For 38 years, #TeamVNFA has been committed to building a service team you can count on for all your financial needs.

GET TO KNOW OUR TEAM: https://valleynationalgroup.com/advisors-and-team/

For 38 years, #TeamVNFA has been committed to building a service team you can count on for all your financial needs.

GET TO KNOW OUR TEAM: https://valleynationalgroup.com/advisors-and-team/

Essential Cybersecurity Measures for Clients (a five-part series)

By: Rob Ziobro, VNFA Assistant Vice President, IT

Be Wary of Phishing Attempts: Cybercriminals often use emails or messages that appear legitimate to trick you into revealing sensitive information. Be cautious when clicking on links or downloading attachments from unknown senders. Always verify the sender’s email address and avoid sharing personal or financial information through email.

Keep Software and Devices Updated: Regularly updating your operating system, software, and apps is more than just a chore – it’s a vital security measure. Updates often contain patches for known vulnerabilities that hackers can exploit. Ensuring your devices are up to date helps seal potential entry points for cyber threats.

Check back next week for additional tips.

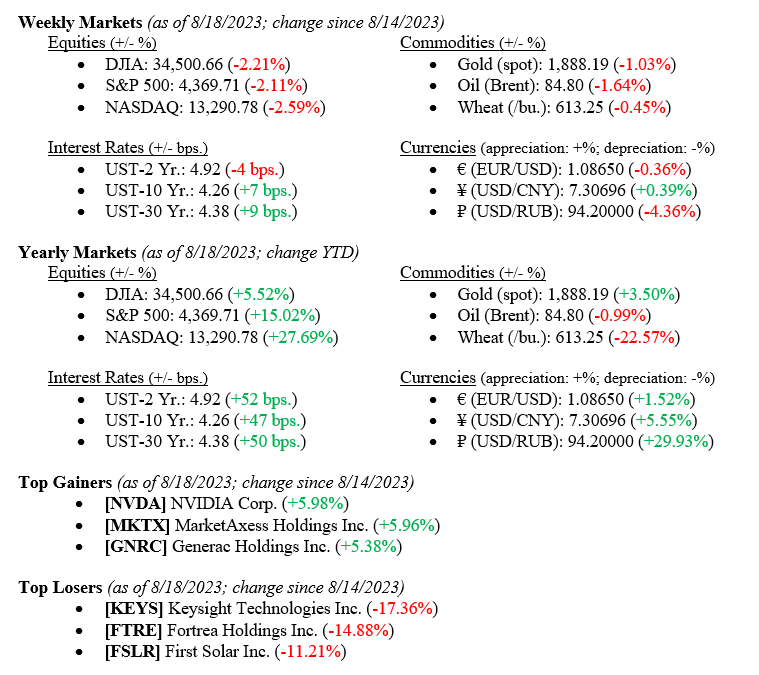

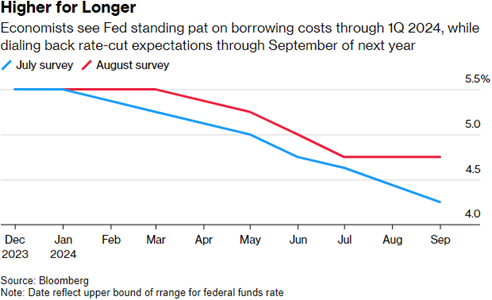

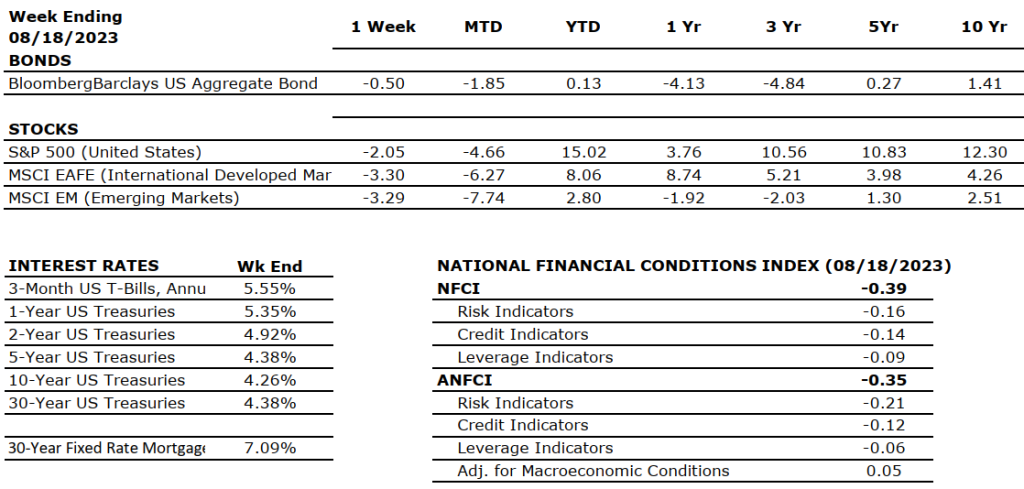

The Dow Jones Industrial Average ended the week down 2.21%, the S&P500 index lost 2.11%, and the NASDAQ fell 2.59%. Global stocks declined due to concerns about China’s economic conditions and rising global rates. Investors also continue to grapple with inflation concerns. Additionally, the CBOE Volatility Index (VIX) reached its highest level since May 2023 last week, indicating increasing market anxiety. The Federal Reserve is meeting in Jackson Hole, WY, this week—we will be watching this symposium to gauge the Fed’s policy stance going forward. We still believe that the Fed will be able to gently land the economy and avoid a recession despite being seemingly bombarded with news to the contrary.

