By: Chief Investment Officer, William Henderson

Last week, we were waiting for three significant events to unfold:

- The FOMC (Federal Open Market Committee) meeting results.

- EPS announcements of a few mega-tech firms.

- Jobs and unemployment data.

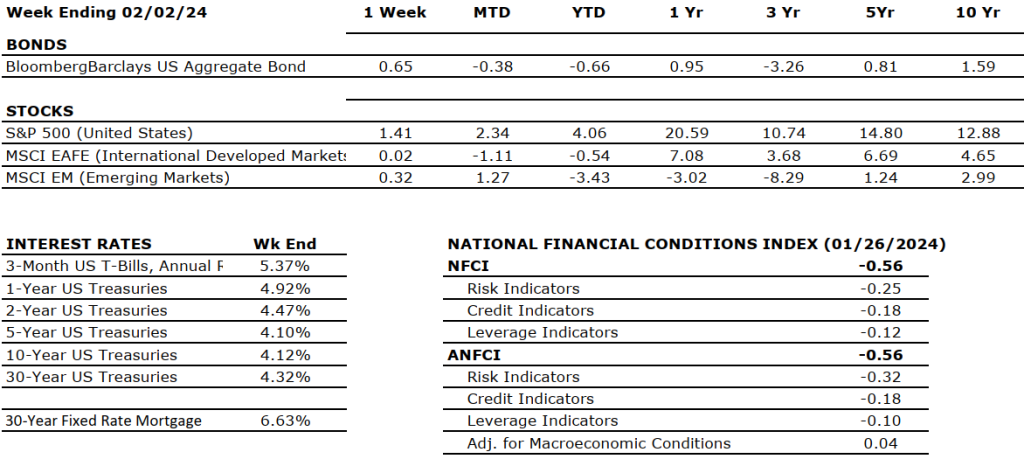

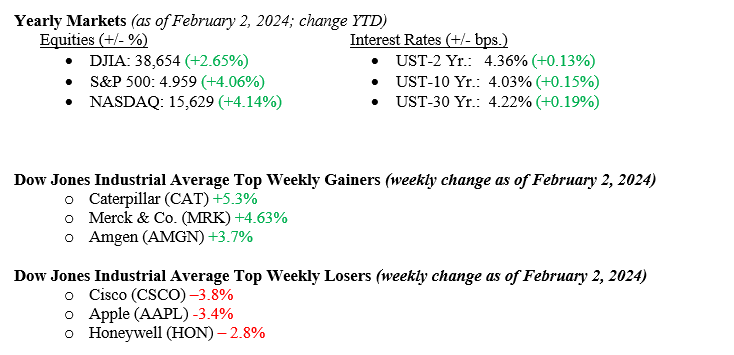

We started on Wednesday with Federal Reserve Bank Chairman Jay Powell and the FOMC first announcing no change in interest rates and reaffirming that rate cuts are unlikely to happen at the March 2024 meeting. That news initially poured cold water on the markets, but this was short-lived as upside earnings surprises by META (Facebook parent) and Amazon.com changed the course of the markets for the week as all major indexes ended higher (Dow Jones Industrial Average, +1.4%, S&P 500 Index +1.4%, and the NASDAQ +1.1%). The week ended with more positive news; we saw higher weekly new jobs created, continued low unemployment, and another rise in Consumer Sentiment. The 10-year US Treasury moved lower by 12 basis points to close the week at 4.03%.

