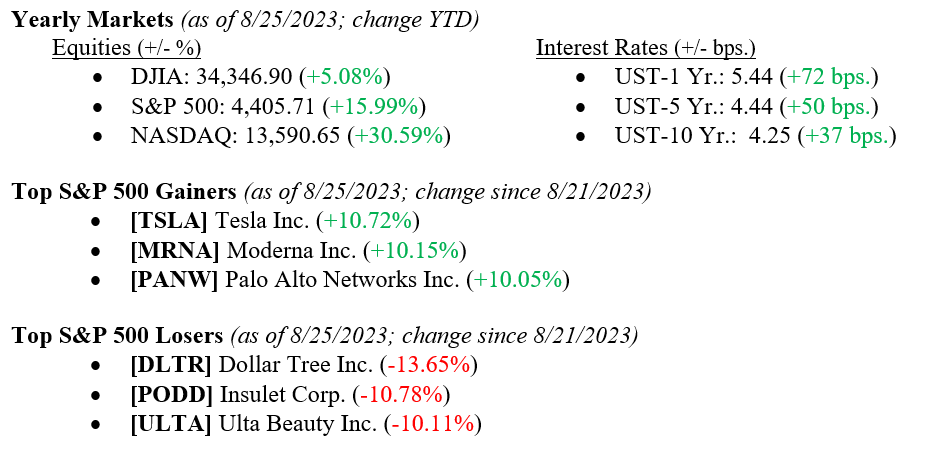

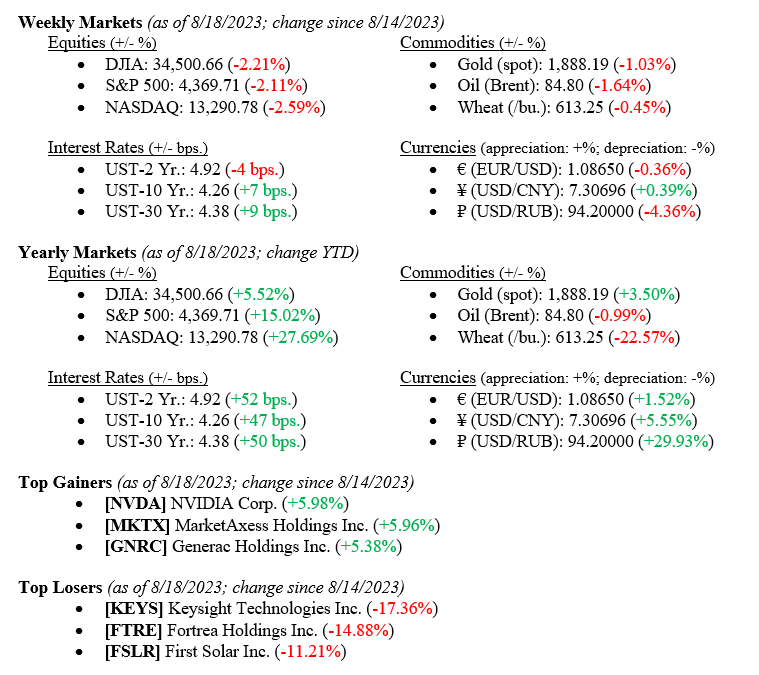

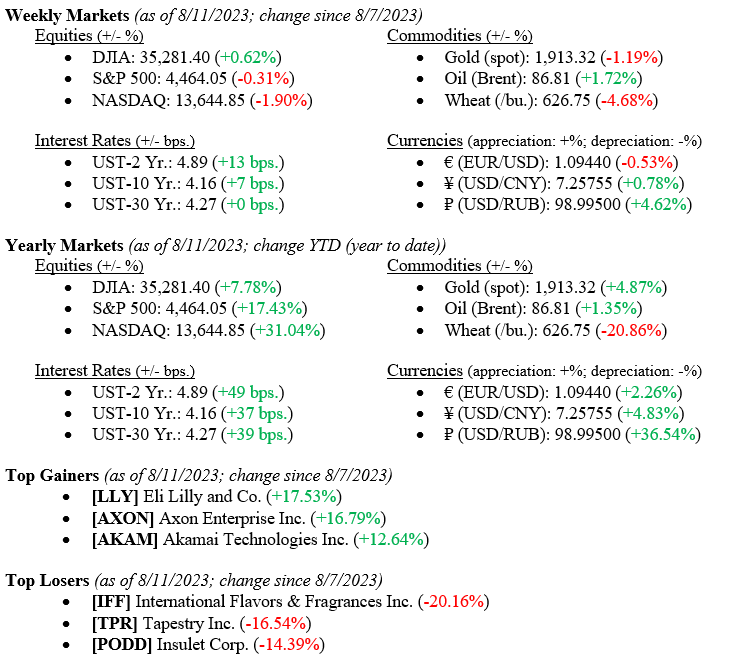

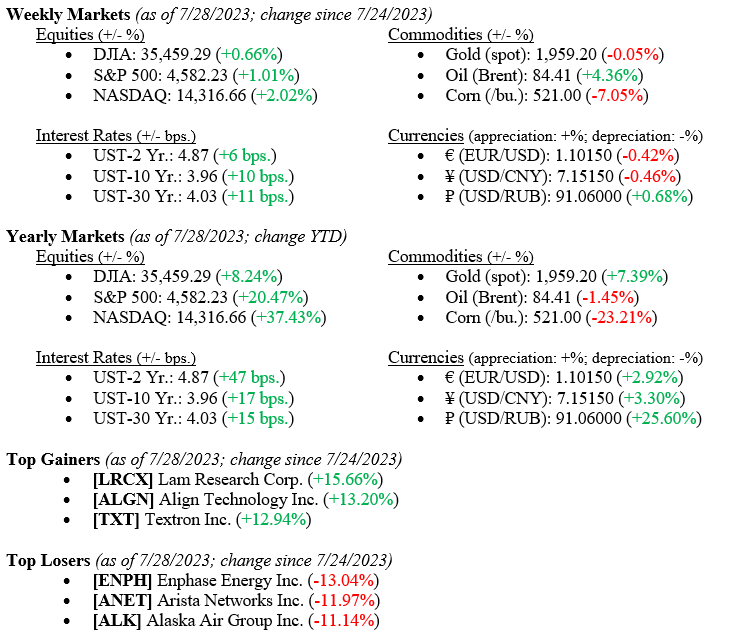

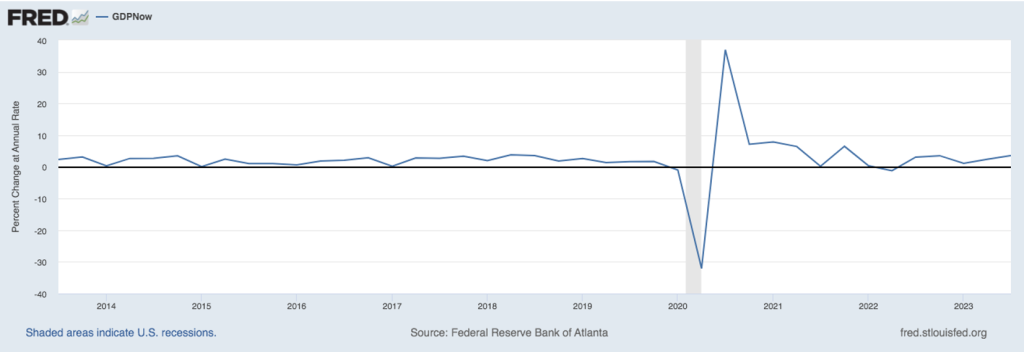

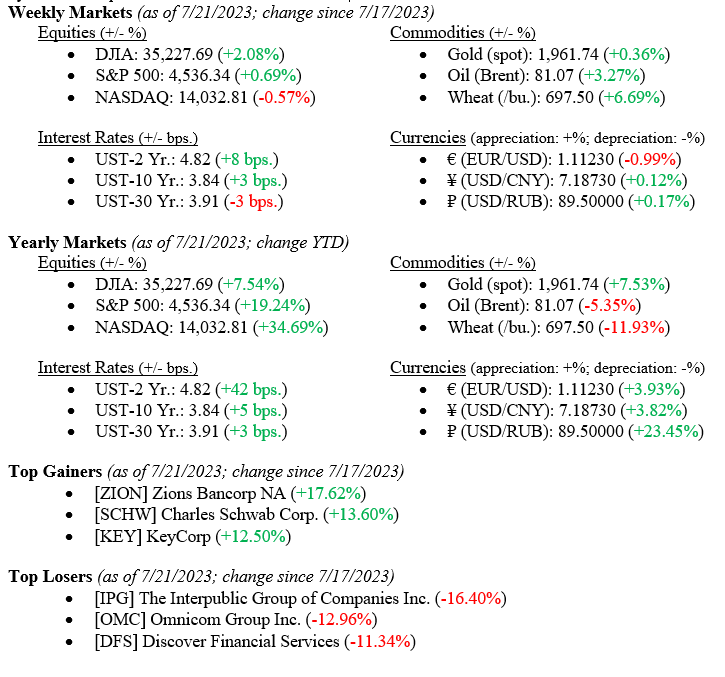

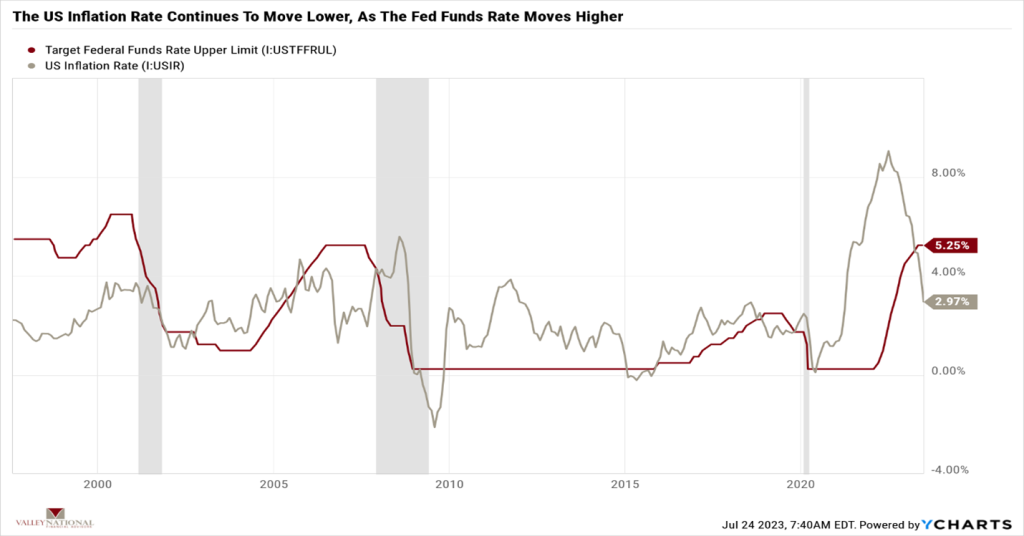

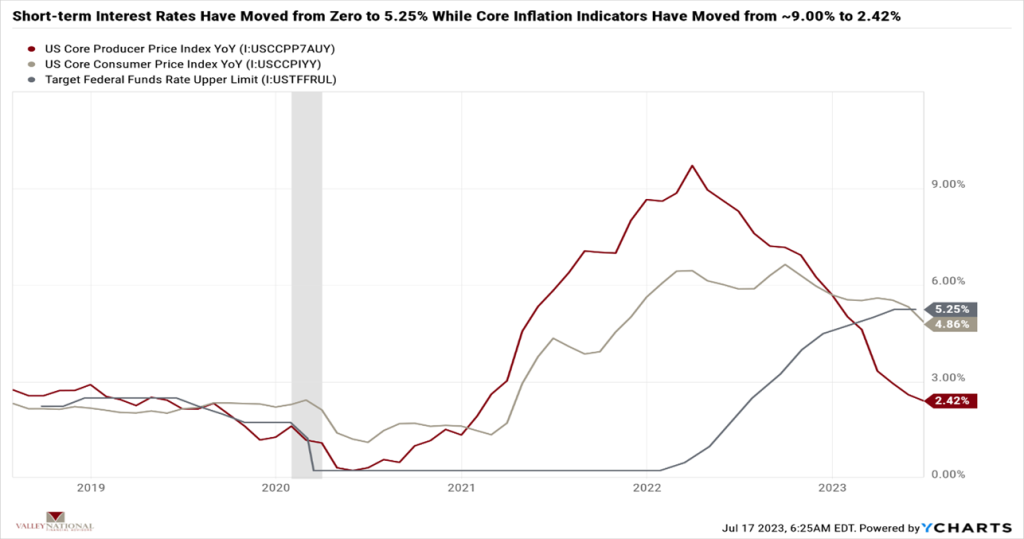