Global Economy

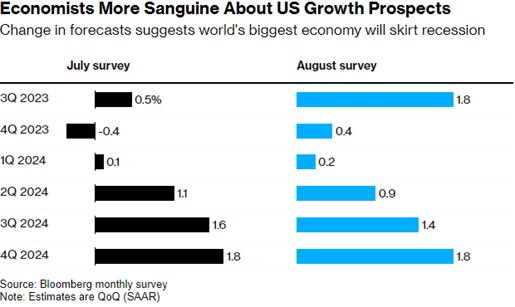

According to a recent survey, the projected 3Q GDP growth has surged to 1.8%, a notable increase from the earlier estimate of 0.5% in July, as seen in Chart 1 below. The economy’s strength is driven by resilient consumer spending, supported by recent retail sales data and a strong job market. Economists’ revised projections depict an average U.S. economic growth of 2% this year and 0.9% in 2024, exceeding previous estimates and aligning with more positive global forecasts. Despite inflation concerns, economists foresee a prolonged period of higher interest rates without any imminent rate hikes, as seen in Chart 2 below. The possibility of a rate cut has been pushed to the second quarter of the following year, reflecting their confidence in a more resilient economy.

Chart 1:

Chart 2:

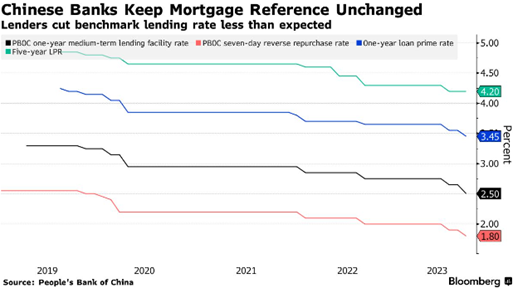

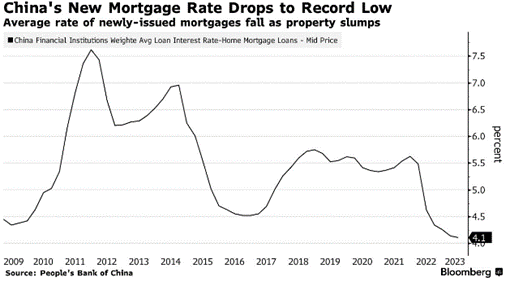

Chinese banks have maintained the key five-year loan prime rate (LPR) at 4.2%, defying predictions for a 15-basis point cut, while ten basis points reduced the one-year LPR to 3.45% (see Charts 3, 4). This unexpected move reflects China’s dilemma in balancing the need to stimulate economic growth with the imperative to ensure the banking system’s stability. The decision is seen as an effort to protect banks’ net interest margins and profitability, which are crucial for financial stability. The Chinese government is grappling with the challenge of bolstering borrowing demand amidst deflationary pressures and waning confidence, all while trying to avoid instability in the financial sector.

