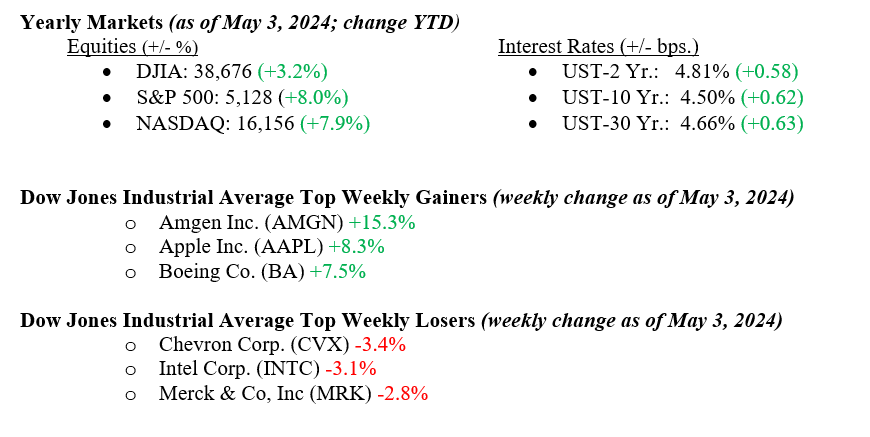

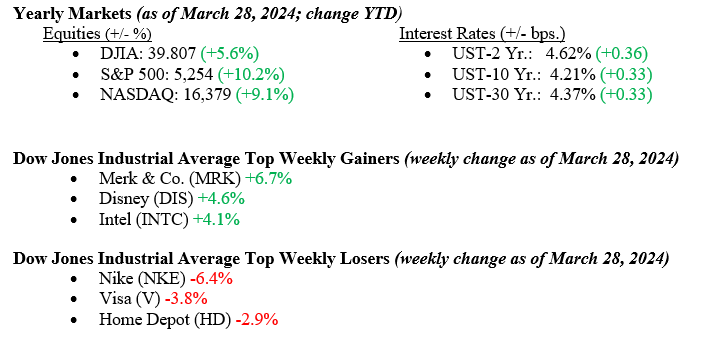

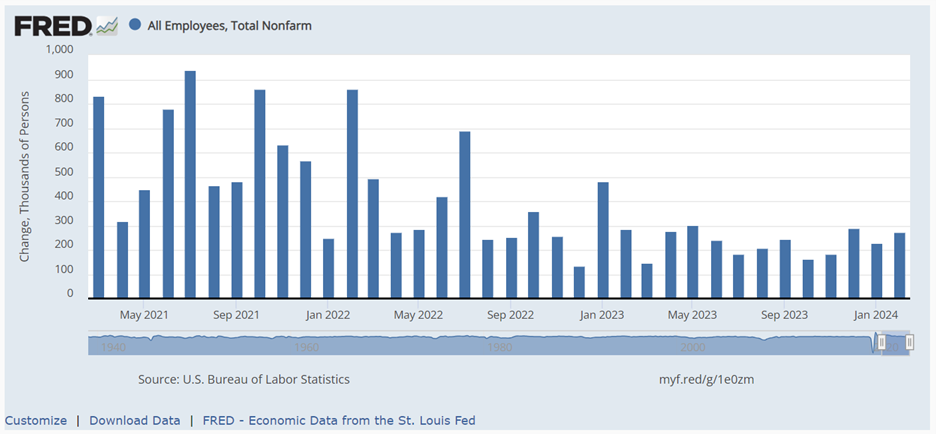

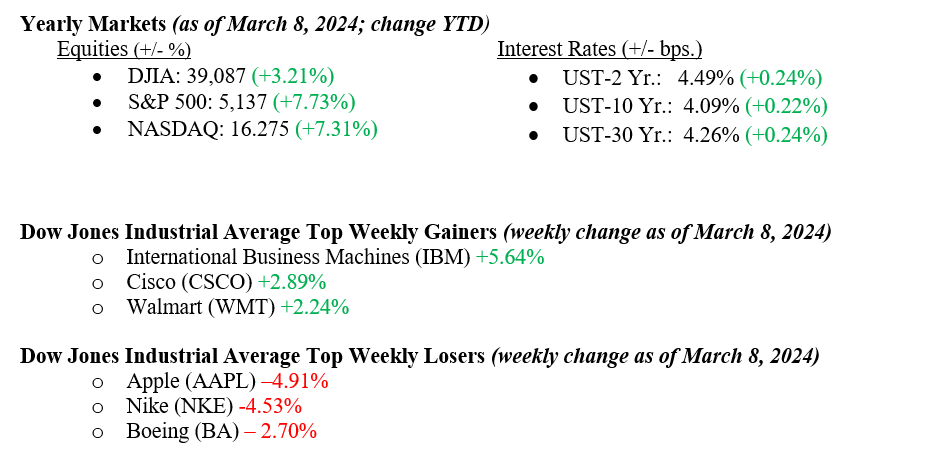

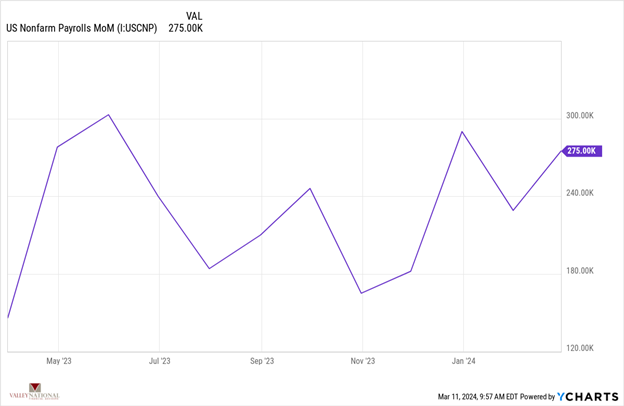

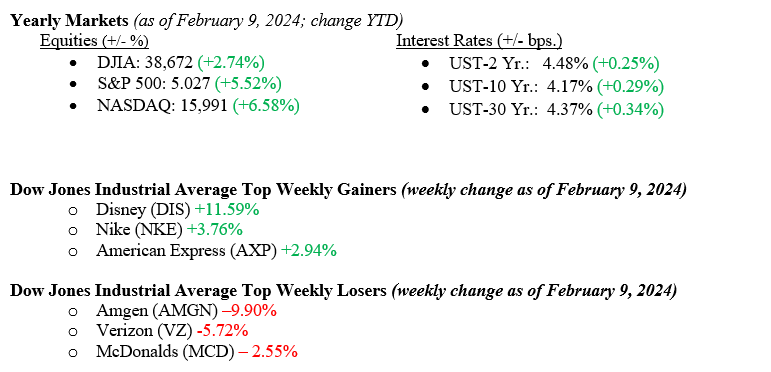

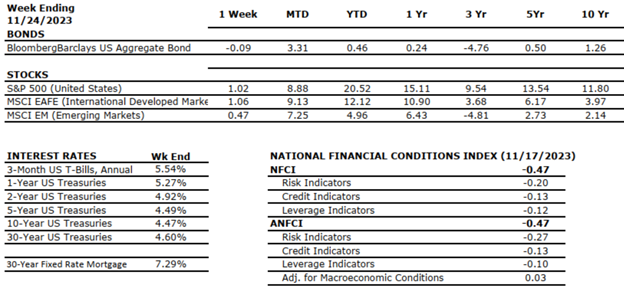

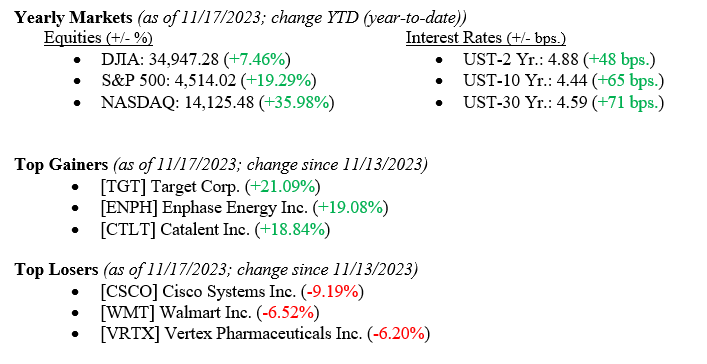

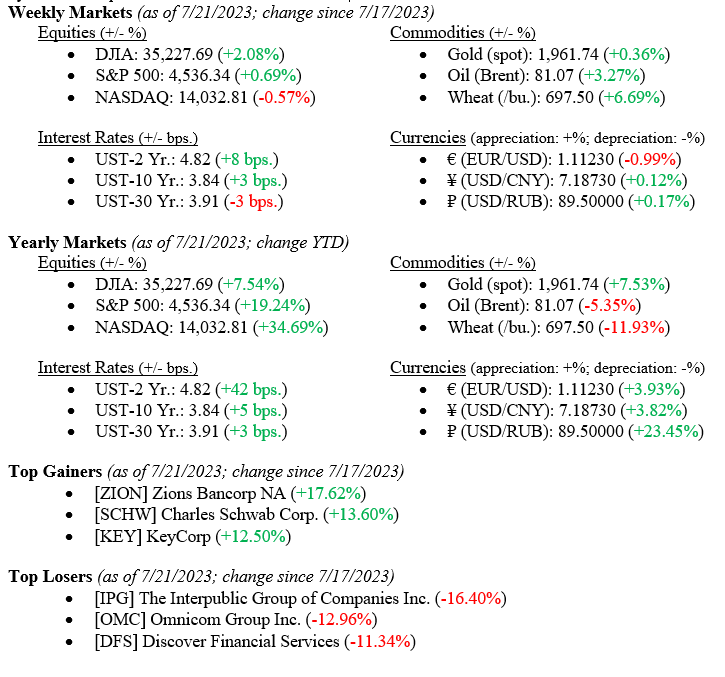