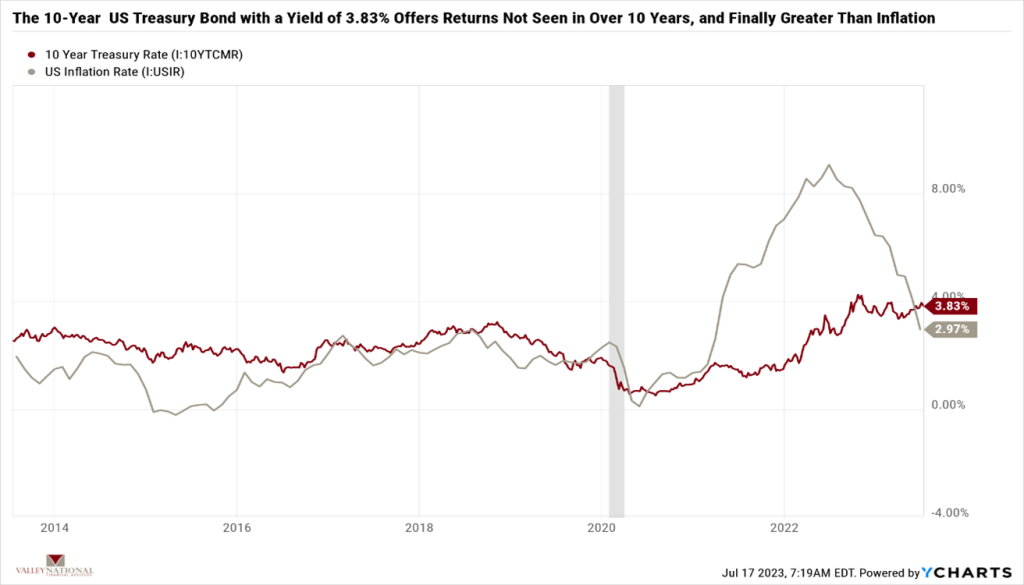

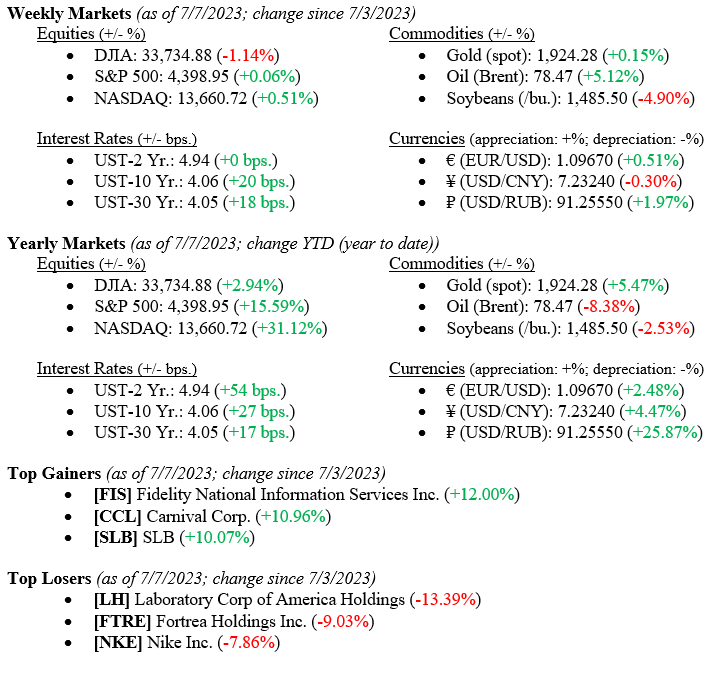

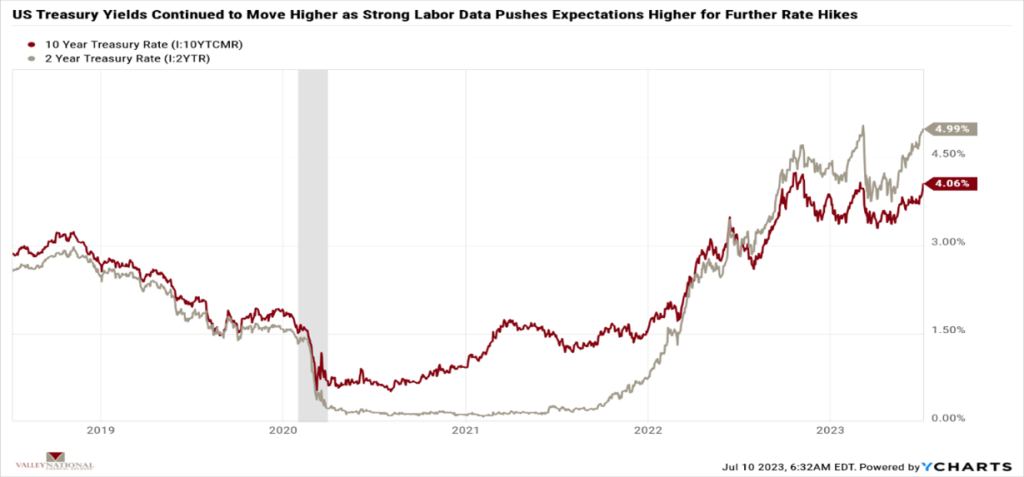

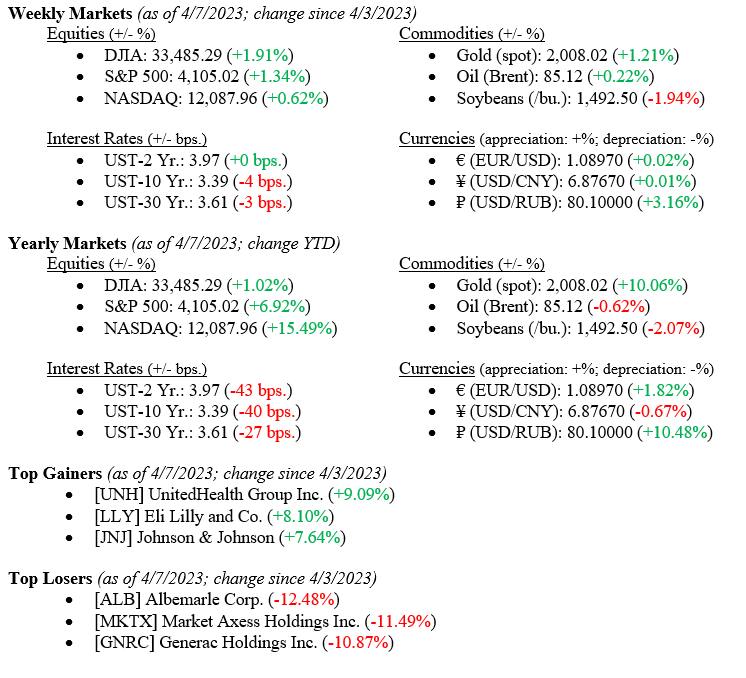

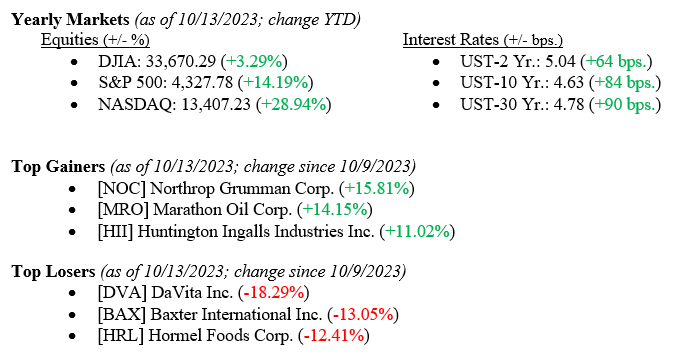

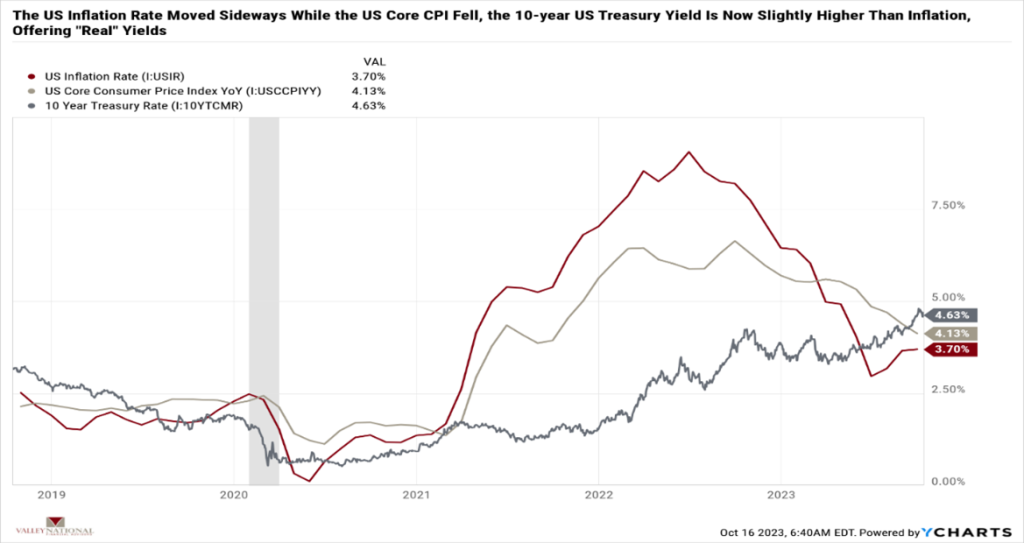

The broader markets rallied last week, seeing through the noise