Chart 3:

Chart 4:

What to Watch

While the market has had negative returns in the past few weeks, we remain cautiously optimistic about the U.S. economy and the markets for 2023. Please reach out to your contact at Valley National Financial Advisors with any questions.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five- and 10- year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

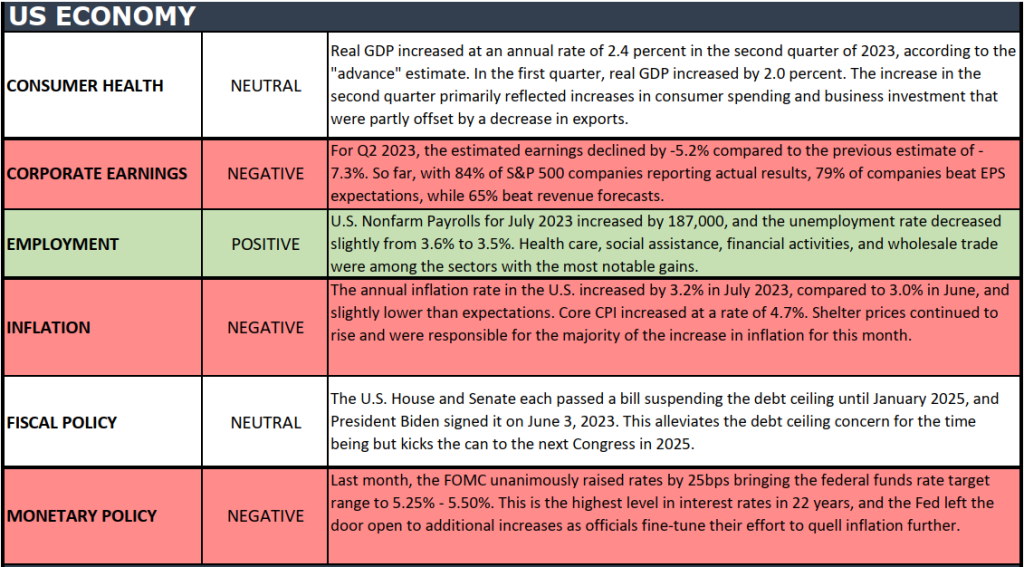

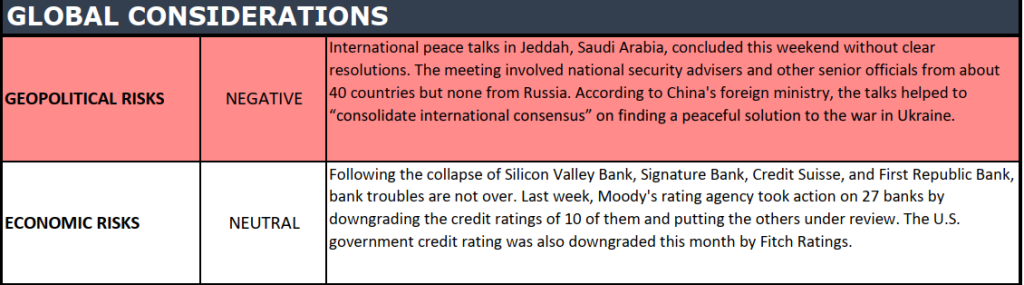

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade key economic conditions that we believe are of particular importance to investors.

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

“The bad news is time flies. The good news is you’re the pilot.” -Michael Altshuler

Tune in Wednesday, 6 PM “Your Financial Choices” on WDIY 88.1FM. Laurie will be Reviewing Financial tools on FINRA.ORG.

Questions can be submitted at yourfinancialchoices.com during or in advance of the live show. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.