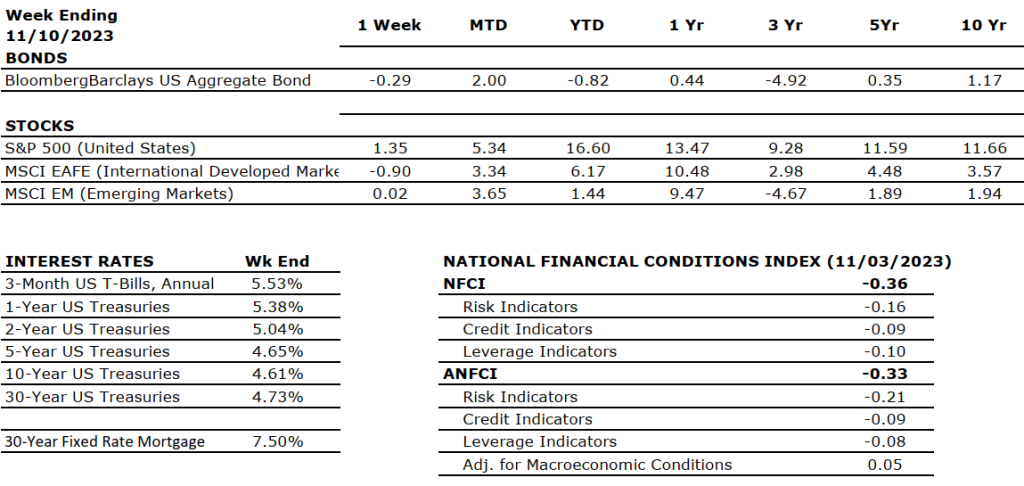

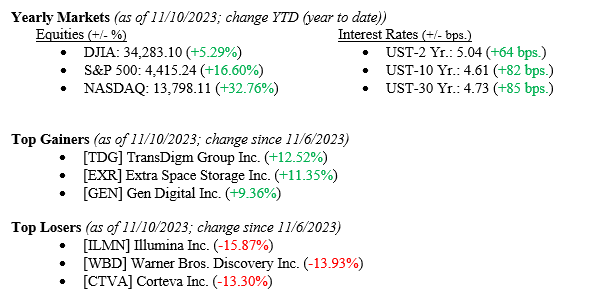

We will talk about market headwinds and tailwinds later in the report, but for now, let us just talk about what the markets did last week and year-to-date to remind investors where we really are and what the markets have done. Last week, the Dow Jones Industrial Average added +0.7%, the S&P 500 Index notched a +1.3% return, and the NASDAQ added +2.4%. These returns pushed year-to-date figures higher for each major index, with the Dow at +5.3%, the S&P 500 at +16.6%, and the mega-tech heavy NASDAQ at 32.8%. Certainly, few investors own only index-based investments or only mega-tech equities. Still, most investors with balanced portfolios own a slice of each and, therefore, have captured their risk-related slice of these market returns thus far in 2023. Bonds moved little last week, with the 10-year U.S. Treasury closing at 4.62%, five basis points higher than the previous week.