of continued inflation concerns, a protracted war in the Middle East, and mixed third-quarter corporate earnings releases. Last week, the Dow Jones Industrial Average and the S&P 500 Index moved +0.79% and +0.45%, respectively, while the NASDAQ moved lower by –0.18%. In a classic “Flight-to-Quality” trade, U.S. Treasury bond yields fell as investors moved to safe Treasuries during a time of global conflict. The 10-year U.S. Treasury bond fell 15 basis points, ending the week at 4.63%. Even at this lower yield, investors are finally seeing “real” yields on Treasuries as the U.S. Inflation Rate has finally fallen lower than the 10-year U.S. Treasury bond yield. See Chart 1 from Valley National Financial Advisors and Y Charts.

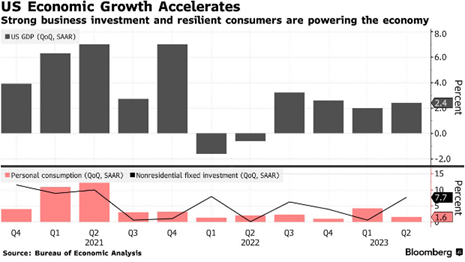

US Economy

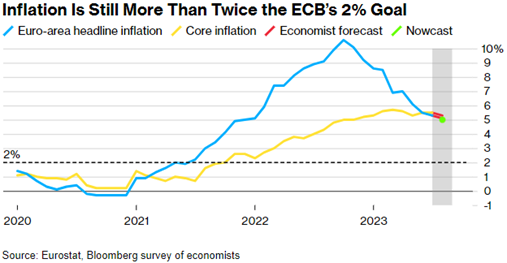

As mentioned above, while stubbornly staying above the Fed’s target rate of 2%, the U.S. Inflation Rate is now 3.70% (released last week). The U.S. Core CPI (Consumer Price Index) fell to 4.13% in September 2023 from 4.39% in August 2023. Chart 1 below shows the 10-year U.S. Treasury and two inflation measures. While inflation remains higher, the yield on the 10-year Treasury is slightly higher, thereby finally offering investors real, after-inflation returns.

