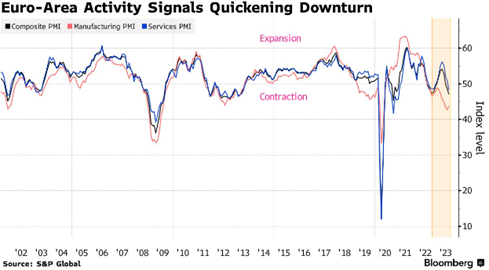

The equity market ended the week mixed as a rally in tech stocks propelled the NASDAQ and S&P 500 Index higher but failed to pull along the broader Dow Jones Industrial Average. For the week, the Dow Jones ended down 0.45%, the S&P 500 up 0.82%, and the NASDAQ higher by 2.26%. The focus remained heavy on the Federal Reserve to see what monetary policy would come out of their Jackson Hole conference, and spoiler alert, Chairman Powell implied that rates would remain elevated until inflation approaches the 2% target and maintains that level. Across the pond, the Eurozone is struggling to combat inflation, which is still above 5%, suggesting the ECB may have to be more aggressive in its policymaking. Finally, the effects of China’s post-pandemic slowdown are beginning to be felt by trade partners and are causing a net detraction in global growth.

Global Economy

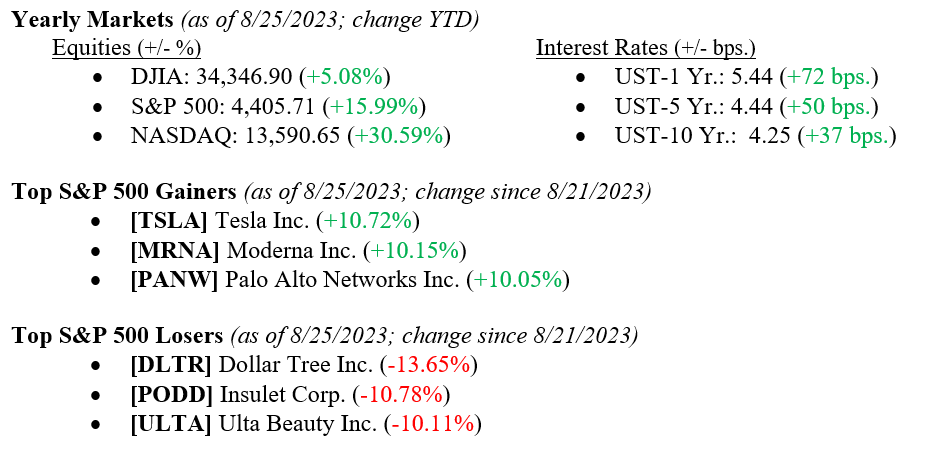

Federal Reserve policymakers met last week in Jackson Hole for their annual conference, focusing on monetary policy. Fed Chair Jerome Powell said that the central bank is ready and willing to continue raising rates if inflation does not sustainably trend down towards its 2% target. U.S. inflation printed last month at 3.18%, while it peaked last August 2022 at 9.1%. Remember that the Federal Reserve raised rates consistently in 2022 and through most of 2023—just recently pausing its tightening cycle, which greatly aided in bringing inflation down to 3.18% from 9.1% during that time period. While we have seen some commentary suggesting that the Fed will begin cutting rates by the end of the year, the news from Jackson Hole suggests that we may be in for an extended period of higher rates through at least mid-2024. Chart 1 below shows U.S. quarter-over-quarter (QoQ) GDP plotted against personal consumption QoQ.

Chart 1:

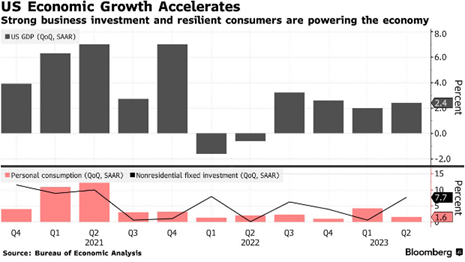

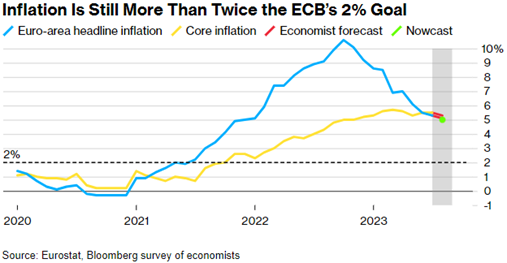

While the U.S. received somewhat clear direction from the Fed last week, Europe faces relative silence from Christine Lagarde and the European Central Bank (ECB) leading up to the bank’s Sept. 14th meeting. Inflation has continued to run rampant in the Eurozone and is the core focus of the ECB’s data-dependent policymaking. For reference, EU core inflation (ex-Energy) remains above 5% versus the central bank’s 2% target (the same as the Fed’s target). See Chart 2 showing European inflation data. However, the recent release of Europe’s Purchasing Managers’ Index (PMI) signaled the contraction of private sector activity, meaning there is now more significant downward pressure on inflation. See Chart 3 for both components and composite of PMI charted against each other from 2002 through the present.