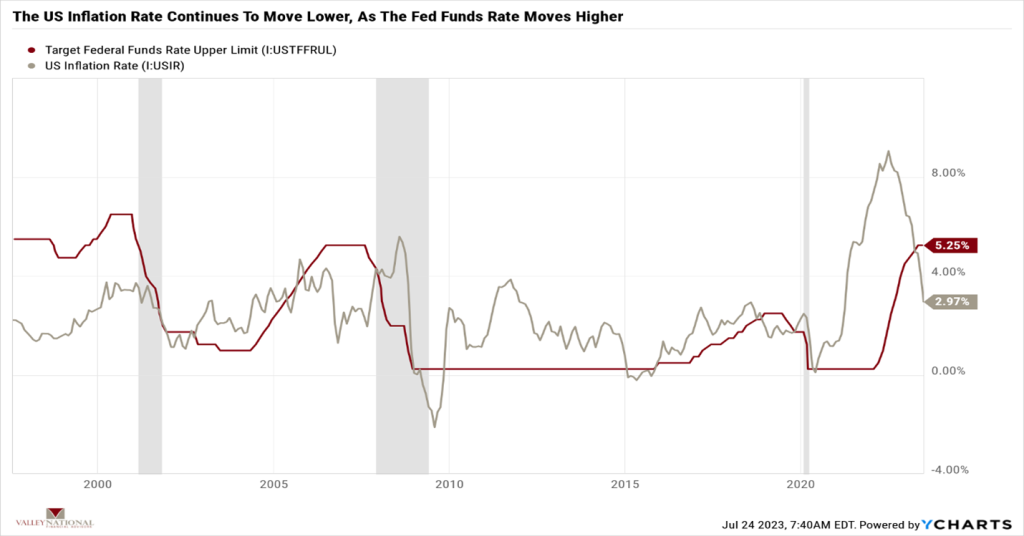

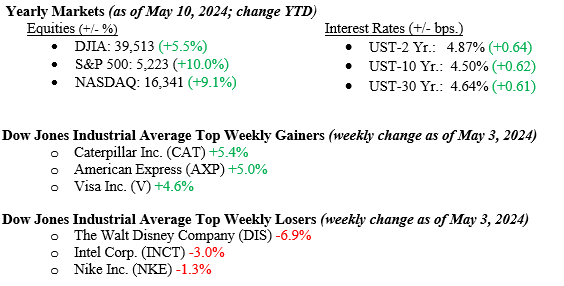

For the week of May 10th, the Dow Jones Industrial Average rose 2.2%, the S&P 500 Index rose 1.9%, and the NASDAQ rose 1.2%. Utilities were the best-performing sector for the week (+4.1%), while consumer discretionary was the worst-performing sector (+0.2%). The labor market experienced a minor setback last week, as weekly unemployment claims rose to 231,000 from 209,000 the prior week. This follows the unexpectedly weak non-farm payroll growth and unemployment rate reported for April. Readings like this will hopefully support the Federal Reserve in commencing interest rate cuts this summer. The 10-year U.S. Treasury closed the week at 4.50%, unchanged from the previous week.

