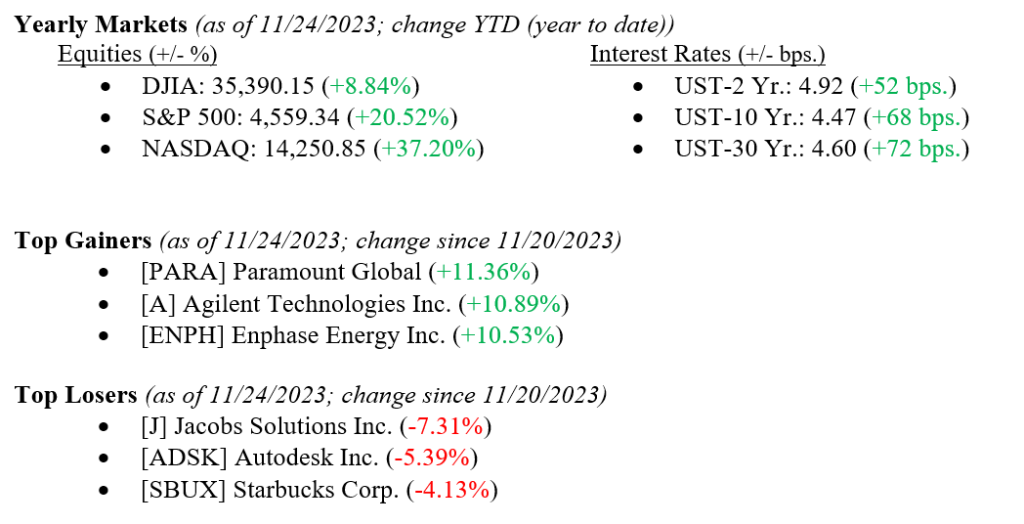

Last week continued the month-long rally we have witnessed across all markets and sectors, with the Dow Jones Industrial Average adding +1.3%, the S&P 500 Index adding +1.1%, and the NASDAQ adding +1.0%. Year-to-date returns also remain healthy across all market indexes (see figures below). Small-capitalization stocks, which have been absent all year, added another +1.9% last week, bringing the year-to-date returns to +4.1%. We point this out as a needed broadening in the 2023 stock market rally to sectors beyond the “Magnificent 7” mega-cap tech stocks into small-cap and industrial names. The month-long stock market rally has been predicated on three issues: softening inflation data, positive earnings releases from U.S. corporations, and a widespread belief that the Federal Reserve is done raising interest rates. The 10-year U.S. Treasury bond closed the week at 4.47%, three basis points higher than last week’s close.

Global Economy

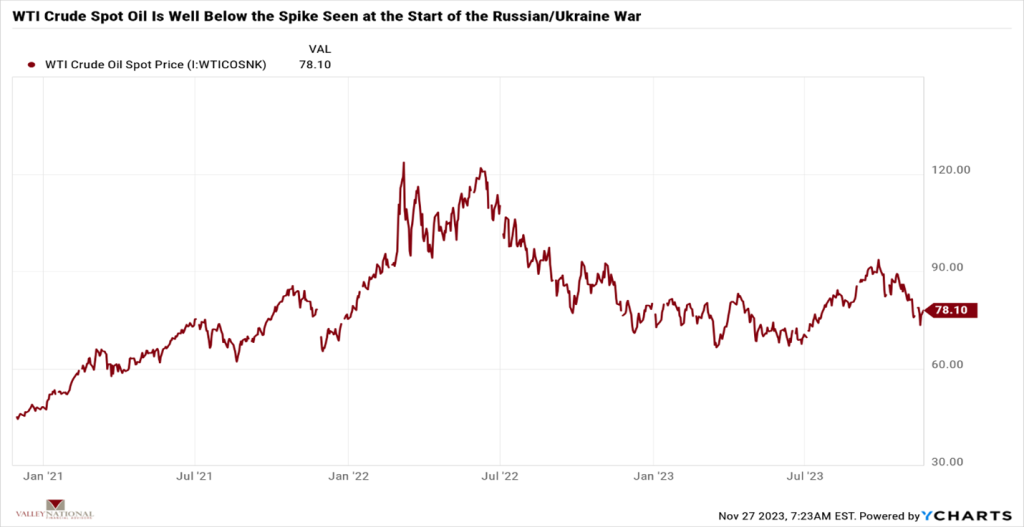

While global unrest and turmoil continue with the Russia/Ukraine and Israel/Hamas war, both conflicts remain regional and have not yet spilled over into 1) a greater European region or 2) the larger Middle East, as #1 could impact oil, natural gas, and food prices and #2 could impact oil prices. Both situations remain horrible humanitarian events and will eventually garner sufficient international pressure to resolve the conflicts. As mentioned, the impact on oil prices from either conflict has been minimal, at least since the initial spike in March 2022. Oil is a key ingredient in many industrial and consumer materials well beyond simply energy. A falling oil price goes a long way in the continued inflation fight. See Chart 1 below from Valley National Financial Advisors and Y Charts showing the price of a barrel of oil.

Global and US Policy and Politics

U.S. politics have reached their yearly quiet period where lawmakers, having passed budget resolutions until early 2024, return to their home states and families for the holidays. Politics are not so sanguine in China, where profit growth is slowing in their industrial sector even as greater housing stimulus continues. According to the Chinese National Bureau of Statistics, industrial profits increased by +2.7% in October from 2022, versus increases of +11.9% in September and +17.2% in August. China is the world’s second-largest economy and remains important to the U.S. and elsewhere.

What to Watch

- U.S. Real GDP (Gross Domestic Product) QoQ (Quarter Over Quarter) for Q3 2023, released 11/29, prior rate 4.9%

- U.S. Core PCE (Personal Consumption Expenditure) Price Index YoY (Year Over Year) for October 2023, released 11/30, prior rate 3.68%

- U.S. PCE Price Index YoY for October 2023, released 11/30, prior rate 3.44%

- U.S. Initial Claims for Unemployment for week of 11/25/23, released 11/30, prior 209,000.

We had a quiet, holiday-shortened week last week, but the markets continued their November rally with all major sectors participating. Early thoughts from retailers are that Black Friday sales were strong, and early Cyber Monday sales look to be strong as well. Is this the start of the “Santa Claus Rally?” As readers of The Weekly Commentary know, we do not invest in short-term rallies or bank on Santa Claus for market returns. We preach the importance of long-term investing, ignoring the noise from Wall Street, and sticking to your investment plan; any help from Santa is just gravy for investors. There are few