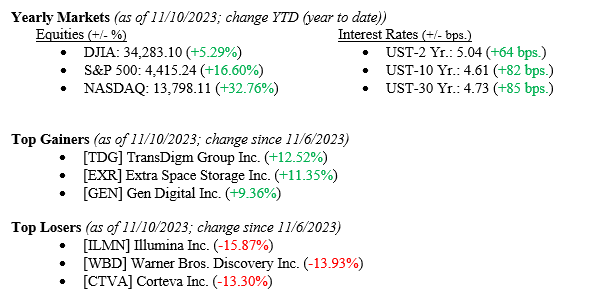

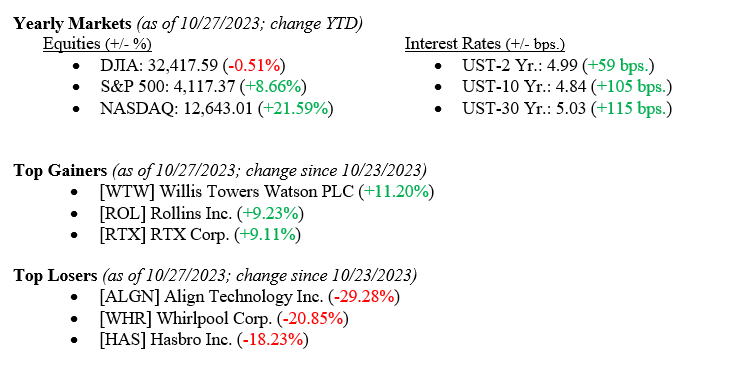

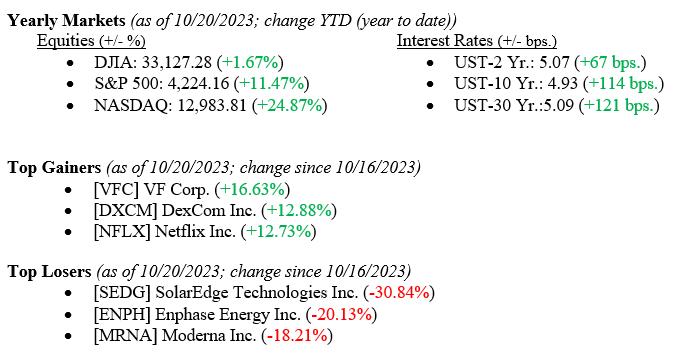

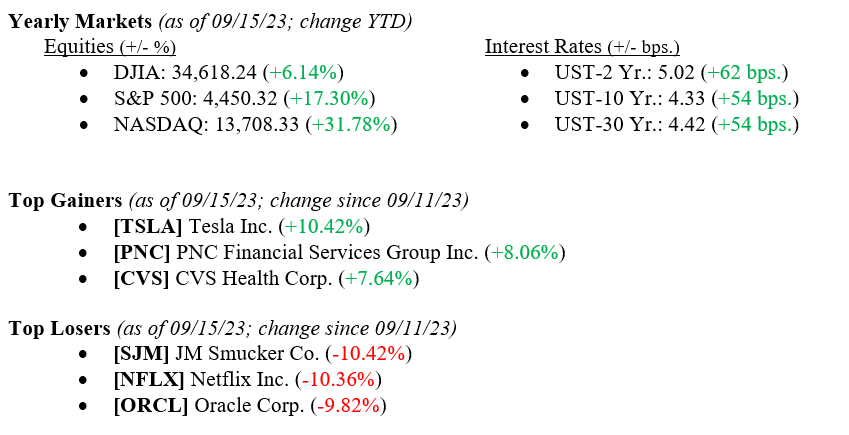

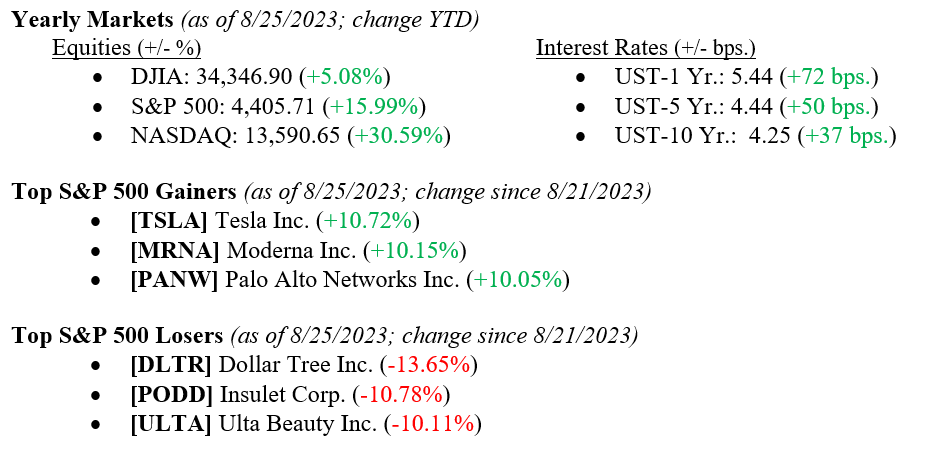

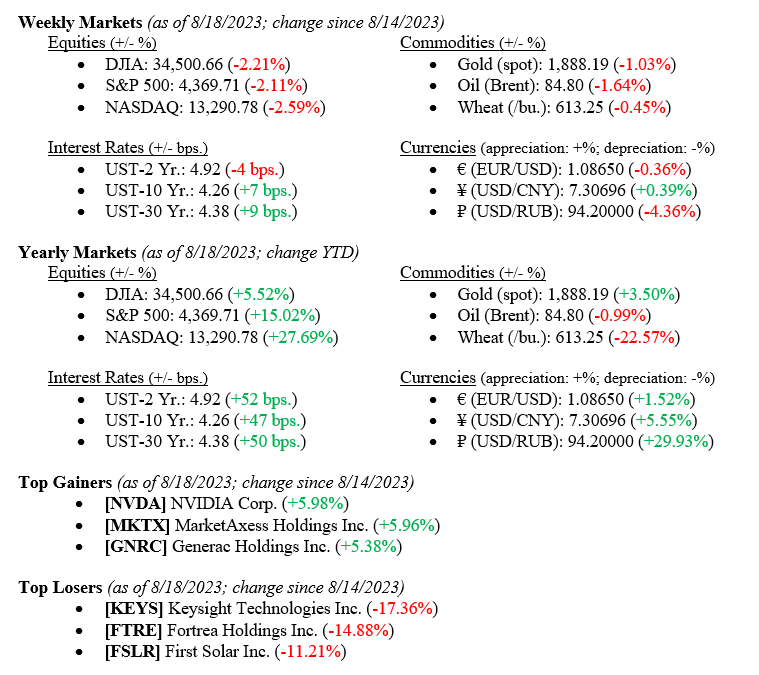

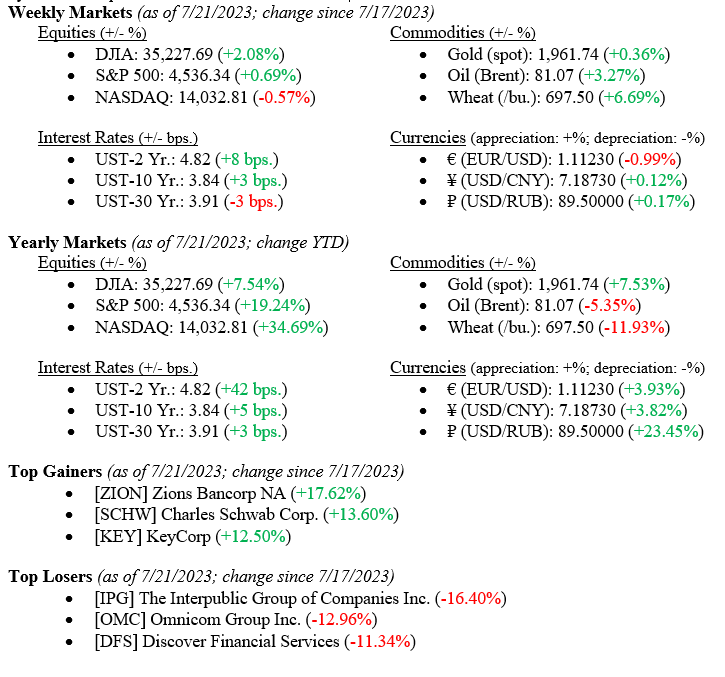

Equity markets notched another modest win last week, with all major indexes reporting gains (see year-to-date numbers below). We typically only point out the major indexes here at Valley National Financial Advisors, but last week saw gains in small capitalization stocks, a sector left out of this year’s market rally. As measured by the Russell 2000 Index, small caps gained +5.5% last week, which also shifted their year-to-date return into positive territory at +3.5%. A rally in small-cap stocks has been long overdue as most of the big gains this year have been in large-cap and even mega-cap stocks like the “Magnificent Seven.” An equity market rally balanced across all sectors and includes deep depth and breadth of all capitalization stocks rather than just large or mega-cap is healthier and more sustainable over longer periods. Bonds also continued their rally, with the 10-year U.S. Treasury falling 18 basis points to close the week at 4.44%.