U.S. & Global Economy

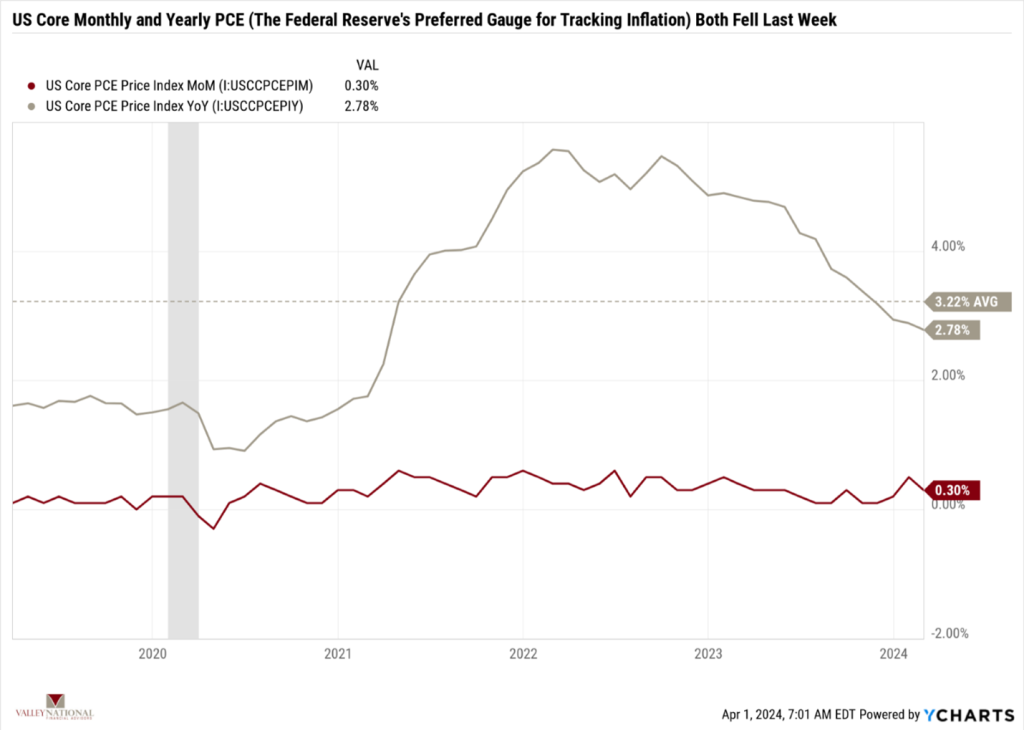

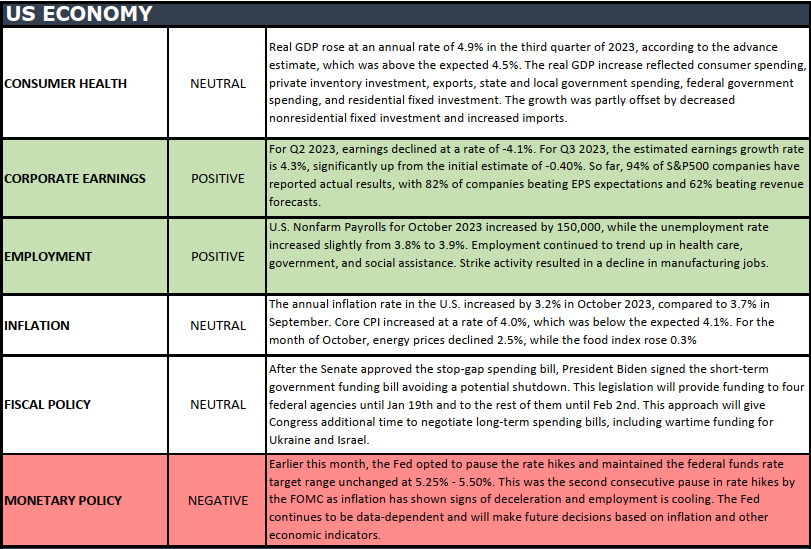

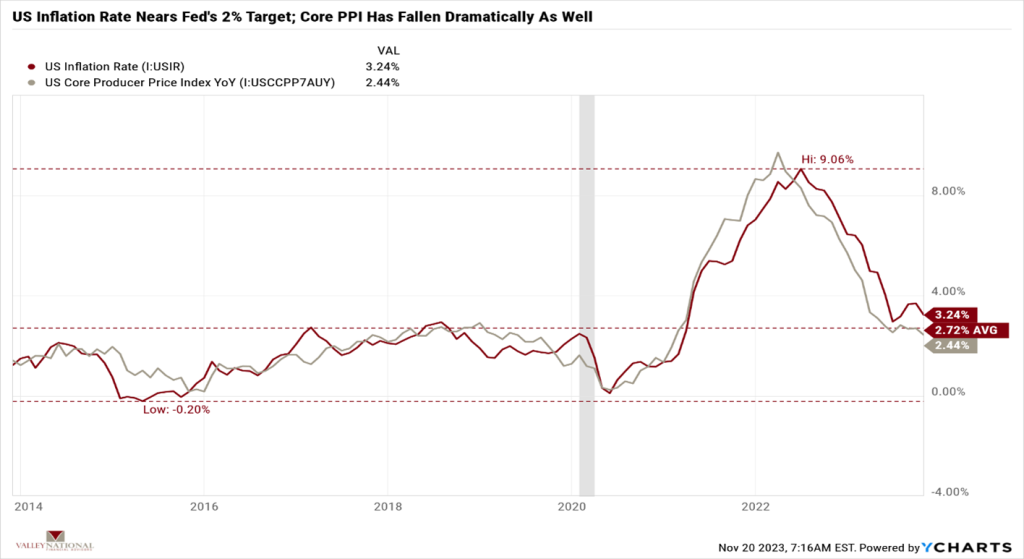

Last week was quiet on the U.S. economic data front. The most notable data points for the week were the weaker-than-anticipated jobless claims number reported on Thursday and Friday’s preliminary reading of consumer sentiment for May, which was weaker than expected. Later this week, all eyes will be on a fresh batch of inflation numbers scheduled to be reported. The Producer Price Index will be reported on Tuesday, with the Consumer Price Index set to be reported on Wednesday. We note below why the data will hang heavily on the Biden administration and their reelection hopes.

Policy and Politics

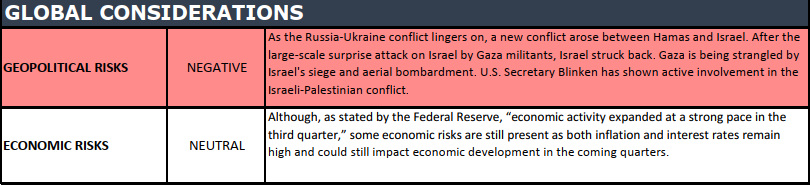

We are encouraged to see Israel-Palestine ceasefire talks help remove risk premium in oil, with prices dropping below the $80 mark. However, there seems to be little real action in negotiations to end this regional conflict. This comes as the Russia-Ukraine war has seen an uptick in intensity by Russia as foreign aid to Ukraine has been slow to move.