U.S. Economy

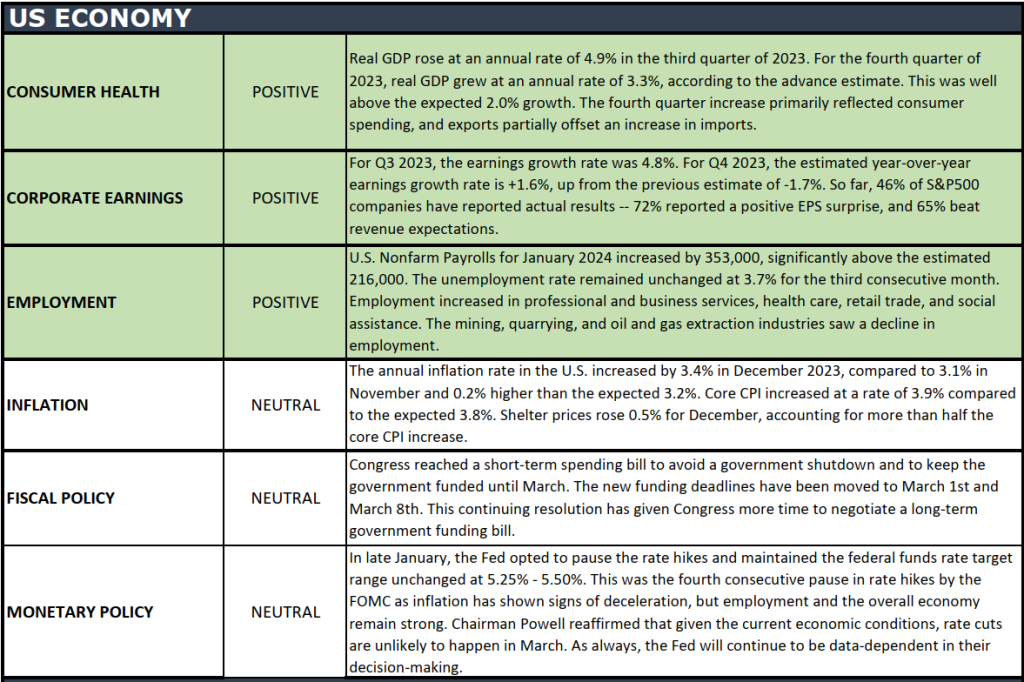

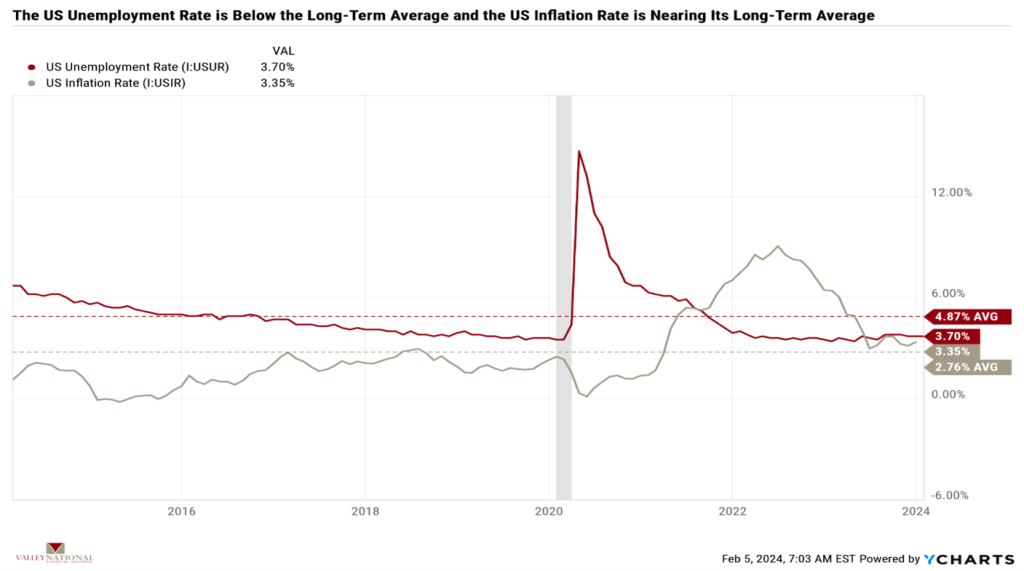

The U.S. economy continues to chug along nicely, confounded most experts and economists. Experts continue to point to the 1970s and 1980s as a guide for what the Fed should do now. 1970 was over 50 years ago, and we did not have iPhones, ChatGPT, or CNBC at our fingertips for data and information flow. We at Valley National Financial Advisors focus instead on the current data right in front of us, which continues to be positive across the board. As mentioned, last week, new jobs created measured 350,000 vs. expectations of +216,000, and the unemployment rate stayed at 3.7%, below the long-term average. See Chart 1 below from Valley National Financial Advisors and Y Charts showing the U.S. Unemployment Rate and the U.S. Inflation Rate. Both are important measures for the Fed as their mandate is “full employment” and “2% inflation.” We are at the employment mandate but only nearing the inflation mandate (3.35%), so to us at Valley National Financial Advisors, it makes sense that Fed Chairman Jay Powell is watching the data and waiting before embarking on an interest rate-cutting path.