US Economy

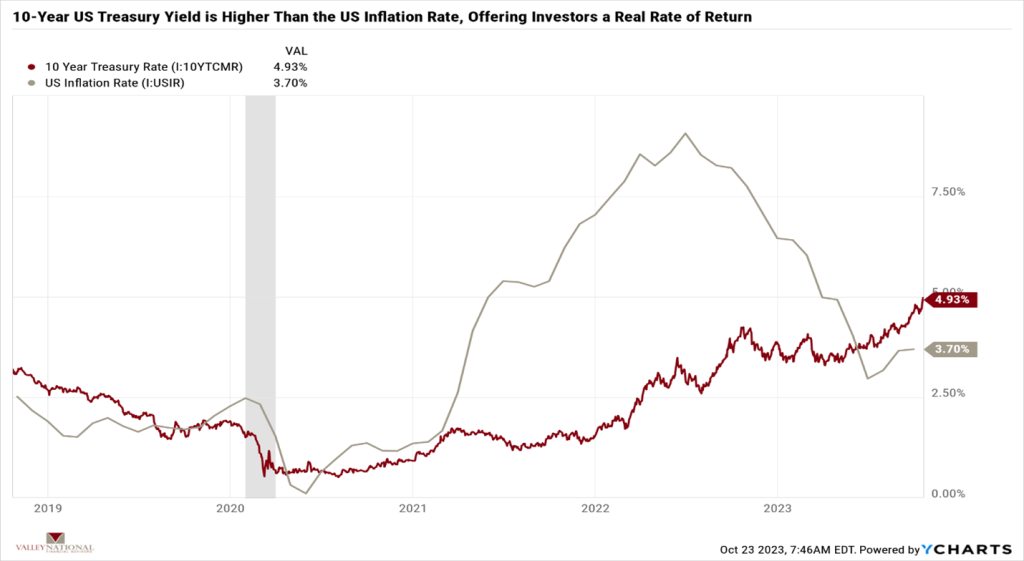

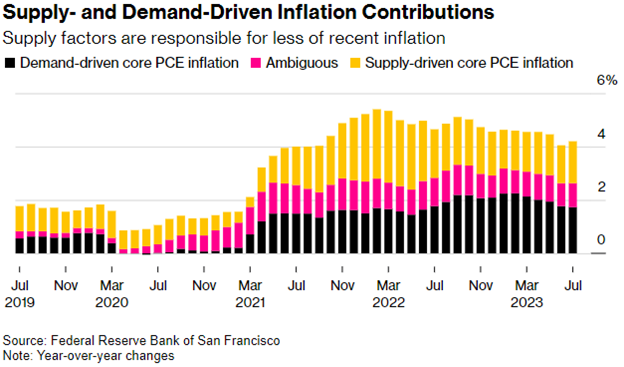

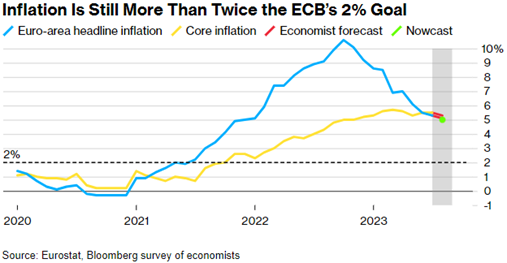

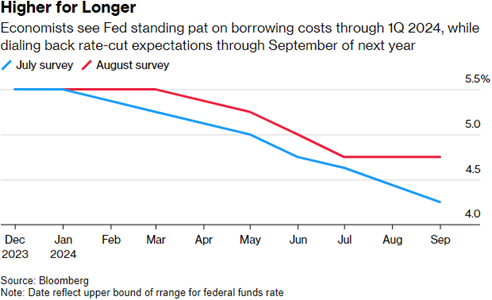

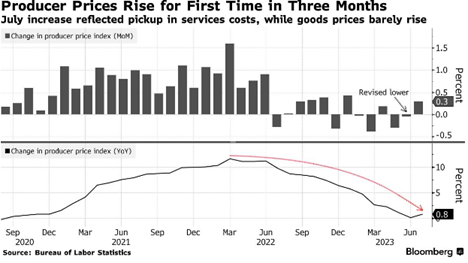

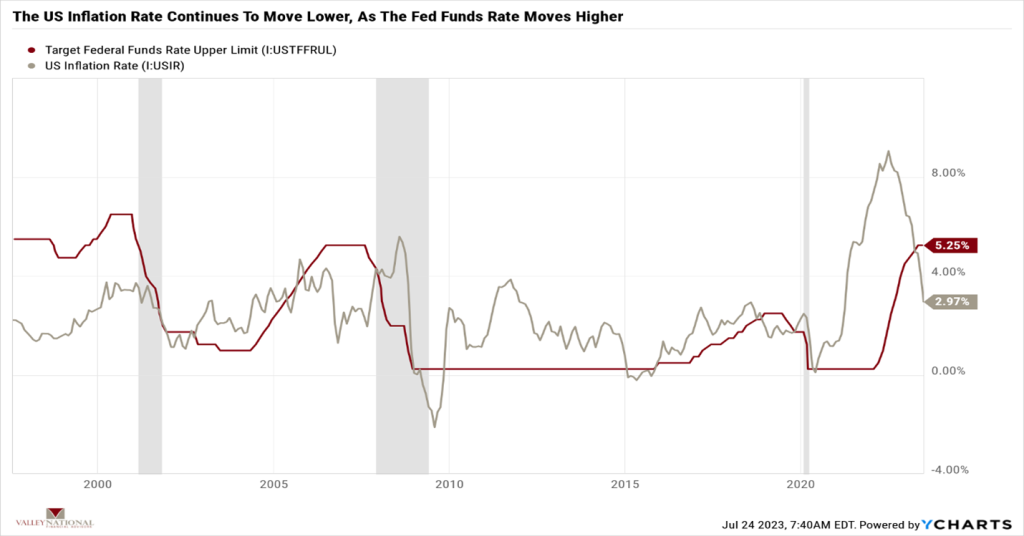

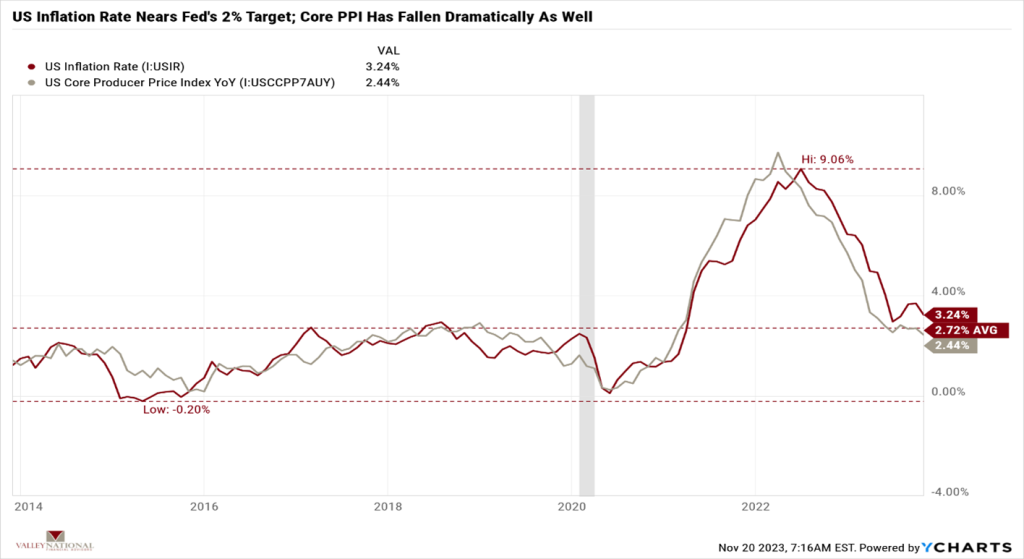

Last week’s equity gains were precipitated by the inflation data released mid-week. The U.S. Inflation Rate fell to 3.24% for October, down from an August 2022 high of 9.06%. See Chart 1 below from Valley National Financial Advisors and Y Charts showing the U.S. Inflation Rate and the U.S. Core Producer Price Index. While the U.S. inflation rate is not yet at the Federal Reserve’s target rate of 2%, the rate has come down dramatically. Furthermore, as we have stated many times here at Valley National Financial Advisors, interest rate hikes take time to work their way through the economy; therefore, even without further rate increases, the inflation rate should continue to track downward from here, given all the tightening that has occurred over the past 18 months. This view, shared by most economists, confirms that the Fed will remain on the sidelines, refraining from further intervention and instead watching and interpreting the data.