Chart 2:

Chart 3:

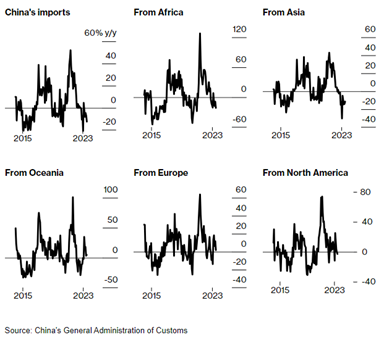

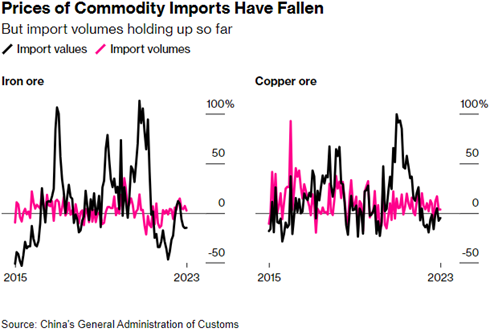

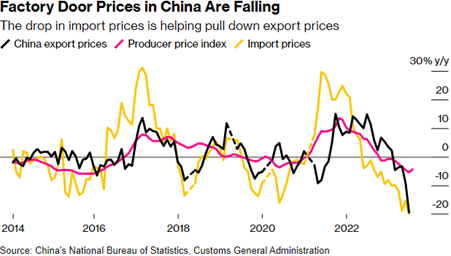

This year, China’s economy was supposed to drive 1/3rd of global economic growth. For reference, for every 1% gain in China’s growth rate, global expansion is boosted by 0.3%. Unfortunately, the country’s post-pandemic reopening has been fraught with weak data seeping into its trade partners. So far this year, more than $10B has been pulled from China’s stock markets in the longest stretch of net outflows in the country’s history. This does not mean there are no benefits from an economic slowdown in China. For example, China’s slowdown will depress oil prices and lower prices for exported goods. This is good news for other places, such as the U.S. and Eurozone, which are still battling elevated inflation and will benefit from falling Chinese demand. Chinese imports have fallen as demand dropped from pandemic-era highs. See Charts 4 and 5 for Chinese import data. Chart 6 belowshows export prices falling with the Producer Price Index (PPI) and import prices.

Chart 4:

Chart 5:

Chart 6:

What to Watch

- Monday, Aug. 28th

- 4:30PM – Retail Gas Price (Prior: $3.984/gal.)

- Tuesday, Aug. 29th

- 9:00AM – Case-Shiller National Home Price Index (Prior: 302.38)

- 10:00AM – Total Nonfarm U.S. Job Openings (Prior: 9.582M)

- Wednesday, Aug. 30th

- 8:30AM – Real GDP QoQ (Prior: 2.40%)

- 10:00AM – Pending Home Sales QoQ/YoY (Priors: 0.26% / -15.60%)

- Thursday, August 31st

- 8:30AM – Personal Income/Spending MoM (Priors: 0.31% / 0.55%)

- 12:00PM – 30 Year Mortgage Rate (Prior: 7.23%)

- Friday, Sept. 1st

- 8:30AM – Labor Force Participation Rate (Prior: 62.60%)

- 8:30AM – Nonfarm Payrolls MoM (Prior: 187.00K)

- 8:30AM – Unemployment Rate (Prior: 3.50%)

- 11:00AM – U.S. Recession Probability (Prior: 66.01%)

Federal Reserve policymakers signaled that they remain vigilant in their fight against inflation with the end goal continuing to be a 2.00% target rate. We believe Chairman Powell sees the impact of the aggressive tightening in 2022-23 and hinted that the impact of these hikes has yet to be fully felt across the economy. We think a continued pause in rate hikes at the September FOMC meeting is plausible but, of course, all actions are data dependent. U.S. economic growth remains resilient with a solid jobs market which is boosting consumer spending. The bond market continues to modestly sell off, especially in the short end of the curve, but this move is also offering investors a yield component on bonds that we have not seen in many years. Summer is nearing a close, back-to-school shopping is underway or already done and Wall Street will be getting back from the Hamptons and elsewhere. “Sell-in-May and Go-Away” means traders and portfolio managers will be hitting the floor looking to cement positive returns for year-end bonus season. Also, pay attention to the shifting climate in China as this will impact the global economy. Please reach out to your advisor at Valley National Financial Advisors with questions or concerns.