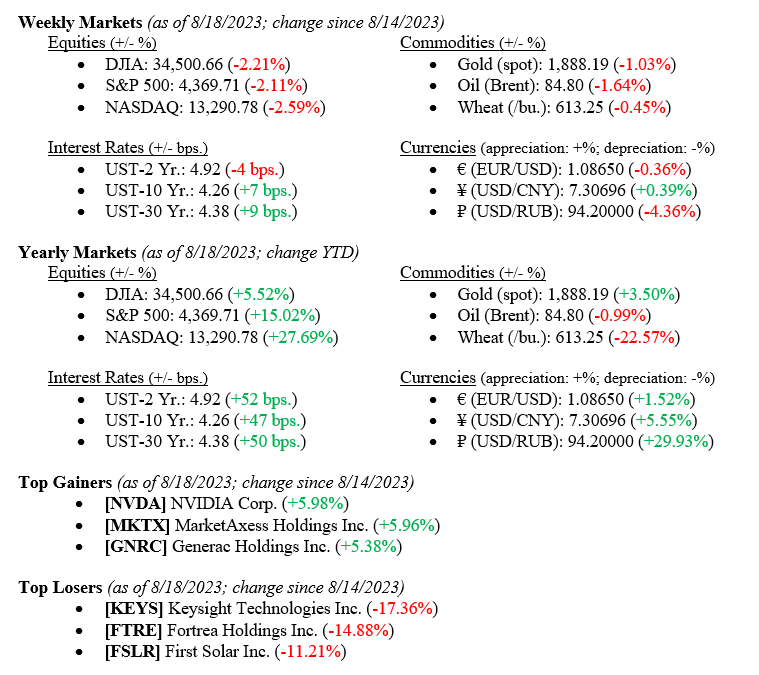

The Dow Jones Industrial Average ended the week down 2.21%, the S&P500 index lost 2.11%, and the NASDAQ fell 2.59%. Global stocks declined due to concerns about China’s economic conditions and rising global rates. Investors also continue to grapple with inflation concerns. Additionally, the CBOE Volatility Index (VIX) reached its highest level since May 2023 last week, indicating increasing market anxiety. The Federal Reserve is meeting in Jackson Hole, WY, this week—we will be watching this symposium to gauge the Fed’s policy stance going forward. We still believe that the Fed will be able to gently land the economy and avoid a recession despite being seemingly bombarded with news to the contrary.

Global Economy

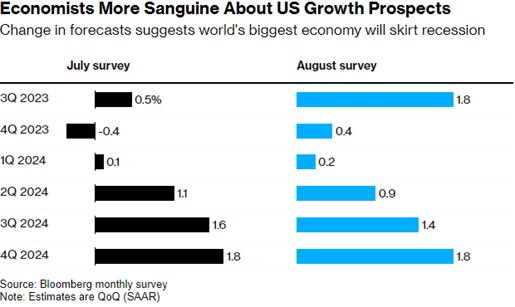

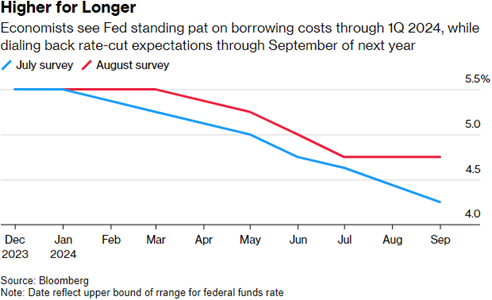

According to a recent survey, the projected 3Q GDP growth has surged to 1.8%, a notable increase from the earlier estimate of 0.5% in July, as seen in Chart 1 below. The economy’s strength is driven by resilient consumer spending, supported by recent retail sales data and a strong job market. Economists’ revised projections depict an average U.S. economic growth of 2% this year and 0.9% in 2024, exceeding previous estimates and aligning with more positive global forecasts. Despite inflation concerns, economists foresee a prolonged period of higher interest rates without any imminent rate hikes, as seen in Chart 2 below. The possibility of a rate cut has been pushed to the second quarter of the following year, reflecting their confidence in a more resilient economy.

Chart 1:

Chart 2:

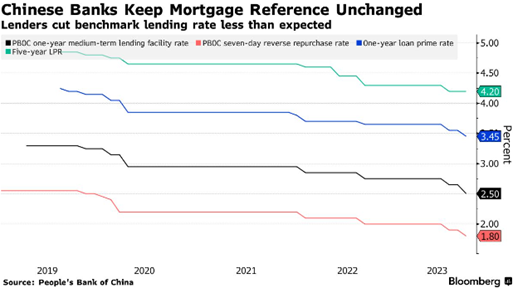

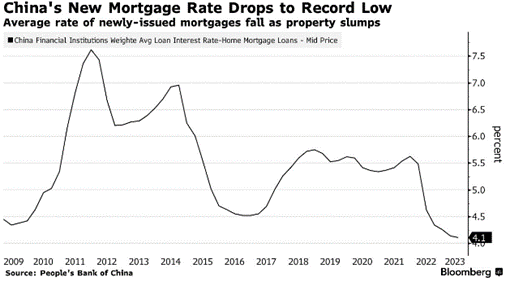

Chinese banks have maintained the key five-year loan prime rate (LPR) at 4.2%, defying predictions for a 15-basis point cut, while ten basis points reduced the one-year LPR to 3.45% (see Charts 3, 4). This unexpected move reflects China’s dilemma in balancing the need to stimulate economic growth with the imperative to ensure the banking system’s stability. The decision is seen as an effort to protect banks’ net interest margins and profitability, which are crucial for financial stability. The Chinese government is grappling with the challenge of bolstering borrowing demand amidst deflationary pressures and waning confidence, all while trying to avoid instability in the financial sector.

Chart 3:

Chart 4:

What to Watch

- Monday, August 21st

- Retail Gas Price at 4:30PM (Prior: $3.962/gal.)

- Tuesday, August 22nd

- Existing Home Sales/MoM at 11:00AM (Priors: 4.16M / -3.26%)

- Thursday, August 24th

- Initial Claims for Unemployment Insurance at 8:30AM (Prior: 239k)

- 30 Year Mortgage Rate at 12:00PM (Prior: 7.09%)

- Friday, August 25th

- Index of Consumer Sentiment at 10:00AM (Prior: 71.20)

While the market has had negative returns in the past few weeks, we remain cautiously optimistic about the U.S. economy and the markets for 2023. Please reach out to your contact at Valley National Financial Advisors with any questions.