Policy and Politics

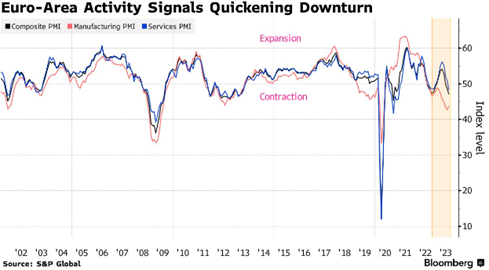

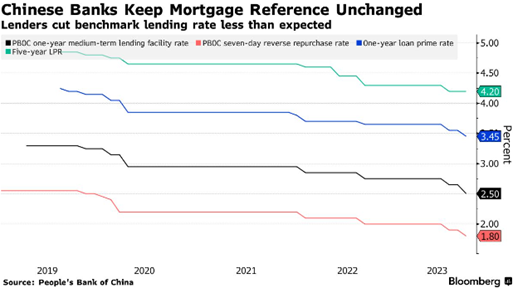

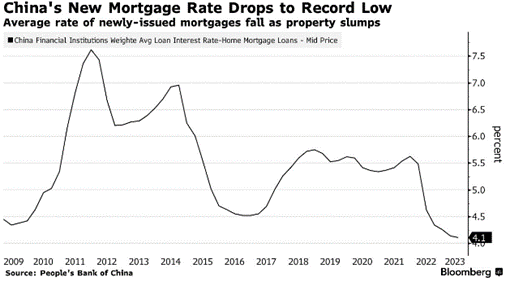

We have talked about global turmoil often and how global issues create uncertainty and fear—both of which markets hate. The Ukraine/Russia War continues to languish well into its second year. Further, the Israel/Hamas War shows no signs of abating. Thankfully, last week’s APEC Summit in San Francisco and the meeting of Chinese President Xi Jinping and President Biden may help to revive the recently cool relations between China and the U.S., the world’s two largest economies. Both countries are moving past pandemic-related inflation periods and experiencing growing economies, so healthy relationships rather than trade wars or tariff spats are important going forward.

What to Watch

- We have a Thanksgiving Holiday shortened trading week so Wall Street will be quiet but Main Street will be all buzz on Friday as the Holiday Season will kick off with Black Friday sales hitting the retail space. Next week Cyber Monday starts and by the end of the week we will have some idea of the consumer’s appetite for shopping and spending as many retailers will report 3rd quarter earnings.