Global Economy

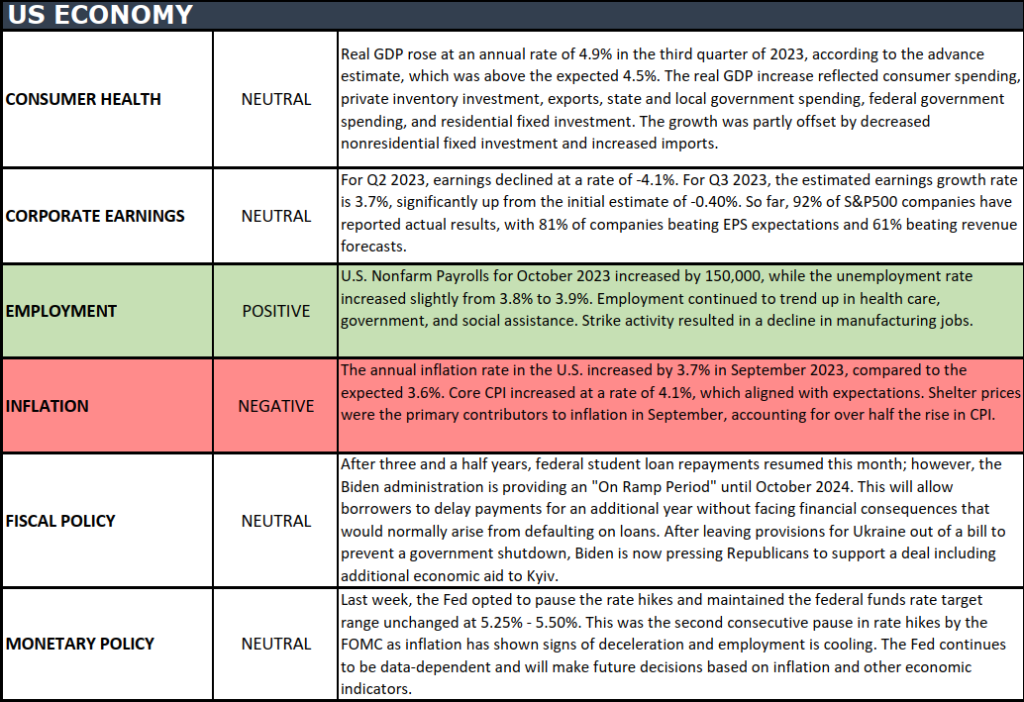

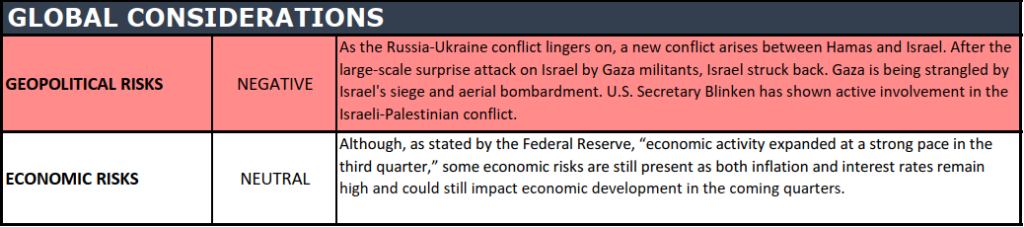

There continues to be sufficient geopolitical global turmoil to worry us at Valley National Financial Advisors. The Israeli/Hamas War shows no signs of abating, while the Russia/Ukraine War has dragged on for almost two years; both wars are overheating the already unsteady markets for oil, natural gas, and some food commodities like wheat and creating an ongoing humanitarian crisis. On the flip side of bad news, Chinese President Xi Jinping will meet with President Biden this week in California in a move that officials on both sides hope will ease tensions in the important bilateral relationship between the U.S. and China. While these three events seem distant from the U.S. equity markets, they individually and collectively add uncertainty to the markets, which everyone who reads The Weekly Commentary knows we hate.

Policy and Politics

In the continuing saga of Washington, DC’s version of “The Gang That Couldn’t Shoot Straight,” we are three days away from another government shutdown. The newly elected Speaker of the House, Mike Johnson, must bring together the contentious parties from both sides of the aisle to pass a budget bill before Friday, November 17, to avoid a government shutdown. While a lot of the actions and bargaining going on in Washington are in partisan brinkmanship, the farce of a looming U.S. Government shutdown has real market implications. For example, last week, the credit rating agency Moody’s lowered the outlook on the U.S. Credit to “negative” from stable, citing large fiscal deficits and declining debt affordability. Moody’s move followed a rating downgrade by another rating agency, Fitch, to A.A. from AAA earlier this year. Although the actions by rating agencies do not have any real market implications, as U.S. Treasury bonds still represent the “risk-free” market measure, moves like this slowly chip away at investor confidence and place a finer negative global spotlight on the U.S.

What to Watch

- Monday, November 13th

- 4:30PM: Retail Gas Price (Prior: $3.52/gal.)

- Tuesday, November 14th

- 8:30AM: U.S. Consumer Price Index MoM/YoY (Priors: 0.40% | 3.70%)

- 8:30AM: U.S. Core Consumer Price Index MoM/YoY (Priors: 0.32% | 4.13%)

- Thursday, November 16th

- 8:30AM: Initial Claims for Unemployment Insurance (Prior: 217,000)

- 10:00AM: NAHB/Wells Fargo U.S. Housing Market Index (Prior: 40.00)

- 12:00PM: 30-Year Mortgage Rate (Prior: 7.50%)

- Friday, November 17th

- 8:30AM: U.S. Building Permits (Prior: 1.473M)

- 8:30AM: U.S. Building Permits MoM (Month Over Month) (Prior: -4.41%)

- 8:30AM: U.S. Housing Starts (Prior: 1.358M)

- 8:30AM: U.S. Housing Starts MoM (Prior: 7.01%)

We have focused on quite a few negative notions this week, which we know is a bit out of character, but there are plenty of positive things to highlight. Contrary to most economists, the U.S. has avoided a recession in 2023, and it looks like 2024 will continue our growth pattern, at least into the first half of the year. Further, inflation has come down from 9% to 3% in just over a year, which means the Fed and most other global central banks are nearing completion in their interest rate hiking cycle. Corporate earnings remain healthy, with most companies reporting earnings that beat Wall Street expectations. Lastly, while the consumer may be getting understandably tired of supporting the economy with their spending, we expect consumer spending to continue well into 2024, especially during the 2023 holiday season. The markets are efficient and always look well into the future rather than watching the past. Investors would do well to do the same. Reach out to your financial advisor at Valley National Financial Advisors for help or questions.