Higher interest rates continue to negatively impact growth stocks as those companies typically borrow money to expand operations or hire additional employees. As third-quarter earnings releases hit the tape, we will get a better picture of which firms and industries are best dealing with higher interest rates for longer. Large banks Citigroup, JP Morgan, and Wells Fargo all reported earnings better than expected as higher interest rates helped these banks as they continue to remain a bit stingy in passing on the higher rates to their depositors.

A widening or global escalation of the Israel-Palestinian conflict could impact oil prices, but thus far, world oil prices have not been materially impacted. It is important to watch this event to see how various actors on the world stage choose sides. For example, the U.S. has moved the USS Gerald Ford carrier fleet to the region to support Israel. Of course, defense stocks (ex. Northrop Grumman, General Dynamics & Lockheed Martin) have modestly rallied because of the growing conflict.

Policy and Politics

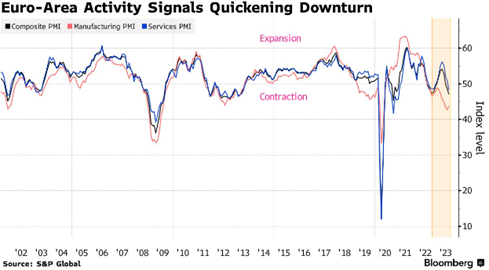

Three government forces are working in the economy right now, and all are impacting the markets, pushing uncertainty and worry into prices:

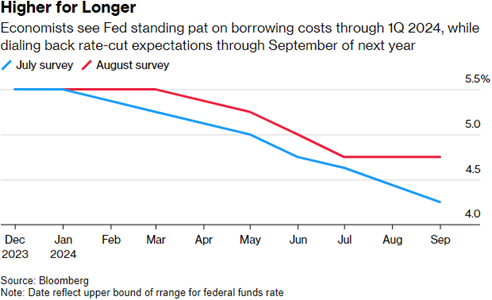

- We have the Fed and its constant fight against inflation. Last week, Federal Reserve Bank Vice Chairman Philip Jefferson noted that higher long bond yields are doing a lot of the work for the Fed in slowing the economy, implying that there is no need for further rate hikes.

- U.S. Secretary of State Anthony Blinken is actively involved in the Israeli-Palestinian conflict, which clearly indicates the U.S. is willing to do whatever is necessary to support our allies in the region.

- We continue to see a circus in Washington, DC, as lawmakers fall over each other trying to elect a new U.S. Speaker of the House.

Taken together, these government forces are adding uncertainty and worry to the markets, which is quite the opposite of what we expect and desire from our leaders.

What to Watch

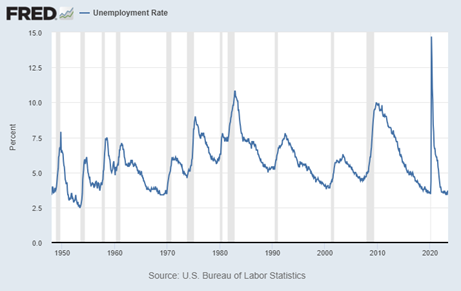

• U.S. Retail Gas Price for week of October 13, 2023, released 10/16/23, prior price $3.81/gallon.

• U.S. Housing Starts for September 2023, released 10/18/23, prior 1.283 million starts.

• U.S. Initial Claims for Unemployment for week of October 14, 2023, release 10/19/12, prior 209k

• 30 Year Mortgage Rate as of October 19, 2023, released 10/19/23, prior 7.57%

• Key Earnings releases to watch this week: Tesla, Netflix, Goldman Sachs, Lockheed Martin.

We pointed out the wall of worry above with confusion on interest rates, continuing global conflict, and a broken U.S. Congress. Meanwhile, the markets are moving slightly higher each week, and bonds finally offer “real” yields for investors. Instead of worrying about what is happening now, the markets are scaling the wall of worry and moving higher as they filter out the noise and see sectors like big tech, healthcare, and mega banks doing well, even given all the noise. It is easy to get mired down with worry and negativity – that is all we see on TV and hear from so-called experts, but the markets see the future and ignore the noise. Investors interested in creating long-term generational wealth should listen to the markets and ignore the TV. Reach out to your financial adviser at Valley National Financial Advisors for advice or questions.