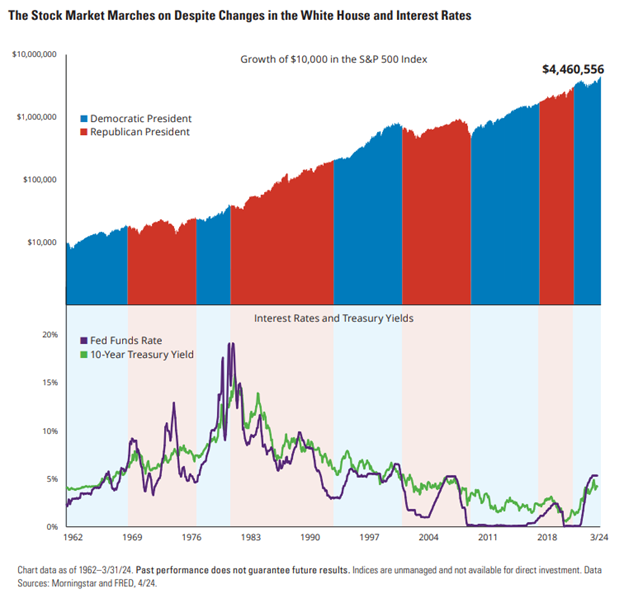

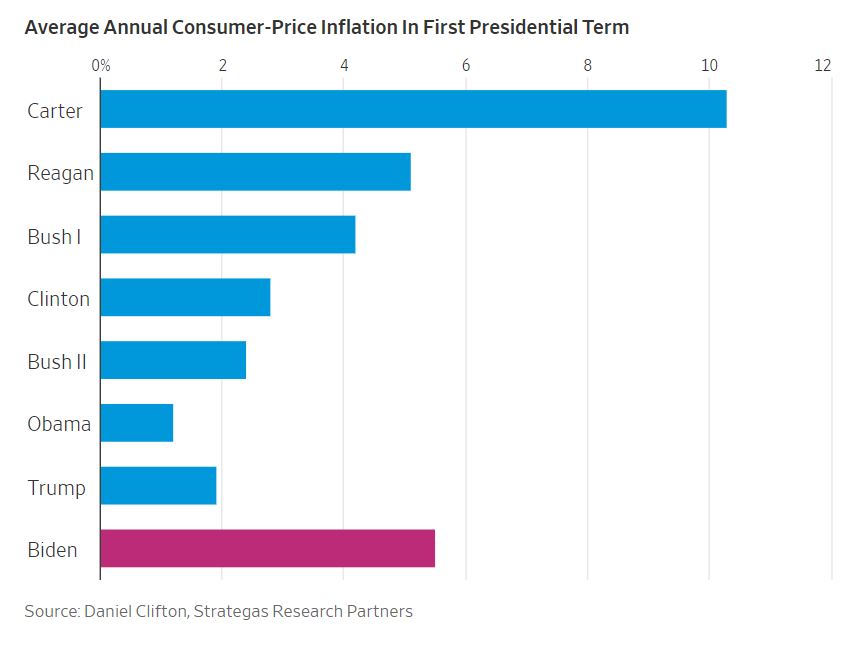

We have shown in the past that regardless of which party is in the White House, stock markets rally when the economy is growing and doing well. However, in elections, data matters, and the inflation problem continues in our economy, with the final path to 2% inflation continuing to be difficult to attain. See Chart 1 below from Dan Clifton at Strategas and the Wall Street Journal, showing the average annual CPI (Consumer Price Index) Inflation during the past eight Presidential first terms. Other President Carter had a higher reading. While it is fair to say the COVID-19 pandemic wreaked havoc on inflation, legislative and administration actions during President Biden’s first term pumped $7.2 trillion into the economy, eventually creating strong demand for goods and services. The inflation story will become more important as we move closer to November.

Economic Numbers to Watch This Week

- U.S. Producer Price Index YoY (Year Over Year) for April 2024, prior 2.09%

- U.S. Core Producer Price Index YoY for April 2024, prior 2.37%

- U.S. Consumer Price Index YoY for April 2024, prior to 3.48%

- U.S. Core Consumer Price Index YoY for April 2024, prior to 3.80%

- U.S. Initial Claims for Unemployment Insurance for the week of May 11, 2024, prior 231,000

Despite the potential for volatility in the coming months stemming from uncertainties around the Federal Reserve’s interest rate outlook and looming concerns over the U.S. presidential elections, market gains continue to be buoyed by the upward trend in corporate earnings. 90% of S&P 500 companies have reported first-quarter earnings, and the results have thus far exceeded analysts’ expectations by 8.5%. According to FactSet, the Wall Street analysts lifted their earnings-per-share estimates for second-quarter results by 0.7%. Remember, when companies make money, they make capital expenditures, pay dividends, buy back stock, and hire employees. Follow the data but proceed cautiously. Please contact your advisor at Valley National Financial Advisors with any questions.