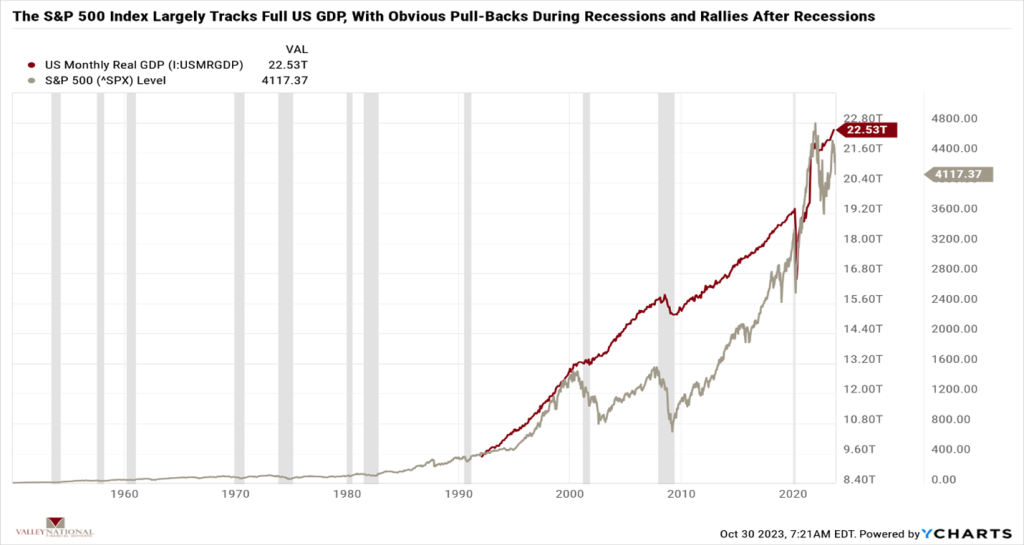

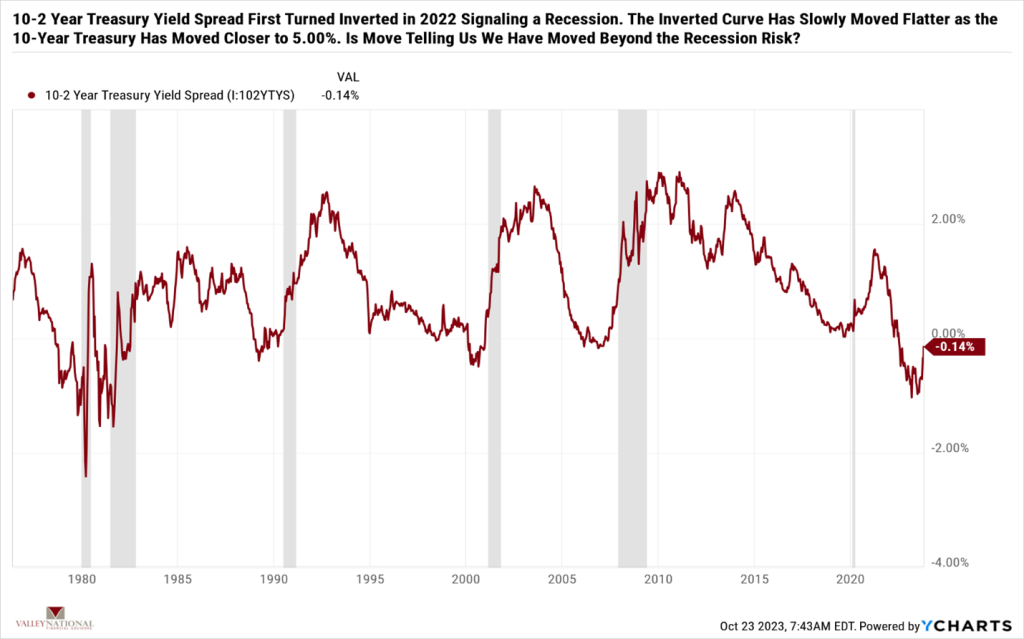

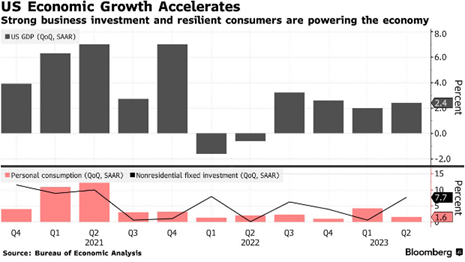

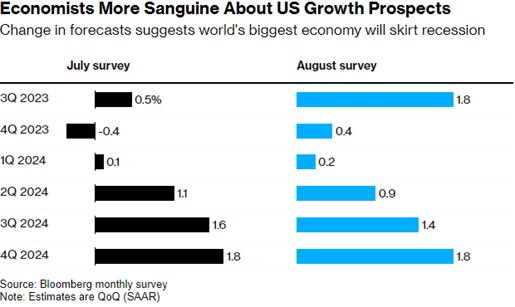

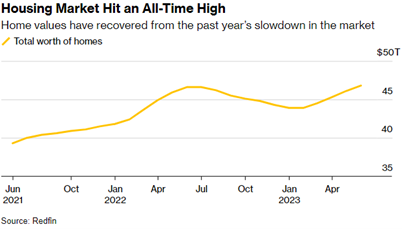

Everyone agrees that the U.S. has avoided a recession in 2023, and the outlook for 2024 is starting to look equally rosy. We remain cautiously optimistic about the markets and the economy, as we have been for over a year. The Fed may be done with interest rate hikes, but even if more hikes are coming, they will be modest, if at all, and minimally impactful. Investors have been rewarded this year for staying the course and remaining invested, a path that is often painful. According to the Nation Retail Federation, consumer spending is expected to be 3-4% higher this holiday season. The U.S. consumer has remained resilient all year and continues to support the economy. Reach out to your financial advisor at Valley National Financial Advisors for help and advice, but more importantly, enjoy the Thanksgiving Holiday Weekend.