spending demand. Finally, two major pharmaceutical firms have filed with the FDA for approval of their COVID-19 vaccine: Moderna and Pfizer. November has wrapped up and looks to be one of the best market returns for a November ever. Keep an eye of e-commerce spending and continued strength in housing as the year comes to close.

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEGATIVE |

GDP increased at a 33.1% annualized pace in Q3. The U.S. economy has now recovered about 2/3 of its output lost to the COVID-19 pandemic. |

|

CORPORATE EARNINGS |

NEGATIVE |

As more than 90% of S&P 500 constituents have reported Q3 results, the index’s earnings are down 7-8% from the year-ago period. This compares to Q2 2020, in which S&P 500 earnings were down by 1/3 from the comparable 2019 quarter. |

|

EMPLOYMENT |

NEGATIVE |

As of October’s end, the U.S. unemployment rate stood at 6.9%, well below where most expected the metric to be at this point some months ago. The unemployment rate has consistently declined since peaking above 14% in April. |

|

INFLATION |

POSITIVE |

The Fed plans to allow inflation to temporarily overshoot its 2% target such that the long-term average is 2%. Inflation has been tame since the Great Financial Crisis, less than 2%. |

|

FISCAL POLICY |

VERY POSITIVE |

A second major COVID-19 stimulus bill is likely to be passed over the coming months. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve supported asset markets with unprecedented speed and magnitude in response to COVID-19. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

VERY NEGATIVE |

The relationship between the US and China, the world’s two largest economies, was already weakened by the trade war but has deteriorated further as a result of COVID-19. |

|

ECONOMIC RISKS |

VERY NEGATIVE |

The impacts from COVID-19 were as swift and pronounced as any shock in modern times. Robust monetary and fiscal stimulus stabilized the system; however, economic activity remains well- below that in 2019, and uncertainty remains high. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“Progress is impossible without change, and those who cannot change their minds cannot change anything.” – George Bernard Shaw

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY 88.1FM: Employer Stock Benefits.

Laurie can take your questions live on the air at 610-758-8810, or address those submitted via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.