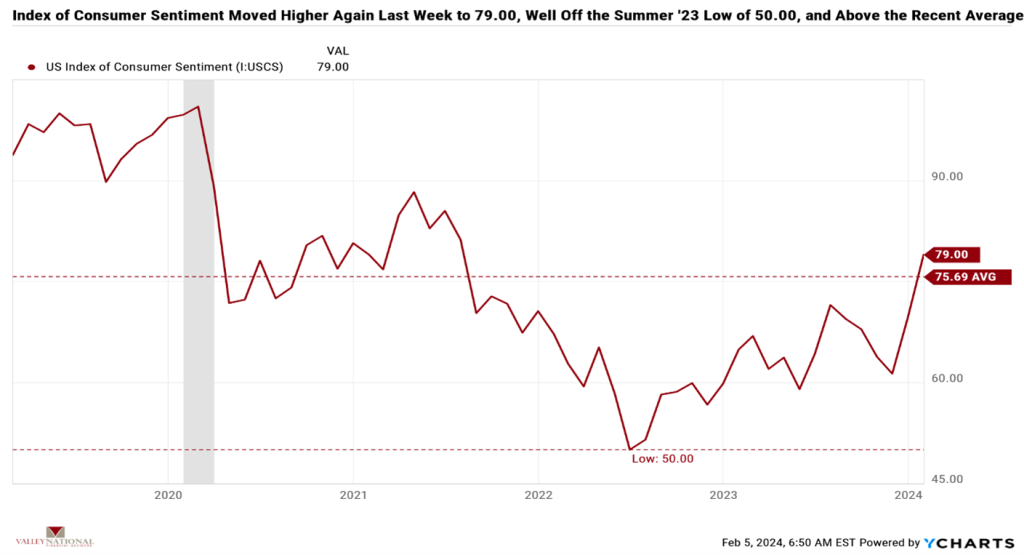

Weekly readers of The Weekly Commentary know that the U.S. economy is 70% consumer-driven, and a healthy, working consumer will continue to consume. Last week, the U.S. Index of Consumer Sentiment (previously called Consumer Confidence) came in at 79.00, well off the 50.00 reading last summer when experts stubbornly predicted a recession. See Chart 2 below from Valley National Financial Advisors and Y Charts. A rising Consumer Sentiment Index displays increased consumer confidence, typically evidenced during expansionary periods. This confidence indicator certainly makes sense to us at Valley National Financial Advisors, as employment opportunities abound and American companies continue to make money, hire, and expand operations, especially within the U.S. borders.

Policy and Politics

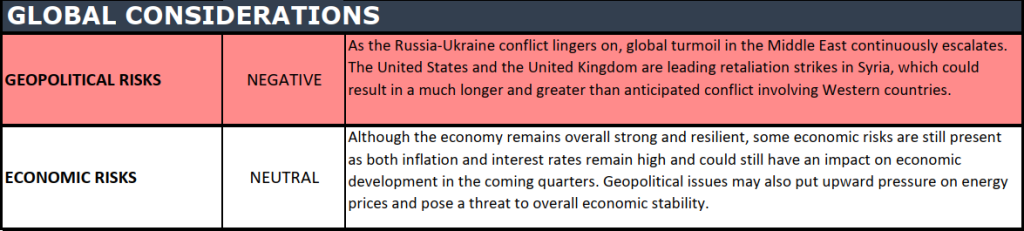

It is a quiet week for Washington, and members of Congress wrangle over a spending bill for aid to Ukraine and Israel and money for border security. These issues will languish, and Washington will eventually do what it does best, which is to spend money. Global turmoil in the Middle East continues, with the United States and the United Kingdom leading retaliation strikes in Syria. We are concerned about this issue and worry that 1) it will last longer than anticipated and 2) spill over into a much greater Middle East conflict.

What to Watch This Week

- U.S. Consumer Credit Outstanding for Dec 2023, released 2/7/24, prior $23.75 billion.

- U.S. Initial Claims for Unemployment Insurance for the week of Feb 3, released 2/8/24, prior 224,000.

- 30 Year Mortgage Rate for the week of Feb 8, released 2/8/24, prior 6.63%

It is too early in the new year to start sounding repetitive clarions about the U.S. economy, the consumer, and the stock market. Still, the data in front of us tells a positive story about the economy’s strength and the consumer’s resilience. Our expectations for rate cuts have been clear in that they are closer to May/June of 2024 than March 2024. Fed Chairman Jay Powell confirmed this notion last week at his press conference and on 60 Minutes. Why fight the Fed? If there is good news in this rate path, when the economy slows in 2024, rate cuts will boost a slowing economy. Lower rates later in 2024 will eventually be a natural tailwind for the equity and fixed-income markets. The salient point is that the next direction on rates is lower, not higher. We need to pay attention to the current data, not the data from the ’70s or ’80s because the market and information flow are different today than they were 50 years ago. Reach out to your financial advisor at Valley National Financial Advisors for assistance.